Modern-day payment systems are getting increasingly complex.

A simple payment transaction initiated in a coffee shop or grocery store passes through multiple hops of back end servers and processing applications before reaching the issuer financial institution, and returning with success or decline message – all in a fraction of a second. The components in between span across infrastructure, application, and transaction layers.

Plus, payments enterprises need to support a growing variety of devices and payment instruments, like mobile wallets and wearables, over and above the traditional debit or credit cards.

Whether you are an issuer bank, merchant acquirer or processor, a resilient payment ecosystem is essential for high-quality customer experience. The right performance monitoring tool brings clarity and visibility to every component in the payment ecosystem. The need to select the best-fit performance monitoring tool is more important than ever before.

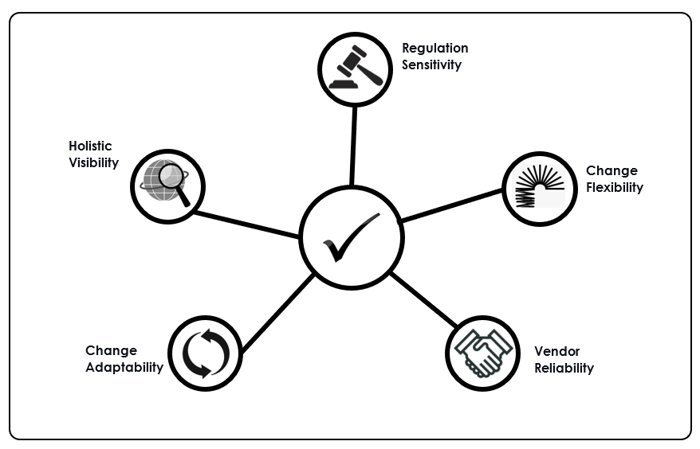

In this blog, I will take you through five key selection criteria to consider when choosing the right tools to achieve payment ecosystem resilience, and enterprise success.

1. Holistic Visibility

Your monitoring tool needs to provide a complete picture of the key health metrics of all the components in your payment ecosystem. As mentioned above, the typical architecture of a payment ecosystem consists of three layers:

- First, the Infrastructure layer – representing the hardware components such as servers, links and queues.

- Second, the applications layer – representing the software elements for processing and clearance of in various components.

- Third, the transaction layer – carrying the contextual information of the payments such as payment type, location.

The performance metrics for the components in each of these layers are different. It is grossly inefficient for a payments system operator to swing between different monitoring screens to gain visibility on infrastructure, application, and transactional performance metrics.

Real-time visibility of your health metrics is essential for the business users to take immediate corrective actions if (and when) problems arise. You need one tool that can bring the health of components across the payment ecosystem into a single pane of glass, with real-time insights.

2. Regulation Sensitivity

The organisations handling payment transactions must comply with several industry regulatory standards. Such as:

- The Payment Card Industry (PCI) standard requires the secure handling of sensitive information, like card numbers, to help prevent fraud.

- Data protection regulations, such as GDPR, improves privacy and extends consumer rights.

- Payments transaction messaging standards, such as ISO20022, enhance data quality and transmission efficiency in handling transactions.

Compliance standards are evolving to suit the rapidly changing technologies in the payment services. The non-compliance of the standards can lead to massive penalties and reputational damage.

Your chosen performance monitoring tool needs to be sensitive to evolving regulations trends. A generic enterprise monitoring tool might not cater to emerging payment regulations. A monitoring tool which is built ground-up cater to the payments industry regulation should be the preferred choice.

3. Core Adaptability

Technological innovations continuously lead to the development of new payment methods, designed to elevate everyday user experience. Traditional contact card payments at Point of Sale (POS) machines have evolved into contactless, mobile wallet payments and wearables payments. And the underlying technologies progressed from traditional magnetic strip to EMV Chip and Pin, tokenization, and real-time payments. Your monitoring tool must keep evolving to support the new tech stacks in the emerging payment innovations.

These new payment methods bring rich contextual information in the transaction data. For example, a mobile wallet payment also provides the customers geo-location and type of device used. You need a capable monitoring tool to capture transaction data and consumer behaviour analytics, and turn that into intelligent insights that drive business growth.

4. Change Flexibility

A dynamic business environment necessitates the introduction of new performance metrics from time-to-time, which need monitoring. For instance, the Covid-19 situation required merchants to focus on contactless payment uptake across different card types.

A monitoring tool, which can easily let the operational and business users configure and bring visibility to new metrics as required, is highly desired. If the tool is rigid and requires frequent tech changes to achieve these new requirements, it can lead to maintenance difficulties and version control overheads.

Payments enterprises that can use performance management software, not only to monitor the system health, but also to investigate the root cause of problems and forecast trends, have a step up on the competition.

5. Vendor Reliability

As a payments transaction processing enterprise, when you use vendor-specific performance monitoring tools, you depend on that vendor for ongoing service support, as well as predictable releases of new features to suit your business needs. Partnering with a reliable third-party vendor can save you time, money, and unnecessary frustration.

A vendor organisation provides 24x7 customer support is also highly desirable – if you encounter a problem, you want to get a speedy resolution.

Payment systems are mission-critical, and any downtime means severe business and consumer impacts. The vendors offering an online forum for member community discussions can offer a lot of value. Such member forums provide an opportunity to interact with other members and learnt from their best practices to make the best use of the software.