High-value payment systems are crucial components of the global banking industry, enabling the movement of large sums of money between banks and their customers, both domestically and internationally.

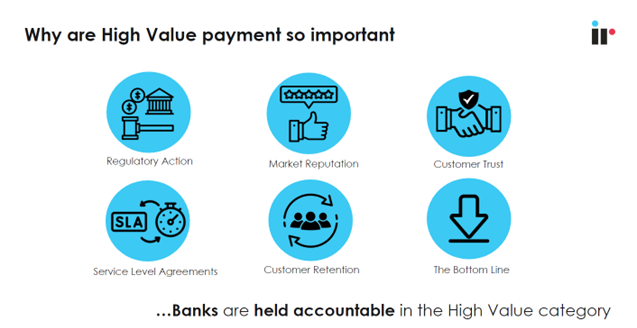

Avoiding outages is essential, but increased demand, complexity and competition heightens operational risk, banks need to do more than just avoid outages. Robust monitoring mechanisms are essential to ensure that these systems are secure, stable, and compliant with relevant regulations. Failure to monitor high-value payment systems can result in significant financial losses for both the banks and their customers, regulatory fines, and reputational damages.

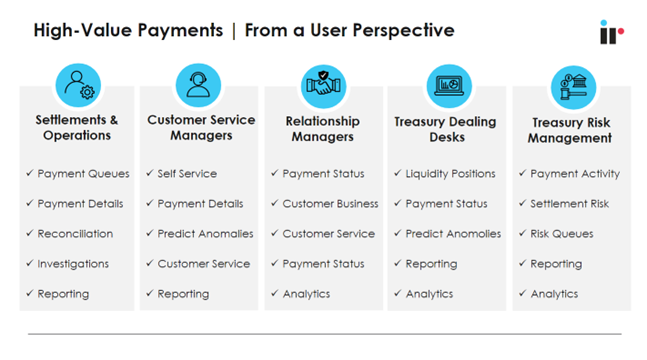

To effectively monitor these transactions, businesses need to have access to real-time data on transaction performance, including response times, success rates, and error rates.

They also need to have the ability to analyze this data to identify patterns and trends that may indicate potential issues, this is not a trivial task when you factor in the multi-layered complexity of domestic and international payment markets.

In my latest webinar I share these important tips and more on how to monitor the health of your high-value payments.

Watch the webinar below

What are high value payments?

High value payments refer to the wholesale and interbank transactions that run through financial institutions. These are generally handled by a bank's treasury and are the central hub of payments globally.

High-value payment systems play a crucial role in the transfer of large sums of money between banks, financial institutions, and their customers. These systems are critical to the smooth functioning of the financial system, but they are also vulnerable to fraud and other forms of abuse. It is important to ensure that they process efficiently, securely, and in compliance with applicable regulations.

Regulation and compliance

Banks must comply with various regulations, such as the Payment System and Settlement Act (PSSA) in India (every country has their own) to ensure they operate within the regulatory environment in which they operate.

Monitoring high-value payment systems helps banks detect and prevent potential violations of these regulations such as settlement defaults, missing daily limits or cut-off times, or monitoring can flag suspicious transaction patterns and allow banks to investigate and report them to the appropriate authorities.

Globally compliance rules and regulations are varied and specific to the jurisdiction in which they operate in and enforced as part of legislation with penalties imposed for non-compliance.

The financial penalties from regulators could be costly, the breach of SLA’s and penalties to customers could be significant and the reputational damage could be devastating.

Having IR monitor the health of transactions is a preventative mechanism for dealing with such situations, increases ability to recover (troubleshoot) such situations and favorably change operational risk posture to customers, regulators and ratings agencies.

Stability and robustness

High-value payment systems must be stable and robust to ensure they are available and functioning as intended. System failures can result in significant financial losses and damage to a bank's reputation.

Monitoring high-value payment systems can help banks detect potential system failures and prevent them from occurring. For example, monitoring can flag potential system overload, hardware or software failure, or network issues.

Operational compliance guidelines in most jurisdictions require yearly system audits for security, robustness and resilience including mandating that fallback, disaster recovery policies systems and procedures are in place in order to be allowed membership in the payments network.

IR Transact forms a part of this larger operational risk management which monitors the key payment flows and systems in these organizations, ensuring that critical payments systems are healthy underpins the health of transactions that flow through these systems.

Legacy systems

Modern electronic payment systems have been around since the 1970’s, vendors in this space are just as old and are the dominant encumbers especially at larger banks. The technologies used are dated and the scale of business is generally too large to risk on a “Greenfields” buildout.

These legacy platforms get upgraded regularly to keep them current, however the core architecture of these systems precludes them from being easily interfaced with more modern systems. Dominant vendors in payment hub systems all suffer from the same legacy system syndrome, these systems are huge, complicated beasts and especially at larger banks are deemed “too big to change”.

IR’s ability to monitor these platforms is somewhat unique, IR has a long track record of being able to integrate to traditional payments processing platforms closing the gap between core payments processing provided by a payment hub with the business need to monitor, troubleshoot and analyze the systems and transactions being handled by payment hubs.

Why is monitoring high value payments so crucial?

The importance of monitoring high value payments cannot be overstated. First, it helps detect errors or discrepancies that may arise during the payment process. For instance, a payment may be sent to the wrong account, resulting in a delay or loss of funds.

High value payments are also a prime target for fraudsters and monitoring them can help detect fraudulent activities and prevent losses. Additionally, monitoring high value payments helps financial institutions comply with regulatory requirements and identify any suspicious activity that may indicate money laundering or terrorist financing.

Monitoring high value payments requires robust technology solutions that can detect anomalies and identify potential fraud.

By using the right tools and techniques, businesses can ensure that their high-value transactions are performing optimally and minimize the risk of costly downtime or lost revenue.

How IR Transact can help

We provide solutions for monitoring high value payments, as well as other payment streams, such as card payments and real-time payments. Our technology stack enables us to monitor the applications that these systems run on and provide dynamic threshold alerts and other data analytics solutions.

Our High Value Payments solution is specifically designed for monitoring high value payments. It provides real-time monitoring of all high value payments, enabling financial institutions to detect anomalies or suspicious activity immediately.

With IR Transact’s High Value Payments solution, financial institutions can set custom thresholds, rules, and alerts to match their specific risk appetite and compliance requirements.