Every enterprise organization at the top of their game has financial agility as a major priority.

To be financially agile means having enough liquid assets to be in a strong cash position to meet financial obligations, and/or having the ability to convert assets into cash easily without losing market value.

Properly managing liquidity would not be possible without extensive visibility into an organization's finances, but without this visibility, businesses are vulnerable to the effects of sudden risks or even insolvency.

Sound liquidity management can also place organizations in a far better position to capitalize on business opportunities, increase turnover, and maintain a competitive edge.

Image source: Nomentia

What is liquidity management?

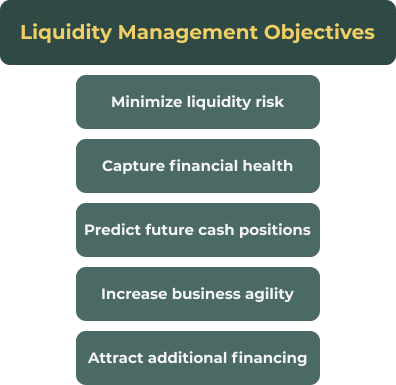

Corporate liquidity management is the job of a company's treasury department, whose responsibility it is to minimize liquidity risk, and ensure that there is always enough liquid cash flow to meet current and future debt obligations.

Sound liquidity management practices are defined by a set of non-negotiable elements including:

-

Complete transparency into all cash inflows and outgoing cash flows.

-

Constantly overviewing and tracking accounts receivable and accounts payable.

-

Creating an accurate and detailed cash flow forecast and a liquidity management strategy that plans for the future, allowing for current and expected business developments.

-

Dynamic planning.

-

Regular updating of financial plans and comparing target-performance.

While the above elements of liquidity management are a treasurer's main priority, organizations also want to increase turnover - but increasing turnover relies on additional cash investments, which can be somewhat contrary to the goal of ensuring liquidity.

So another feature of excellent liquidity management is a treasurer's ability to develop strategies where there is sufficient cash available for investments, while ensuring the solvency of the company.

Find out more liquidity risk management in our guide

Understanding Liquidity Risk: Causes, Measures & Management

The importance of liquidity risk management

A solid liquidity risk management framework is the foundation of an organization's financial management strategy. It helps to ensure a company's ability to fulfill its cash and collateral obligations, accounting liquidity (the ability to pay current and future debts), and that there are sufficient cash reserves, high value liquid assets and committed credit lines.

A company's liquidity position is dynamic, and even with detailed liquidity planning, and cash forecasting, it can change according to both business and market conditions.

Changing market conditions can be both expected and unexpected, and can impact financial performance, so to manage liquidity effectively in the event of a company's cash flow crisis, treasurers need to look at both static and dynamic liquidity.

Robust liquidity management strategies are extremely important when it comes to making investment decisions, but can be complex for businesses operating in different countries and currencies, and holding accounts with multiple banks and financial institutions.

Static and dynamic liquidity

Liquidity, like profitability and solvency, is calculated as a financial ratio, which is used to understand business development. Liquidity shows how well a company can meet its short-term debt obligations and therefore how flexible it is financially.

Static liquidity is an indicator of whether your company can meet its payment obligations with its current assets. Dynamic liquidity compares the ratio of a company's cash flows, both incoming and outgoing.

Cash flow management

An organization's liquidity position is largely determined by its cash flow management practices. Cash flow management is all about tracking the money flowing into your business and comparing it against the money going out, such as bills, wages and salaries, and property costs.

For finance teams, cash flow is still the most important aspect of liquidity management. If not managed properly, businesses can become vulnerable to liquidity risks, find it difficult to meet financial obligations or secure funding, and even struggle to remain profitable.

Having good visibility into your cash flow situation attracts potential investors, and can help businesses land more favorable financing terms.

The most important things to be gained from accurate cash flow planning include:

-

An improved credit rating: A sound cash flow plan allows finance teams to analyze available credit, increasing the likelihood of securing financing from investors or lenders.

-

Better management of liquidity risks: Chief financial officers have earlier warnings of potential risks and can take corrective actions accordingly, with a deeper understanding of unexpected challenges.

-

Increased profitability: It's easier to keep track of idle cash and put it to use for capital investment, stocks, mergers and acquisitions etc. This helps companies gain a competitive edge.

