With international money transfers amounting to trillions globally each day, SWIFT codes exist to ensure the safety, security, and straight through processing of all those transactions.

What exactly is SWIFT ?

The Society for Worldwide Interbank Financial Telecommunications (SWIFT) is a bank code and member-owned cooperative essential for sending international or cross-border payments as it provides transaction security. This makes it a vital part of the financial side of global businesses.

The SWIFT network is a messaging infrastructure, not a payments system. The network doesn't actually transfer the money - it communicates transaction orders between institutions using SWIFT codes.

Thanks to SWIFT, we have standardized IBAN (International Bank Account Number) and BIC (Bank Identifier Code) formats that are used for actual funds transfer.

In addition to customer and bank funds transfers, SWIFT is used to transmit foreign exchange confirmations in a third party foreign exchange deal, debit and credit entry confirmations, statements, collections, and documentary credits.

The history of SWIFT

SWIFT was founded in the 1970s, based on the ambitious and innovative vision of creating a global financial messaging service, and a common language for international financial messaging.

Prior to SWIFT, telex was the only available means of message confirmation for transferring funds internationally. Telex was hampered by low speed, security concerns, and a free message format, meaning it did not have a unified system of codes like SWIFT to name banks and describe transactions.

Telex senders had to describe every transaction in sentences that were then interpreted and executed by the receiver. This system was prone to many human errors, as well as slower processing times

SWIFT is a member-owned cooperative, with members in more than 200 countries, linking more than 11,000 financial institutions.

In 1979, SWIFT delivered 10 million financial messages for the year. In May 2021, SWIFT recorded an average of 42.3 million financial messages per day, a traffic growth of +11.7% versus same period of previous year.

SWIFT is headquartered in Belgium and has offices worldwide, including Australia, Austria, Brazil, China, France, Germany, Ghana, Hong Kong, India, Indonesia, Italy, Japan, Kenya, South Korea, Malaysia, Mexico, Russia, Singapore, South Africa, Spain, Sweden, Switzerland, UAE, and the United Kingdom.

SWIFT and Sanctions

Because of their reliance on SWIFT to conduct fast, seamless, secure communication, countries around the world have an incentive to remain in good standing with the organization. SWIFT is a neutral organization operating for the benefit of all of its members, but it is overseen by central banks from Group of Ten (G10) countries.

In recent years, the possible use of SWIFT membership as a potential sanction against members has emerged multiple times. In 2012, for example, the European Union passed a sanction against Iran that compelled SWIFT to disconnect sanctioned Iranian banks.

More recently, leaders from the U.K., EU, U.S., and Canada announced selected banks in Russia would be disconnected from SWIFT over its February 2022 invasion of Ukraine.

How does a SWIFT message work?

The platform uses a standardized proprietary communications platform to allow the transfer of secure financial transactions, but doesn't hold funds on its own, and doesn't manage external client accounts. SWIFT's primary function is its power to facilitate secure, efficient financial communication between member institutions.

