Payments are at the heart of commerce in any economy. The future of payments is changing rapidly, driven by a growing demand from customers who expect fast, seamless transactions as well as customized user experiences.

With the globally burgeoning trend towards open banking, it means that banks no longer have the monopoly on customer account and financial information.

Download a PDF copy of our Now is the time for Real-Time eBook

The rise of global eCommerce

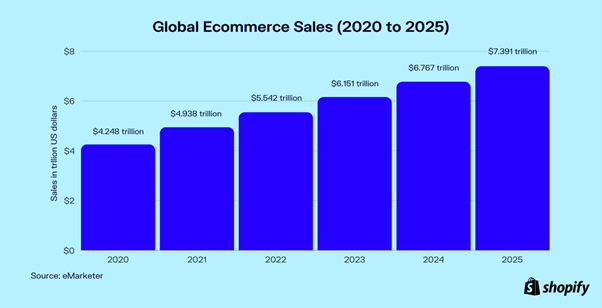

The growth of eCommerce is expected to surpass $5.5 trillion worldwide in 2022. And it’s expected to exceed $7 trillion by 2025. Additionally, 20.3% (or more than $0.22 of every dollar spent) of total retail sales is expected to come from online purchases.

Asia Pacific is leading growth

The main driver of change is the blinding speed with which payments technology is developing in the Asia Pacific region. While each area in the region is different, there are clear signs of the rapid acceleration of online commerce across the entire APAC region.

Emerging technology is the main driver across APAC, where digital leaders are competing head-to-head in a battle to optimize their operations and enhance customer experiences. Eight of the top ten countries to embrace mobile payments are in the Asia Pacific region, and it’s growing fastest in China.

ISO 20022 and modernizing legacy infrastructure

The age of most banks’ internal payment engines means they weren’t designed to navigate the 24/7/365 pressures of real-time payments. These engines are under strain, impacting customer experience. The case for updating is clear. As deadlines approach for the ISO 20022 update, banks in the APAC region are coming under competitive pressure to move to the new standard.

ISO 20022 involves the processing of much larger data volumes compared to conventional legacy formats, so bank systems and databases will need to be capable of processing these larger volumes, and at higher speeds for real-time payments, daily liquidity management, compliance checks, and fraud detection and prevention.

It's essential that there is enough of a time allowance for testing to ensure that all syntax and formatting information is correct, and that the data is mapped correctly within all associated payment and clearing systems.

Smart phones and eWallets are influencing APAC's payment processing landscape

The increasing penetration of smartphones and the widespread usage of the internet has been accelerating the adoption of mobile wallets for years.

China currently accounts for the highest usage of smartphones in the world, at 59.9% (over 865 million users). India is next, with a usage of 43.5% (over 606 million users). These countries have universally adopted the use of eWallets. Offering both payment processing convenience and security, they are now at the forefront of payments change. Through mobile applications, primarily led by key players Alipay and WeChat, eWallets integrate encryption, biometrics, tokenization, and device authentication, redefining the scope of what’s to come.

As a result, many banks and payment processors in Asia are re-evaluating their business strategy, increasing investment in infrastructure and accelerating technology transformation in order to retain their customer base and market share.

APAC leading the cashless revolution

One of the more unique features of the Asia-Pacific payments landscape is that governments are actively pursuing policies that incentivize cashless payments. A survey by Checkout.com revealed that 95% of Asia-Pacific consumers shopped online regularly, with more than a quarter doing so at least once a week. In stark contrast, data from eMarketer found that only 70% of consumers in the US say they ever shop online.

BNPL is changing the payments landscape in APAC

Checkout.com’s data reveals that Buy Now, Pay Later, (BNPL) has started to drive growth in online shopping, due to the convenience of spreading payments interest-free over several instalments. This payment method is proving particularly popular among consumers aged under 30, and as a result, seeing retailers able to reach entirely new customer segment groups.

Social Commerce opening new opportunities for retailers

Social commerce, which allows merchants to use social media platforms as an extension of their digital storefront, is gaining popularity across the Asia-Pacific region.

In China alone, social commerce revenues were estimated to be US$6 billion in 2021, a figure that represents a 66% increase over the previous year.

The outlook for eCommerce across Asia continues to be defined by incredible growth rates, with five-year compound annual growth projected at 21.3% in Malaysia, 20.2% in Vietnam, 18.6% in the Philippines and Indonesia.

The forces driving the creation of alternative payment methods and the growth of payments technology are consumers themselves. With Gen Zs representing 40% of global spending power, they’ve been born with technology, and have high expectations as consumers.

They want payments in real time, and instant transactions with a touch or swipe. They want a positive user experience and are quick to embrace anything technologically new.

How will Asian outbound tourism influence global payments?

The latest data from the China Tourism Academy shows that the outbound tourism market amounted to about 81.3 million trips in the first half of 2019, up 14% year-on-year. With continued economic growth, easier access to visas, more direct routes and other tourism facilities, outbound tourism has penetrated the lower-tier markets.

As a result, Chinese tourists are driving the development of mobile payment overseas and fueling the growth of the mobile payment market for outbound tourism while taking the market to the next stage.

Will the rest of the world follow APAC in the payments space?

The Asia-Pacific payments landscape opens a window onto an increasingly fast-moving future. Physical currency will gradually disappear, payments will be automatic and effortless, and probably even deviceless altogether.

The developments in the Asia Pacific region are certainly influencing the payments space on a global scale, but what works in China, South Korea and other countries in APAC may not necessarily be embraced as quickly by the rest of the world.

A summary of inbound growth throughout APAC

The following are the predicted eCommerce growth figures for APAC countries, based on what we know in 2022:

- A yearly 20% growth in Asian markets (vs <10% on average in Europe).

- China is the leading e-commerce market globally, and other countries from South-East Asia are forecast to be number 4 by 2025.

- Asian e-commerce is mainly driven by very few local marketplaces such as Alibaba, Lazada, Tmall, or Shopee (representing 80% of sales vs 50% in Europe for marketplaces).

- Only a few years ago, Singapore made the highest number of online purchases overseas (73% of 3.5 million online consumers), and 60% of Singaporeans buy one or more products online at least once every month.

- In Vietnam, the e-commerce sector in 2020 GWV had reached US$ 7 billion at 46%. In 2025, it will likely reach US$ 29 billion, growing in value +34% CAGR.

Looking forward

Analytics and insights: Regardless of industry, size or business objectives, the requirement for access to deep data and payment analytics is universal. Data is revolutionizing the digital world and the emphasis is shifting to analyzing that data, using it to better inform business decisions and more effectively plan for the future.

Security: As the volume of data grows, the security of that data is front of mind of all the biggest player in the payments space. Data breaches are highly destructive to a company and a major destroyer of consumer trust. No matter the size of an organization, data security is critical to survival.

Real-time visibility: The ability to see transaction volumes, decline levels, errors, thresholds and traffic in real-time is critical. Not only does this allow teams to quickly pinpoint and resolve issues, but it enables them to move from reactive to proactive management, pre-empting problems before they impact customers.

This will become increasingly important as the volume of digital payments increases and payment types further diversify, and organizations are tasked with expanding and adding further complexity to their environments to accommodate.

The payments landscape in Asia holds a lot of promise but that promise does not come without its challenges. With providers having to contend with worldwide changes and the rapid growth of technologies, to stay ahead of the game, payment transaction monitoring should be a priority for all payment processors. For more insights on the future of payments, read our blog – The Top 5 Payments Trends Shaping 2022.