According to a research report from Markets and Markets, the global Payments-as-a-Service (PaaS) market size is estimated to grow from $56.2 billion in 2020, to $164.3 billion by 2026.

Since the onset of the pandemic, the world has seen a massive digital acceleration, and the rapid uptake of Payments as a Service is answering the demand for faster payment solutions and money transfer methods.

This demand for cloud-based payment processing methods has seen financial institutions and payment service providers facing pressure to transform their payments platform, and re-evaluate legacy payment infrastructure to keep up with rising payment volumes and evolving payment solutions.

What is a payment-as-a-service?

During the last few years, new technologies and global changes have affected and changed human behavior. In the financial market, the steady acceleration towards digital payments, open banking, the use of digital wallets and the rapid decline in the use of cash is having a huge effect on the entire global payments ecosystem.

The challenges faced in this new world of payment processing can be complex. Banks, payment providers and other payment players need to keep up with changes like regulatory compliance, and risk management, while keeping a handle on transaction fraud and still retaining control.

The success of every business depends on its customers, so the future of the customer service they provide is another important consideration for payment providers

One way of dealing with the pace of demand, and elevate the payment experience, is by outsourcing a part of the payments technology by approaching payments like many other software solutions: as a service. The payment as a service model is allowing customers more flexibility and choice, while reducing risk and simplifying the process of restructuring an organization's payments stack.

How Payments as a Service works

PaaS solutions allows banks, payment providers and other financial institutions to offer their customers advanced payment products and services without resource-laden internal development investment costs. At the same time, Payments as a Service providers enable banks and other organizations to move to a more flexible, agile model and expand their payment solutions. Payments as a Service enables then to offer better products through one or more cloud-based third party platforms.

What are payment rails?

Payment rails work behind the scenes to facilitate payments between businesses and consumers. Some have existed for decades, but new payment rails are now being used in various different ways to support traditional payment flows while facilitating up-and-coming payments technology such as Payments as a Service.

The benefits of Payments as a Service

As a platform, PaaS offers multiple benefits to many banks, FIs, and other organizations across the full payments value chain, making the adoption of a PaaS platform a hugely viable option for companies looking to reduce their current operating costs, develop an application for the first time, or those with limited resources. The increasing popularity of Payments as a Service is due to two basic factors.

-

Its lower total cost allows organizations access to state-of-the-art resources without a hefty price tag. The market costs involved with building robust payment environments on premises are often prohibitive, but with PaaS managing your payments ecosystem, there's a clear path for accelerating software development.

-

Payment as a Service solutions allow organizations to focus on what they specialize in without worrying about updates to their payment platform or managing their digital payments basic infrastructure.

The role of a PaaS provider

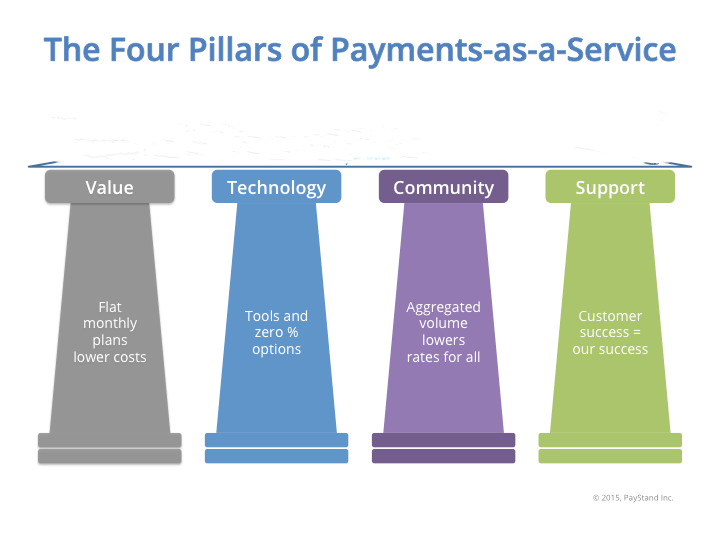

Payments as a Service is a far cry from the traditional way of looking at the payments machine, and begin to look at financial transactions through the lens of Software as a Service (SaaS). PaaS providers first and foremost switch the focus from the transaction itself to the customers and merchants, and provide the opportunity to align incentives between payment processor and merchant, which historically had been at odds.

PaaS providers handle all servers, storage, networking, virtualization, middleware, the operating system, and the runtime. Therefore, organizations are only left to provide the data and applications. Without the need to purchase hardware or pay expenses during downtime, companies can see significant savings.

Image source: Spryker

What is a merchant account?

