A variety of messaging standards exist in the payments world that enable the flow of information related to financial transactions. These standards have been created by The International Organization for Standardization (ISO) to simplify global business communication.

The importance of standardization

Clear, secure financial communication between people, systems and financial institutions is crucial, especially in the financial industry today, with the various technology solutions that have infiltrated the way we do business.

Universal financial messaging standards provide clear, identifiable referencing that means more detailed transaction information, faster payments and better security when exploring payment platforms.

The differences between ISO 8583 and ISO 20022

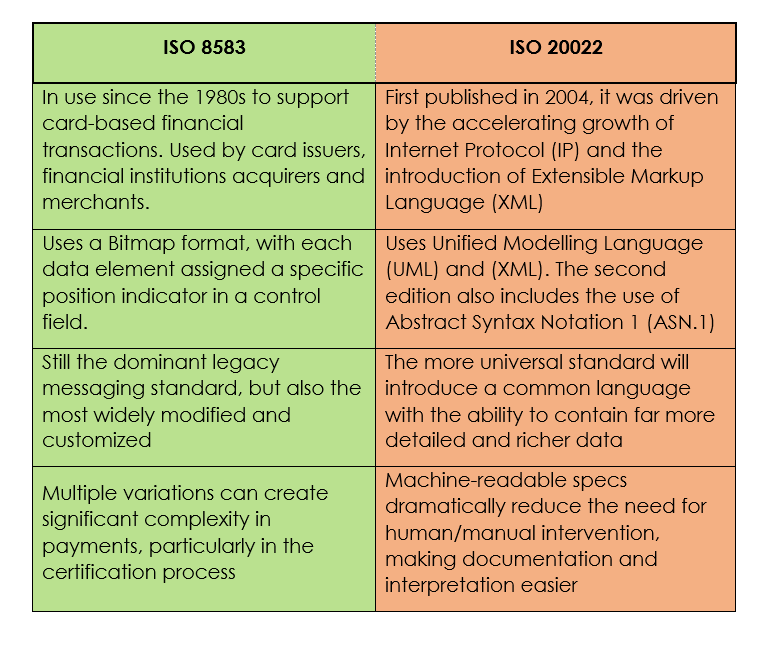

As this blog aims to identify the key differences between one message type and the other, we'll cover the main differences between ISO 8583 and ISO 20022 here, and in more specific detail throughout the blog.

The key characteristic that separates the two payment processing message formats is that ISO 20022 - a universal standard, covers all transactions, whereas ISO 8583 relates specifically to card based financial transactions, with no commonality between the two.

ISO 8583 is still used as the messaging standard for financial transaction card based payments, and encompasses a huge volume of retail transactions. However, the retail payment industry and the financial industry as a whole, is in the midst of global digital transformation, with real time payments, cross border, and high value payments, and open banking leading that transformation. This digital revolution punctuates the need for a global standard.

The world relies on data

More than ever, payment networks rely heavily on data to process payments, therefore the universal adoption of the ISO 20022 messaging standard is aimed at simplifying that data, while bringing a number of legacy message formats into a common, easy-to-understand structure.

ISO 20022 allows for the transmission of richer, more detailed data, enabling targeted analytics, which equates to gold in the finance and payment world.

Read our comprehensive guide to ISO 8583: What you need to know

What is ISO 20022?

ISO 20022 has been created as a common, universal messaging 'dictionary' where information can be exchanged and processed worldwide in a standard messaging format, and in a language that everyone can understand.

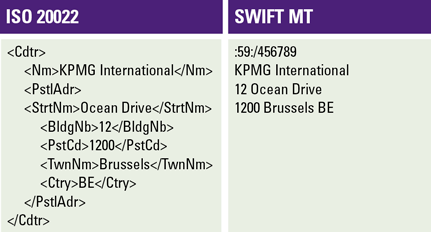

This dictionary streamlines communication for payments, securities, funds, foreign exchange trading and the credit card sector. Below is an example of the difference in the amount of data transmitted using SWIFT MT and ISO 20022

'ISO 20022 standardizes common data objects from the various market infrastructures and offers a common terminology for every financial institution', Compact

As an open financial message standard standard, ISO 20022 specifications are free to use, with the opportunity for further development and the option to be modified to meet every user's needs.

