In a recent webinar hosted by Anna Byrne, Head of Marketing at IR, and Kevin Johnson, VP of Sales for IR Transact, we discussed how payment analytics is the most effective way to create a better customer experience.

The power of data and payments analytics

There is no doubt that the payments industry today is driven by information and data. This has been accelerated by the impact of COVID, the effects of which have seen more advancements in payments in 2.5 years, than in the previous twenty years.

Every player in the payments chain, including card issuer, merchant and acquirer, knows that gaining insights into their transactions, and customer behavior provides a way to improve profitability, optimize revenue and cut costs.

Transaction analytics

When a customer makes a debit or credit card transaction, whether it’s in a gas station, department store, or restaurant, they expect their payment to be processed quickly, and without glitches.

But what the customer doesn’t necessarily know is that from the moment they insert or tap their card to make a payment at the Point of Sale (POS) it goes through multiple steps from payment to acceptance. It all happens in seconds, but the process occurring behind the scenes is complex and prone to failure at any point.

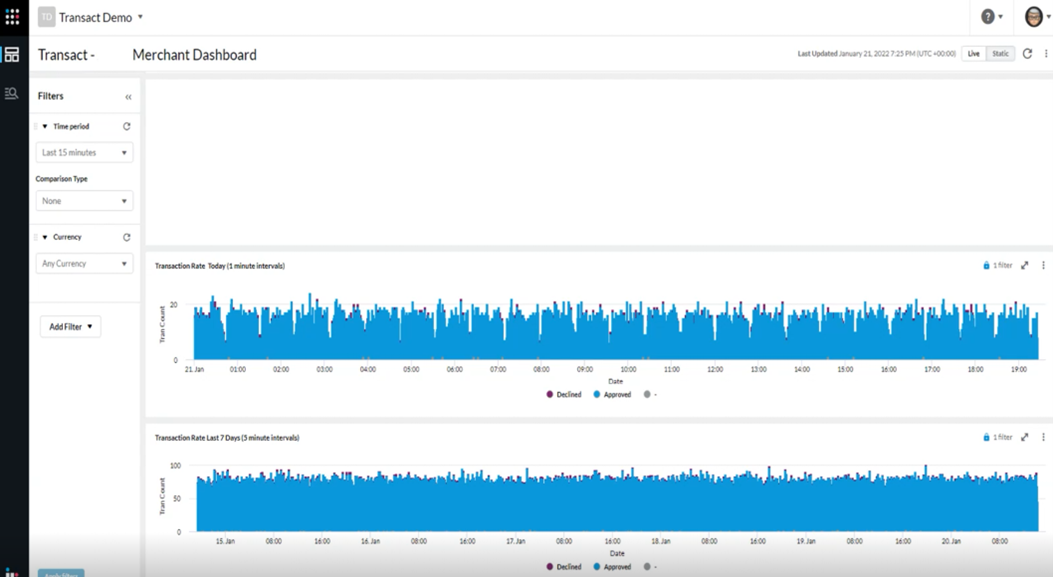

Every acquirer, payments processor or merchant needs real time visibility into their payments system, because poorly performing systems can lead to payment queues and abandoned purchases, severely impacting revenue. For example, the ability to study payment authorization data several times a day, provides the means to improve payment processes dramatically.

Read our guide for a comprehensive guide to real time payments analytics: Real time payment analytics: The linchpin of your payments system

Customer behavior analytics

Every time a customer makes a transaction, it reveals a wealth of information, or data that shows:

- What items were purchased

- The time and amount of the transaction

- What type of payment was used

- The location of the purchase

- Whether the transaction was processed quickly and without failure

All this information, and more, is valuable to merchants and merchant acquirers who can then use it to make important business decisions. For example, staff adjustments, purchasing of merchandise, and learning about what customers want, so they can provide better service.

