According to the 2022 Global Payments Report by Worldpay, "The traditional lines between banking, payments and commerce have all but dissolved. The rules that once limited who participates in money movement—and how that movement happens—have been rewritten. This connected world is creating new opportunities to shape the future of commerce and financial services."

The payments industry is experiencing rapid digital transformation, with more purchasing options than ever. Credit or debit card payments at point of sale no longer dominate preferred payments methods within much of the financial services industry.

Download a PDF copy of our Managing your Changing Payments Business guide

What's driving change?

The doors have been thrown wide open within the payments industry due to the introduction of new payment methods, the widespread availability of high-speed internet, increasing mergers and acquisitions, and ever-advancing technology.

These factors, coupled with consumer behavior and a voracious appetite for convenience, means that the global payment ecosystem is becoming increasingly complex for payment providers, merchants, merchant acquirers, and financial institutions.

In this blog, we'll investigate how the payments ecosystem is experiencing massive changes, what to expect in the near future, and how transaction monitoring can combat these disruptions.

As indicated below, looking forward towards 2025, digital payment methods will continue to rise, and the use of mobile wallets is forecast to to grow as the preferred POS payment method.

Image source: Worldpay Global

Image source: Worldpay Global

It pays to keep up

Technology has done more than facilitate electronic payments. It now plays a crucial role in the payments industry and the way organizations accept payments. Payment technology companies (Fintechs) are amalgamating with traditional financial institutions to satisfy consumer demand and merchant preferences.

In the past, if a merchant could accept credit card payments, they were in business! Payment processing was once simply about being able to facilitate payments by either accepting in store payments, contactless payment, or transferring funds.

Today, the newest contestants in the payment processing game are focused on redefining consumer experience. Business owners have more power to manage their businesses, more scope for growth and more choices within their payment network.

If companies and merchants don't keep up with rapid changes within the payments system, they stand to lose business.

As the world depends more and more on digital solutions, banks and financial institutions are struggling. The financial crisis of 2008 has brought about so many financial regulations in traditional banking, that they must comply, or face massive fees or legal penalties. But now, banks must also find ways to apply the same regulatory standards to their digital banking practices, or risk being non-compliant.

Below is an illustration of global revenues forecast to 2026.

Image source: McKinsey

Image source: McKinsey

Key players in the changing global payments ecosystem

Financial technology is changing the world of finance, not just for banks and financial institutions, but for consumers in so many ways. Let's look at some of the stakeholders who are affecting change in the payments industry.

Fintechs

While the COVID crisis may have accelerated the power of fintechs, the financial services industry was already making significant changes within the payments system based on consumer demand.

-

Thanks to technology, for example, you can open a bank account online, without physically having to go into a bank.

-

You can link your bank account to your smartphone and use it to transfer funds, monitor your transactions, check your credit card balance with a click. Smartphones become digital wallets, and with applications like Apple Pay and Samsung Pay, these mobile transactions become as easy and seamless as pointing your device at payment terminal.

-

The insurance industry is also experiencing huge changes thanks to Fintech, with most motor vehicle insurance providers offering 'telematics-based' insurance. This means data is collected via your smartphone, or a 'black-box' fitted to your vehicle as you drive, and is used to determine the cost of your insurance policy. Many insurance companies even sell insurance on a short-term or 'pay-as-you-go' basis.

-

Technological advances have also touched the investment industry. Consumers can make investments online on an 'execution only' basis without ever having to physically see anyone face-to-face.

-

With regard to in-store transactions, the widespread decision to accept contactless payments during COVID has given rise to alternative and experiential methods, including Buy Now, Pay Later (BNPL), proximity payments like Apple Pay, and click-and-collect.

Image source: Finances online

Download a PDF copy of our Managing your Changing Payments Business guide

Payment service providers (PSPs)

Payment service providers are an integral part of the global payments ecosystem. Payment service providers (PSPs), or merchant service providers are third party organizations acting as payment facilitators that allow merchants to accept any payment method, including credit cards and debit card payments.

Image source: Magestore

Image source: Magestore

They provide efficiency through a payment gateway to a merchant's bank account, ensuring that businesses can collect and manage their payments easily. In today's payment industry, there are three general categories into which these stakeholders fit:

-

Gateway providers

-

Acquirers and processors

-

Networks.

Collectively, gateway providers, acquirers and payment processors can be defined as payment service providers (PSPs). Also collectively, networks, gateway providers and acquirers/processors can be referred to as payment providers.

But these are not definitive descriptions of the services they perform. PSPs can be sole distributors, operating only as gateway providers, and never actually coming into possession of any funds.