Recently, many countries have begun (or completed) their migration to the financial message standard ISO 20022, which is being primarily, though not exclusively adopted for high value, cross border, real time and corporate payments.

ISO 20022 messages use a Unified Modeling Language (UML), Extensible Markup Language (XML)and Abstract Syntax Notation 1 (ASN 1).

Read our guide What is ISO 20022 and how is it changing?

Why is ISO 20022 adoption important?

ISO 20022 provides a standard across payments and card services, defining message specifications for each message type. It transmits consistent, rich and structured data elements for every type of financial business transaction.

The universal adoption of ISO 20022 is aimed at creating a far better payments experience, and processing efficiencies resulting from increased straight-through processing. Fewer rejections and exceptions, better reconciliations, increased security and risk management could ultimately lead to reduced costs for the companies that adopt it.

Who uses ISO 20022?

The ISO 20022 international standard is focused on cross-border communications among banks and financial institutions, their clients, and market infrastructures throughout the payment industry involved in the processing of financial transactions.

The flexibility of ISO 20022 also provides the opportunity for the development of new domestic financial messages, which will streamline electronic transactions and card based payment messages for all financial networks.

The financial transaction life-cycle is a complex and multi-faceted process of passing network specific details throughout the transaction life-cycle. From authorization advice confirmation and advice response messages to secure key exchanges with country specific data elements and data element sub-fields, it highlights the need for a common, flexible, and simplified message structure.

ISO 20022 flexibility also creates several benefits for financial institutions, and the means to improve transaction efficiency while reducing costs and exposure to risk.

Image source: Elait

A summary of the key benefits of ISO 20022

-

ISO 20022 provides a common structure and language for financial business process communications.

-

Enables superior interoperability with other protocols.

-

Generates a financial message standard that encompasses complete transaction sequences.

-

Includes a complete selection of data elements, institution identification codes and messages for investment funds.

-

The ISO 20022 standard will provide longer references for non-Latin alphabets, with a character set ten times larger than SWIFT MT messages, and carrying a great deal more information.

-

Offers financial institutions improved remittance and permitting for extensions.

-

It can effectively manage formats not previously allowed for cross-operation, creating better interoperability.

Image source: Bank of England

The impact of the global adoption of ISO 20022

The worldwide adoption of ISO 20022 will have an immense impact on financial institutions and other payment networks, corporations, and any business with a stake in financial services and the large value payments industry.

ISO 20022 is the way of the future as it's the most comprehensive financial data standard in existence today.

Through richer more detailed data, it can drastically reduce the incidence of fraud and cyber crime throughout domestic, ACH, high value payments and cross-border payments.

But ISO 20022 is not only used for payments. It's set to become the dominant messaging standard standard across the breadth of the financial services industry, enabling a common understanding and interpretation in diverse areas including securities, trade services, Forex, card payments and related services.

