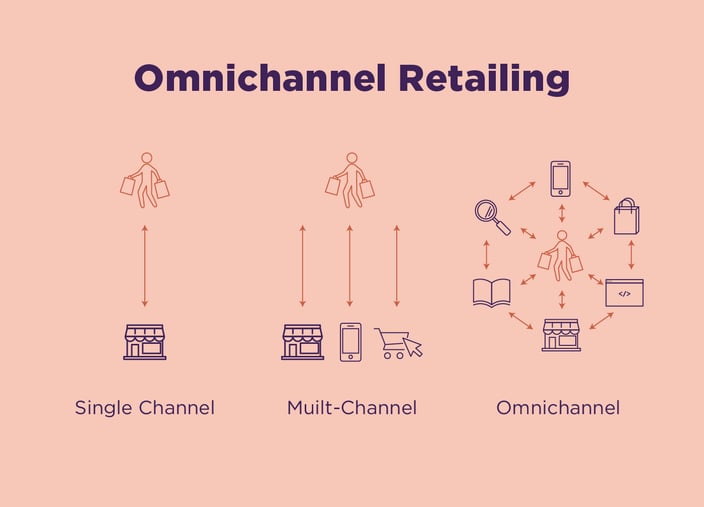

Omnichannel payment ecosystems are the way of the future. Financial institutions are closing the online/offline banking divide, improving customer experience, and attracting new ones with a digital first approach - while at the same time reducing operational costs. This involves incorporating numerous payment methods for incoming and outgoing payments.

Recent increase in consumer demand for a seamless payment experience, has resulted in merchants, financial institutions, and many payment service providers adding new payment methods and more payment options. Acquirers and banks want to have a place in these omnichannel ecosystems and alternative payment methods.

Image source: Plytix

Payments infrastructures have always been notoriously complex, but with huge advancements in payments technology, the accelerating global charge towards digital payments, and the outsourcing of payment services, this complexity is likely to increase.

Payment orchestration could empower a business, facilitate brand enhancement, increase payment security and give service providers the means to streamline your entire online payment process.

What is payment orchestration?

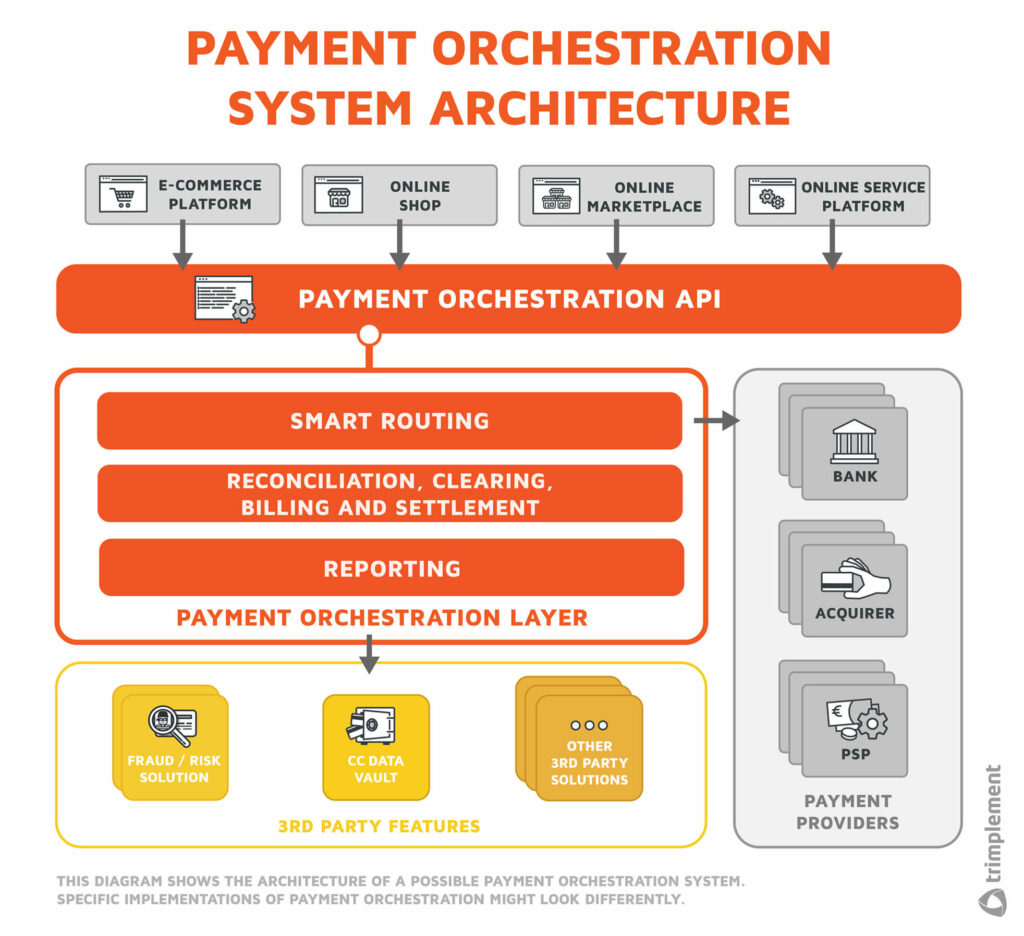

Payment Orchestration Platforms (POPs), also referred to as a Payments Orchestration Layer, is the process of integrating and handling different payment service providers, acquirers, payment gateways and banks on a single, unified software layer.