But at the same time, PSPs can also process payments, transfer and collect funds which means they are also acquirers/processors.

Mobile wallets, such as Apple Pay, Alipay and PayPal can also act as the network for customer transactions, which replaces the actual credit and debit cards network, so that merchants can connect directly to the mobile wallet provider rather than going through a processor. In this instance, the payment gateways, and acquirer/processor roles will also be performed by the digital wallet.

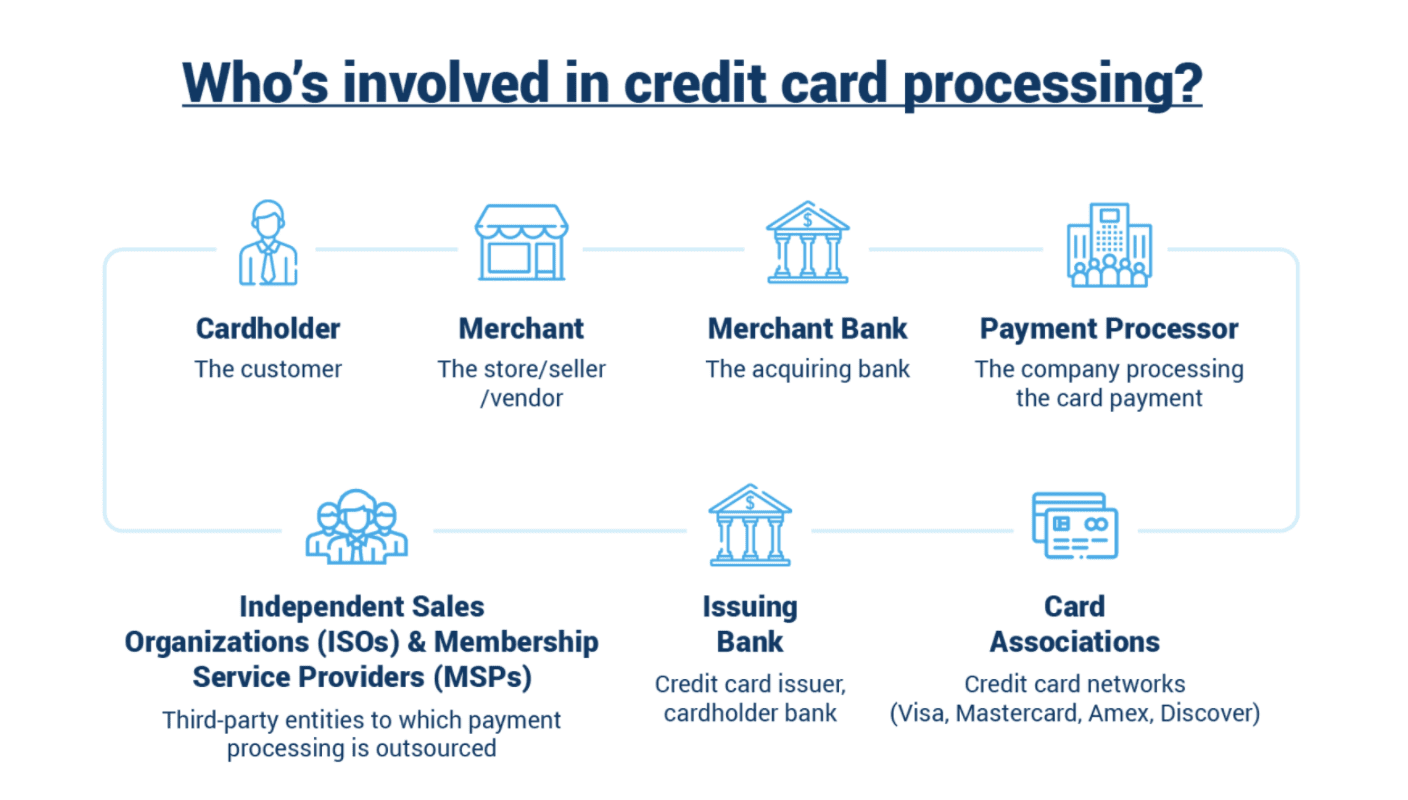

Independent Sales Organizations (ISOs)

An independent sales organization is a third party company that sells credit card processing services independently from a FI or bank, and can approve a business to accept credit cards. Although an ISO isn’t directly part of a bank, they’ll accept credit cards on a business's behalf through the alliances they’ve established with banks.

Image source: Merchant cost consulting

Image source: Merchant cost consulting

Explaining the payments ecosystem

As a business owner and merchant, it's important to understand the payment processing cycle, so that you can choose the best payment solutions for your needs. While the whole payment process happens in seconds, it's a complex journey from the point of sale, to the consumer's bank account to the merchant's acquiring bank.

