New payment processing technology is constantly emerging and evolving, and this is influencing the way consumers, businesses and even financial institutions carry out electronic funds transfer.

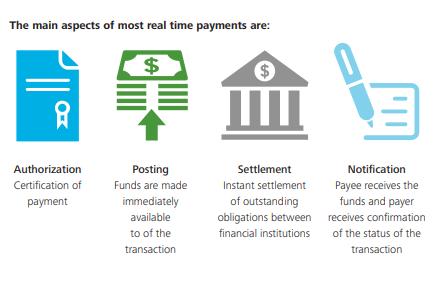

Real-time payments refers to the immediate transfer of funds between two parties, resulting in the funds being received and available instantly, as well as the funds being instantly deducted from the payer’s bank account.

Source: Deloitte

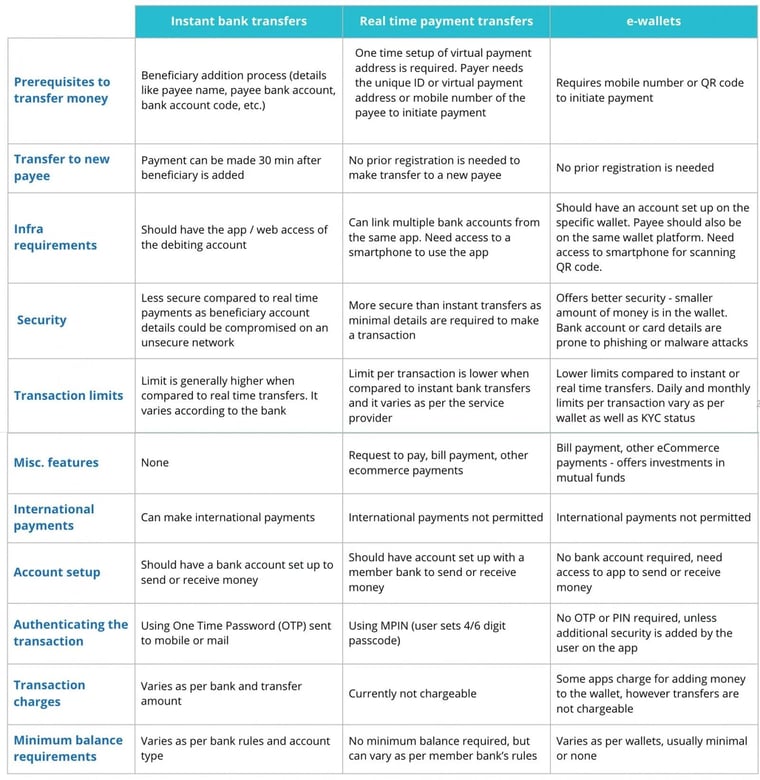

Primarily, there are three kinds of real time payments:

-

Instant bank transfers that use account numbers (the traditional approach)

-

Real time payment (RTP) transfers from one bank account to another using an alias like a mobile number or a unique ID

-

e-wallets

Image source: Thoughtworks

In this article, we'll discuss the importance of having real time payment management software like IR Transact to give you the edge when managing payments.

What are payment management solutions?

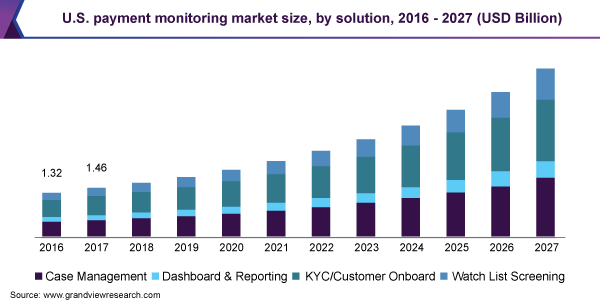

The global payment monitoring market size was valued at USD 9.6 billion in 2019 and is expected to grow at a compound annual growth rate (CAGR) of 16.1% between 2020 and 2027.

Image source: Grandview Research

This is not surprising, because without proper monitoring and management of your real-time payment processes, there are some serious issues that could affect businesses, including attracting penalties for not meeting SLAs, losing revenue and damaging reputation.

The best payment management software ensures that you get actionable insights into every facet of your online payments stack, giving you detailed intelligence and contextual data throughout each step of your real-time payment engine.

A payment management system enables enterprise organizations to track and monitor their payment processes, identify problems and shortcomings in transaction processing, and create alerts when suspicious activity is detected.

The right payment management system can not only track payments, but reduce operational costs and improve cash flow by allowing you to gain visibility into your entire payment ecosystem.

Find out more about the importance of real-time transaction monitoring

How does payment management software work?

Payment management software is a critical component of B2B payment solutions. It provides organizations with a comprehensive solution for optimizing their payment processing systems.

-

Integration. Sophisticated software like IR Transact integrates seamlessly with your payment processing software, and online accounting software. This enables businesses to send and accept payments efficiently between suppliers and vendors.