Image source: Deskera

Best practices for liquidity management

We've already established that liquidity management is critical to the success of any business. But today's volatile economy highlights its importance even more. Here are some liquidity management strategies for finance teams to consider to reduce liquidity risk, and avoid a liquidity crisis:

1. Review financial statements regularly

You don't know what you can't see, so it's vital that finance teams carry out regular reviews of a company's financial statements to ensure that there are sufficient financial resources available to meet financial obligations and maintain liquidity.

2. Inventory management and supply chain management

Effective management of inventory levels is an important part of a company's liquidity and financial health and is essential for a properly running supply chain.

Too much inventory ties up working capital, and too little inventory could result in missed sales opportunities. Supply chain management refers to the process of managing relationships with suppliers and the flow of stock into and out of a company, while inventory management is about managing the flow of goods to, through and out of the warehouse.

3. Accounts receivable (AR) and Accounts Payable (AP) management

Another essential aspect of liquidity management is keeping a close eye on accounts receivable and accounts payable. Finance teams need to make sure that invoices are sent out on time, and payments collected as quickly as possible.

This could involve asking customers to pay upfront, or even offering a discount for early payments. Similarly, negotiating extended payment terms with suppliers, or taking advantage of early payment discounts can improve accounts payable management.

4. Minimizing expenses

Looking into how to cut costs is part of almost every company's liquidity management strategy at some point. During periods of tight cash flow, it's often a way to free up necessary funds.

For example, looking for cost-effective ways to lower fixed overheads such as utilities and rent, transport, insurance costs or travel. Even outsourcing tasks to a third-party provider can save time, resources and money.

5. Unlocking ‘trapped’ cash

For treasurers and finance teams, especially those in multinational companies, 'trapped cash scenarios' can cause serious liquidity risk, and can easily lead to bad investment choices.

Often, this cash is trapped by a combination of a lack of visibility, and legal or regulatory restrictions. In today's digital economy, and with constant technological advancements, treasurers are now able to mobilize some of this trapped cash more easily by taking advantage of:

-

Real-time Payments technology: The growing momentum of faster payment programs allow treasurers to make and receive disbursements or payments between partner organizations 24 hours a day with instant confirmation of transactions.

-

Increasingly sophisticated APIs: Treasurers can now connect directly with both internal and external systems, resulting in a seamless flow of data between internal stakeholders and banking partners.

-

Foreign Exchange Tools: FX tools allow treasurers to move money in real time into and out of currency markets.

-

Automation: The increase in the use of AI/machine learning has improved automated functions like the transfer of payments and working capital, cash management, and internal transfers.

6. Centralizing financial data

A centralized data system can help finance teams to manage liquidity risk by providing easier access, visibility and management of data. Centralization also increases productivity, streamlines payment processes, enhances security and allows better control over cash flow forecasting.

It stands to reason that when all your data is stored in one central location, it's far easier to keep track of - and this in turn improves data accuracy and the identification and correction of errors and discrepancies.

Find out how IR Transact’s High Value Payments solution can simplify the complexity of managing your entire payments environment

Sound liquidity risk management

Every aspect of liquidity risk management is important in its own way, and strategies vary according to individual businesses. But there are some key elements of effective liquidity management that apply across the board.

-

Having the means to collect the right data at the right time

-

The ability to carry out in-depth data analysis

-

Risk measurement

-

Stress testing

-

Monitoring and reporting

The future is real-time liquidity management

For all enterprise organizations, their key financial management strategies include:

-

Having transparency and visibility of their cash inflow

-

Being able to foresee and curtail operational risks

-

Being able to control and grow revenue streams

-

Having the ability to diversify funding sources

-

Reducing costs

Being able to see the full financial picture is the foundation of effective liquidity management. Without full visibility, liquidity management becomes impossible. Without full control, CFOs are unable tomake the best business decisions.

Making the right decisions at the right time, and having a healthy balance sheet is dependent on having visibility into all transactions as they happen, in real time.

Managing data collection and having access to deep, dynamic insights and analysis of that data is becoming more more crucial than ever, to ensure that an organization remains financially viable.

IR Transact: Helping with liquidity risk management

IR Transact simplifies the complexity of managing modern payments ecosystems. With IR Transact, businesses of all sizes and natures can become better informed, and can bring real-time visibility and access to their payments systems.

Transact can help give organizations unparalleled insights into transactions and trends, helping to urn data into intelligence, by offering thousands of points of reference, from a single point of view.