Payment Orchestration is innovating digital payments by simplifying front-end and back-end integration between an organization's website and various payment service providers.

A Payments Orchestration Platform is software that executes complete payment processing, from validation to routing to settlement. A Payment Orchestration provider brings together merchant and user accounts, acquirers, payment providers, fraud detection services, etc. to initiate, validate, route and process transactions involving those parties.

Additionally, a Payment Orchestration Platform can handle payment flows and payment processes such as reconciliation, billing and settlement, payouts and reporting.

Image source: Trimplement

The benefits of a Payments Orchestration Platform

A Payments Orchestration Layer simplifies the payment process. It's designed to serve as the entry point and core of eCommerce and online payments systems. It alleviates the need for eCommerce platforms and online payment service providers to integrate different payment processors, payment methods and every payment service provider and acquirer separately, reducing integration complexity.

A Payment Orchestrator provides more payment functionalities so businesses can optimize their payment stack and scale their business more quickly.

Image source: Ixopay

With only one platform to connect with multiple payment processors, Payment Orchestration providers enable businesses to accept more payment methods, expand geographic coverage, and use technology to improve the payment flow. This, in turn, provides a better customer experience and boosts brand loyalty.

As well as streamlining interaction, a Payments Orchestration Platform also simplifies the maintenance and further development of payment systems for platform owners and merchants.

Image source: Paydock

Below is a summary of the main benefits of using Payment Orchestration Platforms.

Easier integration

Through Payments Orchestration, merchants can work with many payment service providers, so if they need support for alternative payment methods, they can use one unified API instead of seeking third-party integration.

Easy adaptation to consumer preferences

With a payments orchestration platform, there is access to an abundance of payment services providers. This makes adding an additional payment method through an eCommerce website easier through a single API integration.

Makes scaling a business easier

Payment Orchestration allows the setup of many payment methods and features more quickly, meaning speed to market will be faster and with more payment options, you’ll be able to reach more people, improve the customer experience, and even support cross border sales.

Results in more approved payments

Payments Orchestration Platforms can prevent losing sales through technology failures by routing transactions to the best performing payment processor, reducing declined payments and leading to more authorized payments at the checkout page.

Reduces payment processing costs

Payments Orchestration will help a business reduce costs throughout their entire payment stack, resulting in fewer setup fees for multiple integrations, and additional fees that stand-alone payment services providers charge for automated transaction routing.

Centralized reporting and data analytics

If payment data is spread across multiple payment gateways and service providers, analyzing it and implementing strategies to improve business can be difficult. Payment Orchestration, combines all data into one dashboard that offers insightful real-time analytics.

Payment security and compliance

Managing PCI Compliance and other regulations in digital payments is mandatory for PSPs, including payments orchestration platforms. Whether it’s managed in-house or outsourced, you won’t have to worry about payment security requirements.

How does Payments Orchestration work?

The main advantage of Payments Orchestration Platforms is that the software layer automatically identifies the best route to send payments, through automated transaction routing.

Sometimes a payment fails for any number of reasons, and could potentially result in the loss of sales. In the event of online payment failure messages, POP software has the ability to automatically route transactions to multiple payment processors. If the alternative payment processor is successful, the transaction goes through. In effect, the Payments Orchestration Platform acts as a 'director' of transactions, and by finding the best performing processor, it leads to more payment authorization.

The payment flow process

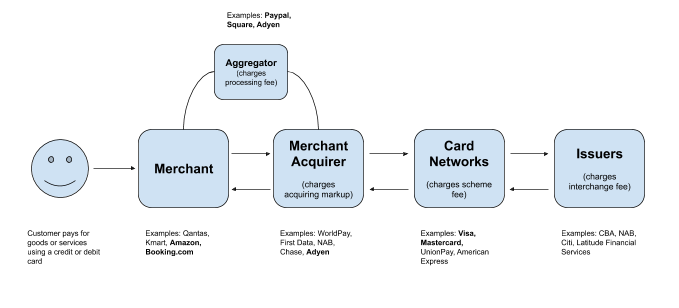

With all digital payments, there are common payment processing rules for payment settlements.