Image source: Red Compass Labs

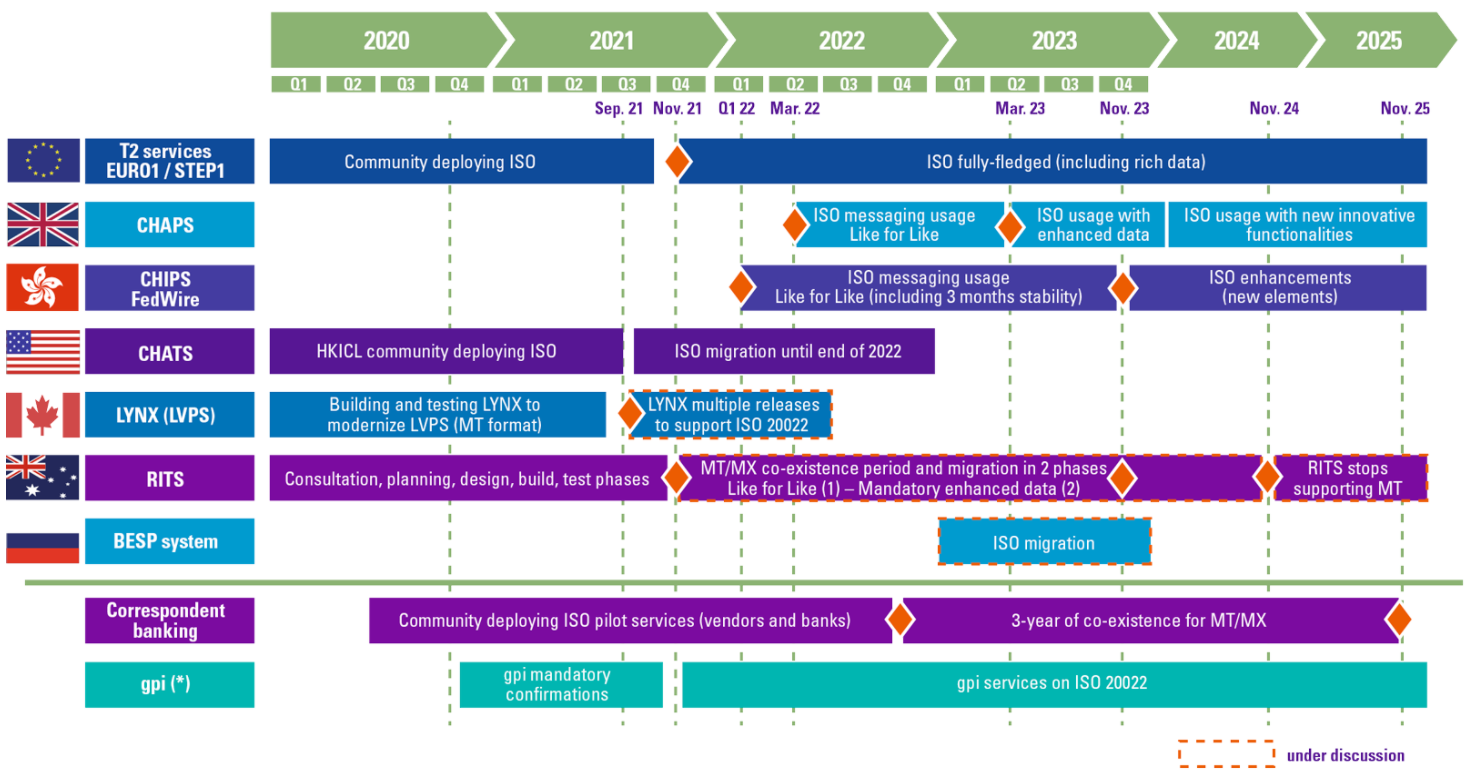

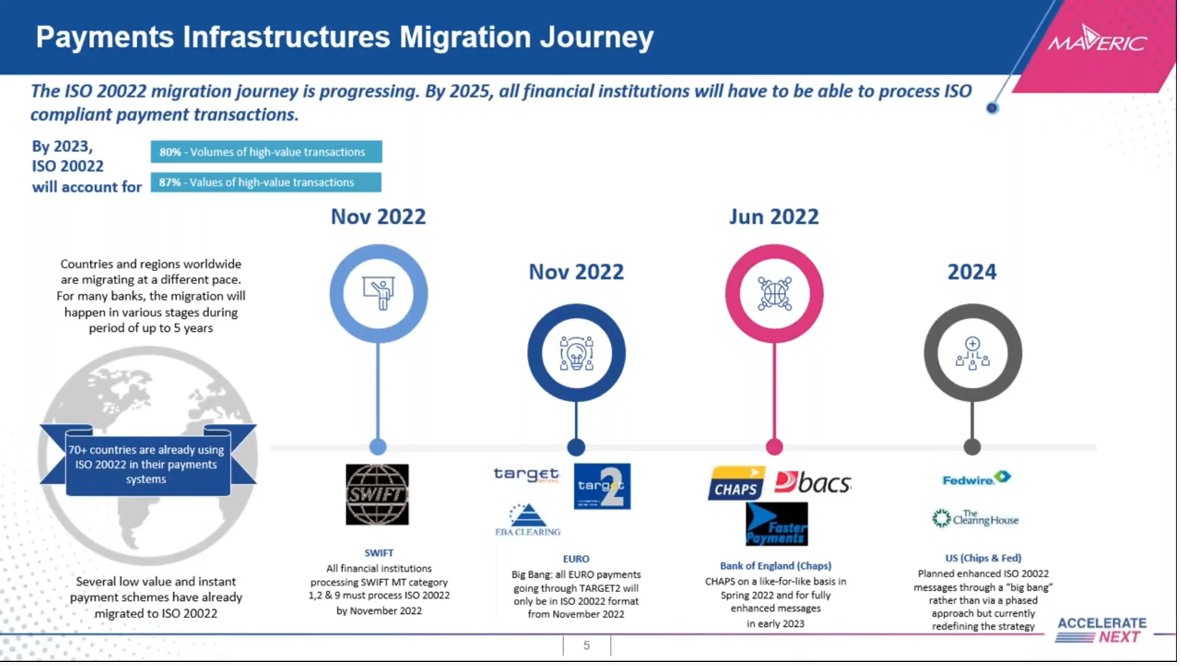

What is the timeline for ISO 20022 adoption?

Any financial institution that processes SWIFT messages must be able to receive and process ISO 20022 by March 2023.

The SWIFT network has stated that "there will be a three-year period of coexistence for MT and MX, allowing early adopters to benefit from ISO 20022’s richer, structured data, and other banks to adopt at their own pace."

Over 70 countries have already transitioned to ISO 20022 in their payment systems including Switzerland, China, India and Japan. And with over 200 payment types in scope, ISO 20022 will harmonize each format and data element from different payment methods that could not previously work together.

Image source: Compact

ISO 20022 will help to reduce financial liability, throughout the global financial industry, every payment gateway, and multiple technology solutions.

What is ISO 8583?

As briefly covered earlier in this blog, the ISO 8583 messaging protocol is used for retail payments systems that process a credit and debit card transaction initiated by cardholders using payment cards such as Visa and Mastercard.

Basically, when a cardholder uses a payment card, the electronic transaction data is exchanged throughout the network using ISO 8583 data elements, messages and code values.

The ISO 8583 standard is officially titled "Financial Transaction Card-Originated Messages — Interchange Message Specifications".

How does ISO 8583 work?

The ISO 8583 standard is typically used by POS devices and ATMs. The messages themselves commonly contain data including, where it originated, card account number, and bank sort code.

Some of the applications that use the data transmitted by ISO 8583 include:

