Speed, choice, and control are driving real-time transactions in today’s rapidly changing financial world.

In the United States, a highly disparate financial landscape and deeply rooted payment predispositions are the main reasons instant payments, also known as real-time payments, have been relatively slow to take off.

However, fueled by the COVID-19 pandemic and a surge in the adoption of eCommerce solutions, there has been a significant uptake in the real-time payments space.

Real-time payments schemes

Industry predictions show that real-time payments are the future of the evolving payments industry. The forecast is that by 2025, RTPs will represent a CAGR of 43.4% - or $6.2 billion.

By 2023, 90% of U.S. businesses expect to be utilizing faster payments, enabling financial institutions to make real-time payments safe, efficient, and available 24 hours a day, 365 days a year.

Traditional payments currently comprise the majority of transactions in the U.S. But, the volume of instant payments is expected to soar during 2022 and beyond. In the U.S., consumers, businesses, and governments now have two schemes live and another in pilot.

- Zelle – Offered by over 750 financial institutions across the U.S., supports individual and business accounts. Funds can be transferred using the Zelle app, participating bank or credit union apps, or online banking services.

- The Clearing House – A real-time payments network with 24/7/365 access that allows P2P, B2B, B2C, C2B, C2G, and G2C payments.

- FedNow – A pilot payments scheme due to be launched by the Federal Reserve, The FedNow Service represents an expansive, tech-enabled leap forward, allowing instant transfers any time on any day. It’s expected to be fully launched in 2023.

Read more about how real-time payments are changing the world here

The future is faster payments

The pandemic has been a key player in the emerging faster payments landscape.

Managing cash flow and working capital in a wildly fluctuating economy has been among the top concerns for many businesses as they navigate this uncertain landscape.

Financial decision-makers, including chief financial officers, treasurers, and account administrators, said they wanted faster payments to improve cash flow management with “speed and finality” and make operations more efficient with help from instant payment data and messaging.

Image source: Payments Journal

Modernizing the U.S. payment infrastructure

To keep pace with the rapid rate of change, more and more institutions are upgrading and future-proofing their payments infrastructure. But this is no easy task.

Before the benefits of real-time payments can be universally recognized, financial institutions and infrastructures need standardization and interoperability to expand their RTP network. And they will also need to restructure their business models.

They must deal with obligations to their domestic customers to provide round-the-clock payments, manage the multiple payments schemes worldwide, and combat the risk of fraud.

Real-time payments are changing the world

Instant payments are revolutionizing global commerce and financial infrastructures. It’s a change that is already happening.

For example, over 160 million real-time transactions occur across India, China, and South Korea. These three countries represent the global leaders in the real-time payment space. India alone contributed 25.5 billion real-time payment transactions in 2020.

Read more about how real-time payments are changing the world here

The real value of real-time payments

Executing a payment within the banking system is very efficient, but the end-to-end processes that go with it are not. Complete and integrated information has always been a challenge. Real-time payments will simplify these end-to-end processes.

Image source: JP Morgan

FedNow

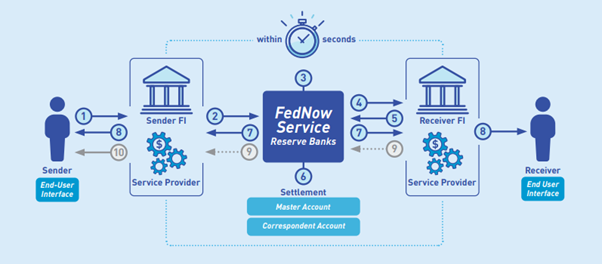

In January 2021, the Federal Reserve launched the FedNow pilot program, consisting of more than 200 financial institutions and processors to support real-time payment processing.

FedNow service will allow any financial institution in the U.S., regardless of size, to offer instant payments to its customers, and funds moving between financial institutions will allow end-users access to their funds in real-time, at any time.

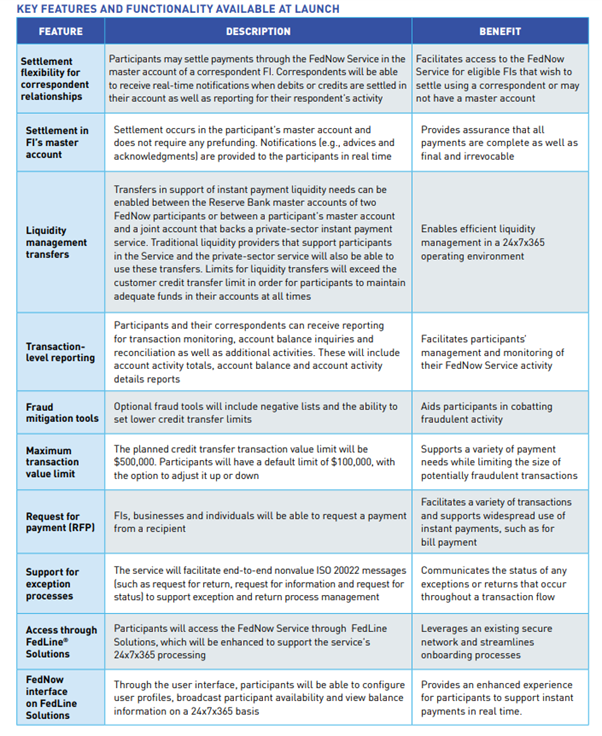

Key features and functionality

With its full debut on track for 2023, the FedNow service will be deployed in phases, allowing the initial service to be launched quickly, with additional features and enhancements released in stages after the initial launch. This phased approach will allow for adjustments and improvements in response to industry needs or changes in technology.

Preparing for tomorrow, today

Real-time payments are emerging as a chapter in a much broader open banking narrative unfolding in the U.S.

The traditional role of banks is shifting from being a financial services provider to a partner in both the private and corporate customer’s financial journey.

By joining the RTP network, banks have already collaborated more than they are accustomed to doing with peers and competing banking institutions.

With major changes to a nation’s financial ecosystem imminent, banks and financial institutions need to be well prepared to deal with the impact of such changes.

Real-time payments will create a new architecture in technology and business strategies, requiring real-time insights and analytics to manage the increasing volume of data across the entire infrastructure.

Ensuring RTP success with data and analytics

Through real-time insights into payments data, organizations have access to intelligence that can reveal and resolve issues affecting RTP systems, such as:

- Infrastructure or application performance issues related to customer payments

- Performance issues with specific payment types

- Performance deviations with payment volumes

- System performance and root cause analysis

- Fraud alerts for suspicious transactions or behavior

Organizations can gain unlimited access and insights into customer usage data and end-to-end transaction performance metrics. This crystal-clear view of all metrics means the ability to make proactive decisions instantaneously.

Additionally, by gaining full visibility into their RTP systems, all players in the payments chain – from financial institutions to businesses, acquirers, and processors – can meet regulatory compliance requirements.

With an all-encompassing third-party performance management solution like IR Transact, financial organizations can increase transaction completion rates and improve stability across the entire delivery chain of payments.