-

The customer makes the payment and chooses a payment method

-

Payment information is sent to the payment gateway

-

The payment gateway encrypts the cardholder's payment information and sends it to the acquiring bank and payment processor.

-

The acquiring bank and issuing bank communicate to authorize the payment.

-

Payment collection or a declined payment message is then sent from the acquirer to the payment gateway, and finally to the merchant.

As mentioned, with payments orchestration, if the payment fails, transactions are automatically routed, if need be to several payment processors, to reduce false payment failure messages.

Image source: Spaceship

The growth of the payment orchestration model

Faced with the continuously complex task of managing payments across geographies and many sales channels, multiple providers are often needed to handle customer conversion, increase cost savings, and improve anti-fraud procedures and use cases.

Payment Orchestration Platforms allow merchants more ways to adapt their payment infrastructure and grow their business, while continuing to offer an excellent customer experience.

Image source: Modopayments

Choosing a Payment Orchestration Platform provider

Payment technology can be complex and there are various factors to consider when choosing a POP. Remembering that the Payment Orchestration layer acts as a conduit within the payment system, the POP should be vendor-agnostic. This gives merchants the ability to connect to any (PSP) and payment gateway they need as well as finding the best smart routing solutions.

This can help increase acceptance rates and approved transactions, therefore boosting profits and improving the overall customer checkout process. Indeed, a POP that isn’t this flexible can lower acceptance rates and increase fees, negatively impacting an organization’s bottom line and scalability.

Evolving customer payment preferences

Merchants and retailers are rapidly responding to the demand from customers to include the payment methods and payment solutions of their choice. They don't want to have to input their payment details and sensitive data over and over again.

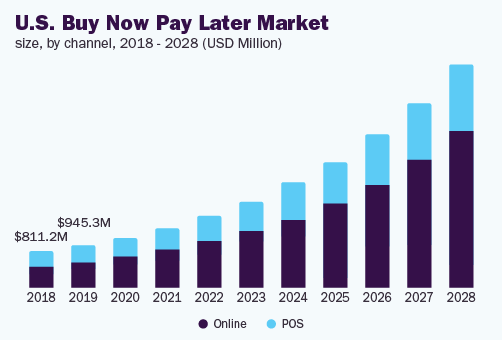

True omnichannel banking allows payment providers to offer complementary services, and Payment Orchestration is bringing about changes in the capacities of Payment service Providers to better respond to retailers’ needs. Trends like Buy Now Pay Later (BNPL) for example is on the rise and more and more retailers are responding by including this payment option in their payment process.

Image source: Millioninsights

The evidence is clear. Today, more than 60% of retailers need to work with several payment providers, while over 25% see implementing payments orchestration as an important step in their transformation as a business.

Payment orchestration vs. payment gateway

A Payments Gateway and a Payments Orchestration Platform both aggregate many payment methods, however, they operate on wholly different payment support levels.

For example, payment gateways process transactions through one processor, which imposes limitations on merchants with payment routing rules.

Payments orchestration platforms allow more flexibility, control, and the ability to scale your digital payments process, with only one platform needed to handle all payment service needs.

The importance of analytics

The payments industry is increasingly driven by information and data. While this is nothing new, card issuers, retailers and acquirers have realized that gaining better insights into customer behavior provides a deeper understanding of sales and customer spending patterns.

Analytics also helps to reveal payments trends and anomalies. Without transaction data and analytics to get clear visibility into the payments environment, a business wouldn't be able to identify transaction performance issues, or detect fraud and other anomalies.

Services would be disrupted, repair times and troubleshooting processes would also be derailed, and the risk of bottlenecks for services like online banking, POS or mobile payment networks would increase.

How IR Transact can help

IR Transact, built on the powerful Prognosis platform, simplify the complexity of managing modern payments ecosystems, bringing real-time visibility and access to your entire payments environment. Transact can integrate with Payments Orchestration platforms, to reveal unparalleled insights into transactions to help streamline the payments experience.

By turning data into intelligence, businesses can gain unlimited access and insights into customer usage data, end-to-end transaction performance metrics. With dynamic visualization tools, businesses easily get a clear view of all this information to make proactive management decisions.

The benefits of IR Transact as part of your payments solutions:

-

Insights into the way each different channel is performing to improve conversion rates and deepen engagement with customers.

-

Better understanding of the ROI of each software application and device in use, a plus break down of the revenues and costs of different digital transactions

-

Analytics on customer product use, transaction types and amounts, through one clear window

-

The adoption of more sophisticated cross-channel integration without the risk of service disruptions.

-

Businesses, acquirers and processors can meet regulatory compliance by identifying suspicious transaction behavior and alerting to specific response code errors .

-

Transaction performances can be improved and interaction with customers can be more successful by isolating device, host connectivity, network and related application issues.