A merchant account enables merchants to process payments through the payments platform or payment rails of their choice, but merchants have no control over their merchant account; it’s simply a holding place for deposits. Since merchandise can be returned, there’s always the chance that money received by a seller will have to be paid back, so in effect it's a risk mitigation solution. Returns are subtracted from whatever sits in the merchant account at that time; the remaining funds are then transferred to your bank account.

How PaaS is transforming online payments for businesses

Enterprises are leveraging APIs to introduce new products, services and financial solutions provided by FinTechs. Incumbent primary payment technology providers also help curate FinTech partnerships and integrate them directly into the banking technology stack. This integration into back-end technology means that FIs can easily utilize FinTech capabilities to plug product and service gaps. They can also optimize costs by translating CapEx to OpEx, strengthen brands, and deliver tailored services to target audiences.

Enterprises are heartily embracing the PaaS model and using current and emerging technologies to engage customers upstream and downstream from the point of payment. This helps to leverage all related data to automate and increase straight-through processing.

Integrating each payment solution with online customer engagement points or respective services is crucial. Embedded finance is now the way forward for future-smart payment ecosystems. With Payments as a Service, enterprises and companies can continue to focus on their core business.

PaaS providers offer their services to relieve the burden of constantly overseeing infrastructure, while providing the skills required to align businesses with the latest payment technology and business models.

Why PaaS is here to stay

New emerging technologies and complex regulations pose significant challenges to the traditional business model servicing payments through payment hubs. These clunky payments ecosystems processing large volumes on batch framework, are standing in the way of payment modernization.

PaaS is the contemporary alternative to these traditional payments hubs spanning the entire gamut of the payment value chain.

The next decade in Payments as a Service

While digital payments and innovative new payments services have become such a huge part of the lives of consumers, enterprises and banks, there is still a huge scope for the payments industry to grow and diversify.

Faster connections: Faster payments

5G technology services and advances in WiFi increasing speeds are enabling the payments process to become virtually instantaneous. This has implications for blockchains and how they can be used to link high-speed networks and create a fast flow of transactions globally.

The next decade has the potential to see such fast, real-time payments become the norm, and with increased speed comes an increase in volume, limited only by the efficiency of the server in your location.

Additionally, higher speeds will lead to a great volume of transactions, providing increasing scope for automation to be brought into the payment network.

New arrivals: New opportunities

The introduction of payment services like PayPal at the turn of the millennium saw the online payments industry soar in popularity.

The last decade saw the rise of apps like Apple Pay and Google Pay, so there's a greater likelihood of an influx of non-traditional payments players in the next 10 years. The rise in cryptocurrencies and the rapid growth of Fintech companies suggests an increasing range of more flexible payment options to companies and consumers alike.

Regulations: A challenge for the payments world

The digital age has brought with it a whole new form of finance, which is proving to be an ongoing challenge for regulators.

The rise of digital finance means that there is less differentiation between countries and even currencies themselves. This has created problems for regulators, and forced nations to take measures to protect their own currencies. One such move has seen China create its own digital currency, and it's suggested that other countries will follow. State-controlled or other digital currencies are likely to present a huge challenge for financial regulators in the next few years.

Fraud: The price of digital convenience

Fraudulent activity is ever-present in the world of finance, and with the rapid increase of digital payments, the opportunities for fraudsters is expected to increase.

However, security measures have evolved, with features such as biometrics, like fingerprint and face recognition, and two-factor authentication required to unlock phones and payment apps, but the price for the constant convenience of digital is equally constant vigilance.

Data: A currency of its own

Financial transactions may be the main aim when it comes to the various payment platforms, but the trade in data is becoming just as competitive. Each online transaction reveals more information about about a consumer, and this information is highly valuable to payment companies.

The trade in data is set to become more sophisticated and diverse, meaning that its value will rise. Gaining access to, and interpreting that data will prove vital as it can provide useful insights into consumer behavior.

How IR Transact can help you gain insights and optimize your payments

With the payments industry evolving at such an astounding rate, organizations need to find a way to effectively manage booming transaction volumes and an increasingly complex payments environment.

Payment analytics brings everything together. With access to all your traditional payment data and what’s happening inside your payment system in real-time, you have complete insight over your payment environment.

IR Transact suite of solutions, built on the powerful Prognosis platform, uses dynamic visualization tools to simplify the complexity of managing your Payments as a Service ecosystem.

Transact brings you real-time visibility and unparalleled actionable insights into every transaction, turning data into intelligence, elevating customer satisfaction, and delivering a flawless payment experience every time.