The payment processing cycle

We'll look at a typical credit card payment process.

Image source: Deloitte

Image source: Deloitte

-

Customers and merchants. A customer (a business or individual) buys goods or services and chooses credit card as their payment method. The merchant submits the transaction to the acquiring bank.

-

Networks make the connections, oversee the payment processing activity, monitor transaction settlement, and regulate and manage the corresponding compliance policies.

-

The acquiring bank has a contract with the merchant to provide payment acceptance and processing, and submits the transaction to the issuing bank, after which the acquiring bank pays the merchant the cost of the goods or services.

-

The payment processor Executes the transaction by transmitting data and/or transferring funds between the other parties.

-

Gateway provider is responsible for the technology that captures the payment method and transfers payment data from the customer to the acquirer and back.

-

The issuing bank offers credit and issues credit cards to customers on behalf of the networks. They accept payment, approve the transaction and remit the total cost (less fees) to the acquiring bank.

-

The consumer’s bank account is debited for the price of the goods.

Looking to the future: The forces reshaping the global payment ecosystem

Global cashless payment volumes are expected to increase by more than 80% for the period spanning 2020 to 2025, from about 1 trillion transactions to almost 1.9 trillion, and to almost triple by 2030, according to analysis by PwC and Strategy&.

Image source: PwC

Image source: PwC

Financial institutions are challenged with the regulatory burdens, risk management, capital constraints, and cost pressures of the payments industry. This makes it difficult to keep up with the pace of change and abundance of choice in payments.

For this reason, businesses often bypass their banks by engaging directly with fintechs to settle any friction in the payments process. This process of 'cutting out the middle man' is increasing competition between FIs and fintechs, while at the same time, providing opportunities for innovation and cooperation between them.

The potential for collaboration coupled with new end-user demands is driving a surge in innovation, indicating that the future of payments should see a a more synergistic relationship between banks and fintechs as they collaborate to drive growth.

Image source: BNYMellon

Image source: BNYMellon

Downtime equals financial mayhem

Throughout the payments ecosystem, whether it's acquiring banks, merchant services, card networks, or payment facilitators, it’s crucial to gain full visibility into your payments ecosystem. Transaction monitoring and POS monitoring is vital to combat service disruptions and potential lost revenue.

As we've mentioned, from business to consumer, the payment process passes through numerous stages before it's completed. Payments move from a point of sale, mobile or online transaction, through a credit card network, merchant bank, data centers, multiple switch servers, and several backend databases.

To manage this complex transactional journey, and guarantee the completion of critical transactions, operations teams need full visibility of all traffic coming in from the various processing stages.

The importance of transaction monitoring and performance management

Full visibility of your payments ecosystem in real time means you can see where payments are being processed successfully, or where transactions are being declined.

Data such as request and response timings, transaction dollar values, error codes and network address information needs to be clearly visible to investigate where and when a problem occurred, so that you can quickly determine why it happened and how to resolve it.

As your payments infrastructure grows, so does the complexity within, and this makes transaction monitoring all the more important.

How IR Transact can help

With IR Transact, you gain visibility into your entire payments ecosystem, no matter how complex your payments system. The payment transaction monitoring process is broken down by card, or merchant acquirer, enabling you to drill down into individual locations and provide geographical insights into card taker and usage.

There’s a lot that can potentially go wrong in payments ecosystems. Problems that affect even the smallest of transactions can quickly impact many customers, before you even realize there’s an issue.

IR Transact gives you exceptional clarity, and complete real-time insight into the health and performance of the entire payments environment.

How does it work?

-

With rapid troubleshooting, and comprehensive analytics and reporting, Transact is 100% proactive, and can confidently solve issues faster, which translates to improving consumer experience. Not only does this keep the payments system flowing, and customers satisfied, but maximizes revenue.

-

Transact can also ensure system and infrastructure readiness when new technology is introduced.

-

As well as monitoring hardware platforms, Transact also monitors the application layer allowing organizations to ensure that all systems are up and running and talking to each other as they should be - and that transactions are flowing smoothly. It means that acquirers and processors can gain insight and analytics into their top merchants’ transactions, and receive instant notification the moment anything abnormal occurs.

Watch our webinar: Payments Analytics; Improving the Merchant Experience

Need to know about real time payments?

Find out how real time payments are revolutionizing global commerce

IR Transact can not only simplify the complexity of monitoring and managing modern payments systems, but can turn data into intelligence to enhance business operations and increase revenue. Additionally, businesses can leverage the power of payment analytics to achieve more agility and adaptability in a rapidly changing payments landscape.