-

Purchases

-

Withdrawals

-

Deposits

-

Reversals

-

Refunds

-

Balance inquiry

-

Payments

-

Inter-account transfers

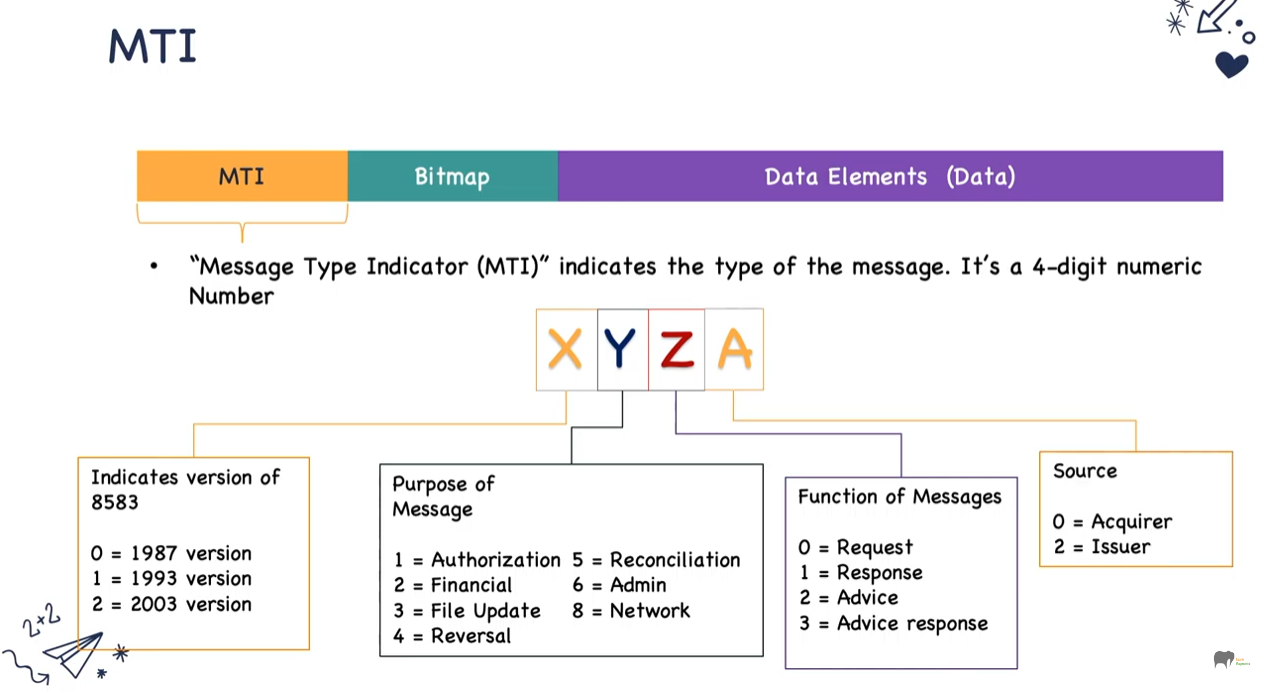

ISO 8583 uses a bitmap format, assigning each data element a definite position indicator in a control field.

ISO 8583 also defines point-to-point messages for totals reconciliation, network sign-on and sign-off as well as other administrative messages.

Prior to ISO 20022, corporate payments (which used SWIFT messaging) and retail payments (which used ISO 8583) had no commonality. The introduction of ISO 20022 is an attempt to bring a number of legacy message formats into a common structure.

Below is a basic illustration of how the ISO 8583 Message Type Indicator works. However, we explore in more detail the mechanisms behind ISO 8583 in our guide to ISO 8583.

Image source: Learn Payments

Benefits of a common, integrated messaging structure

The transition to ISO 20022 signals that it's time for the retail payments industry to embrace the benefits of adopting a single common messaging structure.

Due to multiple variations of the ISO 8583 standard, it can cause a great deal of complexity, particularly with the certification process, which often requires the need for human intervention, documenting and interpretation of the standard.

With ISO 20022, transaction information is machine readable and will significantly streamline the payments messaging process.

Image source: Temenos payments hub (webinar)

The importance of real-time payments analytics

As we've covered in this blog, various message systems exist to make payment procedures flow seamlessly, but the payments industry is becoming more complex with the evolution of cross-border payments and high value payments.

How IR Transact adds a new dimension to your payment network

Real-time payments analytics are vital to measure and monitor, view growth and make decisions all the way through the payments chain, and across each different platform. This is even more important now with the impending global ISO 20022 migration.

IR Transact simplifies the complexity of managing today's payments and infrastructure environments. Our solutions help you find and resolve performance issues in real-time, unlock insights from your data, integrate new systems and ensure every financial transaction is seamless.