-

Electronic invoices. Payment management software uses AI and automation to streamline workflow associated with processing invoices.

-

Recurring payments. Payment management solutions can automate recurring payments, allowing you to streamline your accounts payable process.

-

Pending payments. Payment management software provides visibility into payments pending or payments due.

-

Payment workflows. Payment management systems can track and monitor different payment types, enabling businesses to streamline their payment workflows.

But most importantly, payment management software provides valuable insights into cash flow.

This enhances security by implementing rigorous authorization controls, and also ensures compliance with payment regulations.

How to choose a payment management solution

Everyone who needs to process payments, from issuing banks, merchant acquirers, growing businesses or payment processors should ensure that their payment ecosystem is efficient, resilient and robust.

Customers demand a high quality experience, so the right payment management tools will bring clarity and visibility to every component in the payment environment, and this means selecting the best-fit performance monitoring tool is more important than ever before.

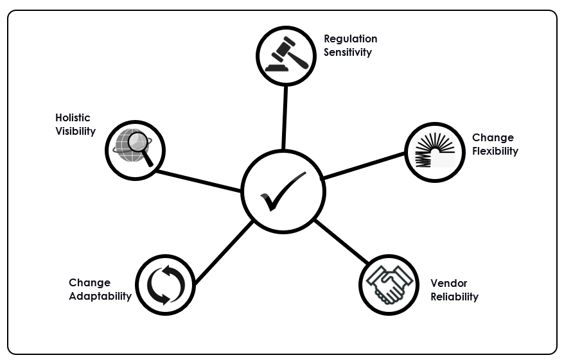

We believe there are 5 key criteria to consider before deciding on a management solution.

1. Holistic visibility

Real-time visibility of your system is vital throughout the payment process in order to act immediately when problems occur. You need one tool that can give you real time insights and a convenient single view of every component of your payment ecosystem.

2. Regulation compliance

Payment transactions must comply with several industry regulatory standards, which unfortunately are changing all the time. Your chosen performance monitoring tool needs to be sensitive to evolving regulations trends, or risk serious penalties and damage to reputation.

3. Adaptability

Payment options have evolved into contactless, mobile wallets and wearables. Associated technologies have also moved - from traditional magnetic strip to EMV Chip and Pin, tokenization, and real-time payments.

Your chosen monitoring tool also needs to keep evolving and be capable of capturing transaction data and consumer behavior analytics, and turn that into intelligent insights that drive business growth.

4. Flexibility

Payment management should not only monitor system health, but also have the capability to investigate the root cause of problems, forecast trends, and easily let operational and business users configure and bring visibility to new metrics as required.

5. Vendor reliability

Vendor-specific performance monitoring tools mean you depend on that vendor for ongoing service support, updates and new features.

Partnering with a reliable third-party vendor that provides 24/7 customer support can save you time, money, and unnecessary potential frustration.

Want to know more about the 5 criteria for choosing a payments monitoring tool?

Deliver seamless experiences with IR Transact

Analytics for real-time payments are critical within the payments industry, given that it deals with mass batches of payments, huge volumes of data, and is prone to volatility.

The need to detect complex patterns in real-time, correlate information, analyze and act on this information immediately is critical.

IR's real-time solutions give you the means to track inbound or outbound payment flows, allowing you to view this information based on different metrics such as response time for each instruction, aggregate response time, and even number of transactions passing through each channel.

A payment monitoring tool like IR Transact enables end-to-end visibility into your payment gateway, merchant transactions, and all of your payment services, as well as integrating seamlessly with your accounting system and billing software.

As real-time payments are rapidly becoming a global standard, payment providers need to prioritize real-time and ensure their payments systems are optimized for peak performance.

Need more information? Read about Tracking, Monitoring and Managing Your Real-Time Payments

Keep real-time payment information flowing

Easily identify and resolve issues. Monitor the health of your real-time payments, and spot anomalies with an all-encompassing view into queue status, transaction volumes, and bottlenecks, enabling you to get ahead of potentially disruptive events before they impact the customer.

- Streamline operations and reduce costs

- Have real-time visibility of your transactions, no matter what vendor you’re using

- Stay in control of your payments ecosystem with dynamic thresholds and alerts

Improve customer satisfaction

Deliver the experience your customer expect. If the entire process offers a seamless real-time payments experience, it can increase customer spending and loyalty.

- Find and fix problems before they impact customers with rapid troubleshooting

- Ensure successful deployments and optimal performance across all payment types

- Reduce downtime and optimize service levels

Get complete visibility

Understand your environment. Get a comprehensive view of historical transaction information to help investigate and identify the root cause of issues. You can even customize your dashboards to display the information most relevant to you.

- Use customizable dashboards to see the information most important to you

- Translate complex data sets into straightforward, digestible representations

- Understand how your environment is performing

Unlock insights in your data

Leverage your data. Turn payments data into business insights and uncover opportunities to grow and streamline your business processes.