Leveraging data analytics for business insights

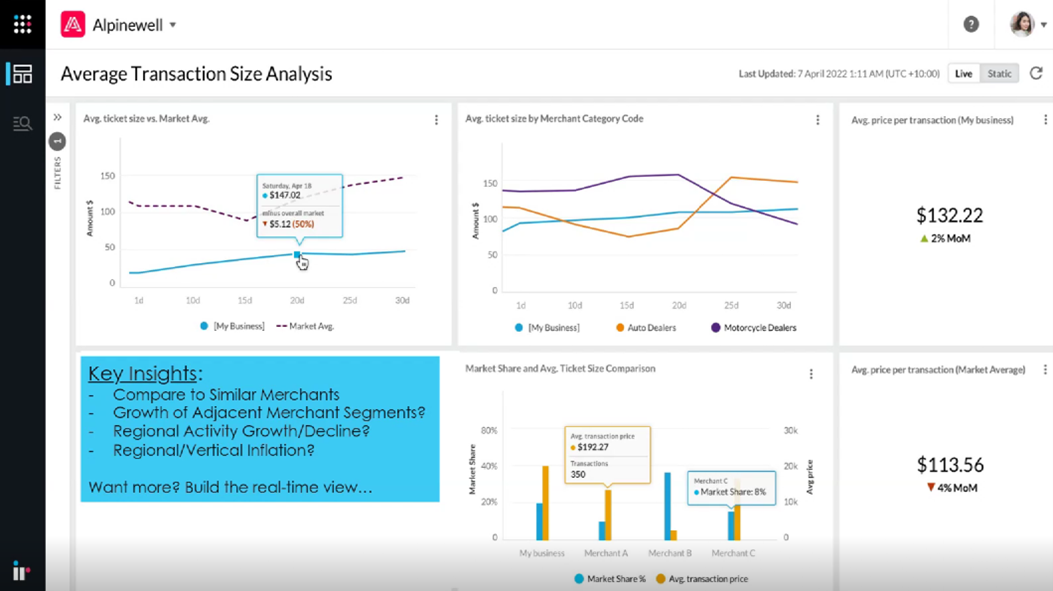

Analytics provide a valuable source of information that can answer a lot of questions relating to important business decisions for merchants. By looking at payments analytics, merchants can gain insights such as:

- Staffing levels, opening hours and business location

- When to add or reduce staff

- Should you open the store earlier/close later

- Is it viable to open (a restaurant) for lunch/dinner

- Should you look at a new/additional location

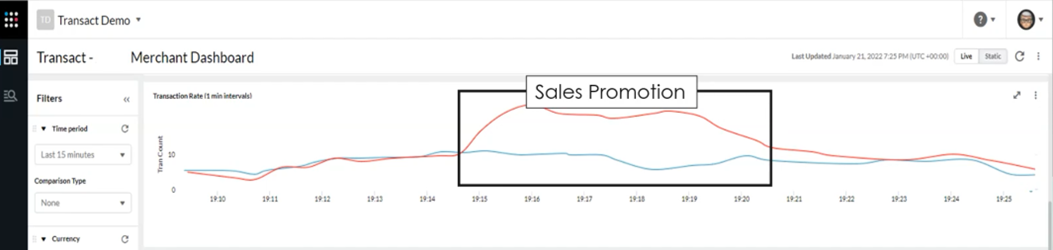

- Should you be running more promotions, and do you have the means to support the extra traffic

- Is it worth opening or expanding into an adjacent market

- The effects of inflation on your geographic area

Many small to medium businesses have limited staff, and most are non-technical, with limited economic insights. They don’t have the means to decipher complex charts and graphs. The ability to easily see the information they need, and interpret this data can enable game-changing decision making. For example, insights into average transaction size, and being able to compare this to the market average can help businesses to review where they’re succeeding, or may need to make adjustments.

How IR Transact can help businesses increase revenue

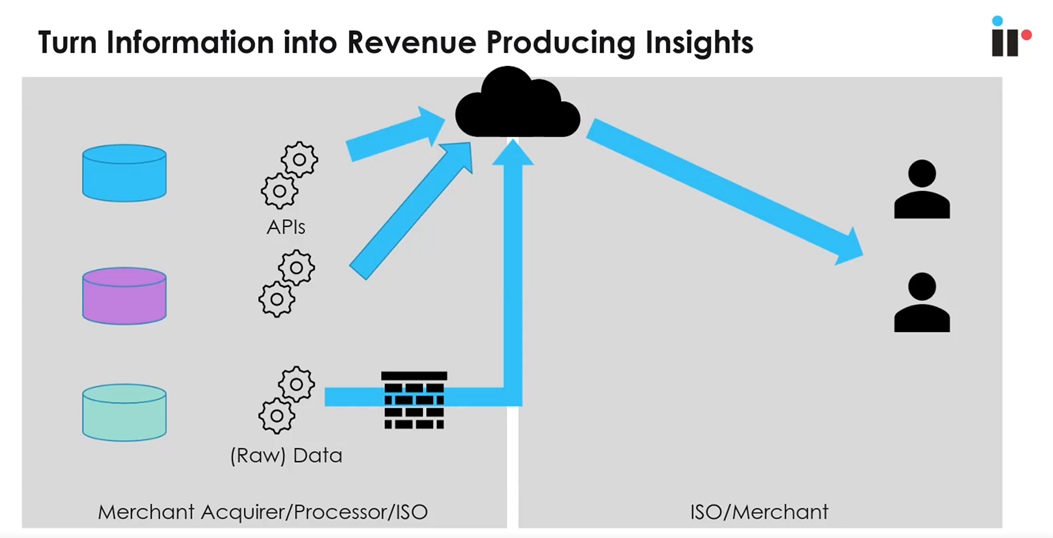

IR’s leading payment analytics solutions can empower merchants to make better business decisions by turning data into revenue producing insights that can be accessed from an integrated cloud platform.

Every customer’s interaction with your business should be a positive one. By using analytics to better understand your customers, you can personalize their experience, improve satisfaction and retain valuable customers.

IR Transact can not only simplify the complexity of managing modern payments systems, but can turn data into intelligence that can optimize business operations and increase revenue. Additionally, your business can leverage payment analytics to achieve more agility and adaptability in a rapidly changing payments landscape.