Over the last decade, technological innovation, consumer demand, and new market players have transformed both card-based payment processing and Account-to-Account (A2A) payment processing globally.

The worldwide digital banking disruption in 2020 and 2021accelerated the use of A2A payments – or moving money from one bank account to another without going through card networks.

Recent open banking initiatives have enabled third-party services to link with users' bank accounts using APIs, making instant payments between individuals and businesses fast, easy, and frictionless.

So, it’s no surprise that A2A payments represent a rising star on the payment industry’s horizon.

A2A payments in the person-to-person (P2P) space is not new, but what about A2A payments from consumer-to-business (C2B), business-to-consumer (B2C) or business-to-business (B2B)?

In this article we’ll explore how the increasing popularity of A2A payments is set to invigorate the retail and business payments space, with lower costs, lessened risk of fraud, and instant availability of funds.

Who in the world is using A2A payments?

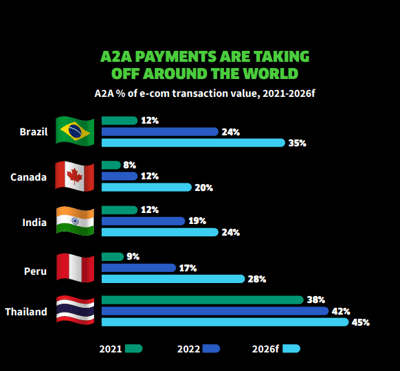

There are nearly 70 real-time payment schemes globally, providing the high-speed payment rails that enable new A2A payment use cases.

- In Thailand, PromptPay is an important part of the Thai government’s initiative to transform their financial infrastructure.

- In Brazil, Pix, led by the Central Bank is proving successful, doubling A2A’s share of eCommerce transactions in one year.

- In Peru, Yape and PLIN are private bank-operated systems driving the popularity of A2A payments.

- In India, UPI’s seamless interoperability with commercial wallets like Google Pay and PayTm is driving the growth of A2A.

- In the UK and Europe, A2A payments account for 18% of eCommerce payments with a predicted growth of 10% CAGR through to 2026.

- Nordic countries, with their well-developed digital payments infrastructure and openness to innovation are seeing strong A2A payment adoption rates. In fact, in Finland, A2A has become the leading payment method.

Worldwide A2A transaction value, worth $525 billion in 2022, is predicted to grow at 13% CAGR through to 2026.

Image source: Worldpay

In the United States, A2A payment adoption has been slower, due in part to regulatory framework challenges, leaving banks at a competitive disadvantage in consolidating their presence in the payments market.

Additionally, as part of their embedded culture, Americans have long preferred credit cards and the various rewards systems they offer. However, the US Federal Reserve’s FedNow scheme, launched in July 2023, offers instant transfers to a broader range of businesses and financial institutions, which could promote a higher uptake of A2A.

Business use cases for A2A payments

Retailers and businesses across various sectors have embraced the adaptability of A2A payments.

- For businesses with extensive supply chains, A2A payments can streamline the payment of suppliers and vendors.

- Many organizations use A2A to transfer employee salaries directly into their bank accounts.

- A2A works well for businesses with subscription-based models, or recurring billing.

- A2A provides secure, safe and efficient payment methods for eCommerce customer transactions.

- Companies who trade internationally can use A2A for seamless cross-border transactions.

Card payments vs A2A payments

Driven by the rise of open banking, A2A payments are set to become a significant disrupter of legacy payment value chains.

Reduced cost of transactions, faster transfer of funds and the potential reduction of fraud is giving businesses and consumers plenty to smile about.

Card payments

Card payments are an established and universal payment method that enable online sales from anywhere in the world. Ease of use from a customer’s point of view translates to potential increased sales.

Disadvantages

- Card payments can incur hefty fees from banks and processors, including a percentage of each transaction. This can amount to fees as high as 6% per transaction including third-party charges.

- Cards have high failure rates which are usually out of a merchant’s control, including expiration, or exceeded limits.

- If a customer disputes a charge, businesses often have to issue refunds and pay a chargeback fee.

- It generally takes two to four business days for card payments to be processed, and for funds to reach a merchant’s account.

- Fraud is a major concern with card payments, but trying to mitigate this with extra security measures can degrade customer experience and cause a decline in conversion rates.

A2A payments

Without the need for intermediaries and accompanying fees, or payment instruments like cards, A2A payments use open banking APIs to overcome the fragmentation of traditional clearing rails.

A2A offers several benefits for merchants including:

- The frictionless nature of A2A allows customers to pay directly from their mobile devices, increasing the success of completed purchases.

- Fees can be as low as .35% per transaction, with no additional fees from third parties.

- Generally, A2A payment methods provide instant availability of funds, helping businesses to improve cash flow management.

- Open banking enables data analytics and insights into customer credit and spending patterns, improving fraud detection and personalized marketing.

Disadvantages

Due to transfer limits, A2A payments may not be ideal for larger transactions.

- At the moment, not all businesses accept A2A payments.

- A2A payments may also be subject to ‘friendly fraud’, as they don’t provide the same level of payment protection as cards.

- New payment types generally require new tech which isn’t currently readily available in stores.

The future of A2A payments

With high card fees, costly fraud management solutions and other drawbacks associated with card payments, open-banking powered A2A payment systems look set to become a key growth accelerator for businesses.

Additionally, global regulators have reinforced their commitment to supporting open banking and A2A payments.

So, will A2A payments will displace card payments? Despite the benefits discussed earlier, a complete shift seems unlikely.

What is likely, is A2A payments rising in popularity and availability, adding yet another payment method into this already diverse landscape. For consumers, this means stronger competition and better payment choices. For payment providers, it requires more innovation, greater agility, and the ability to manage even more complexity.