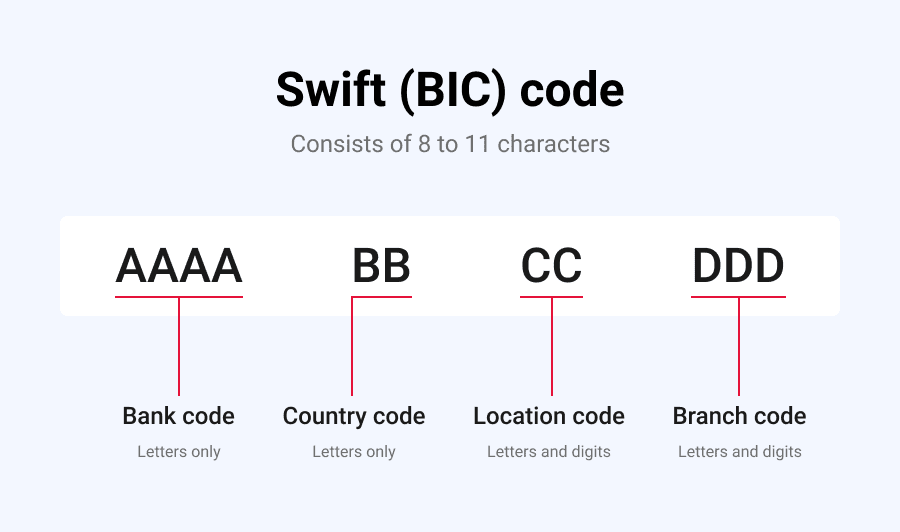

SWIFT codes are a combination of various letters known as Bank Identifier Codes (BIC) used to identify the branch codes of banks. The terms BIC and SWIFT codes are often used interchangeably, even though they mean the same thing.

Image source: Worldfirst

For money transfers, SWIFT assigns each participating financial organization a unique code with either eight or eleven characters. The code has three interchangeable names: the bank identifier code (BIC), SWIFT code, SWIFT ID, or ISO 9362 code.

For example, the SWIFT code for Paris, France would look like this:

Cross-border payments that involve sending large amounts of money can be complex, so the process needs to be secure and foolproof, and the same applies when receiving international payments.

A bank needs to be a SWIFT member to receive the SWIFT code and be part of the network. Then, for any transaction made by banks or financial institutions on an international level, they will use their unique SWIFT code, which acts as an international digital language.

The concept makes for a faster, more hassle-free process. The SWIFT system is electronic and uses a cloud platform to quickly transmit codes to and from banks.

The SWIFT network primarily started for simple payment instructions, although it now sends different message types for a wide variety of actions, including security transactions, treasury transactions, trade transactions, and system transactions.

In Swift's latest report, from January 2022, data showed 44.5% of SWIFT traffic is still for payment-based messages, while 50.6% represents security transactions, and the remaining traffic flows to Treasury, trade, and system transactions.

SWIFT categories

The table below shows the different categories and the message type descriptions.

-

Category 1 message type, is Customer Payments and Cheques, with the type designation MT 1xx.

-

Category 2 message type is Financial Institution Transfers, with the type designation MT 2xx.

-

Category 3 message type is Treasury Markets, Foreign Exchange, Money Markets, and Derivatives, with the type designation MT 3xx.

-

Category 4 message types, Collections and Cash Letters, with the type designation MT 4xx.

-

Category 5 message types, Securities Markets, with the type designation MT 5xx.

-

Category 6 message types, Treasury Markets, Precious Metals, with the type designation MT 6xx.

-

Category 7 message types, Treasury Markets, Syndication, with the type designation MT 7xx. Example message 707 information: To advise the receiver of the terms and conditions of a third bank's documentary credit.

-

Category 8 message types, Travellers Cheques, with the type designation MT 8xx.

-

Category 9 message types, Cash Management and Customer Status, with the type designation MT 9xx.

SWIFT MT Message Structure

All SWIFT messages include the literal “MT” (message type). This is followed by a three-digit number that denotes the message category, group and type.

A SWIFT MT message consists of the following blocks or segments:

-

{1:} Basic Header Block

-

{2:} Application Header Block

-

{3:} User Header Block

-

{4:} Text Block

-

{5:} Trailer Block

Image source: Shuddh Desi Banking

A SWIFT message ending in 95 denote queries, those ending in 96 denote answers, and those ending in 99 mean that you are free to write anything in the message box.

Image source: Shuddh Desi Banking

SWIFT Message Structure: Basic Header Block

This is the structure of a Basic Header Block – the bit that starts {1:

It will typically consist of something like: {1:F01YOURCODEZABC1234567890} where:

-

{1: – Identifies the Block – i.e. the Basic Header Block

-

F – Indicates the Application Id – in this case, FIN

-

01 – Indicates the Service Id

-

01 = FIN

-

21 = Acknowledgement (ACK) or Negative Acknowledgement (NAK)

-

-

YOURCODEZABC – The Logical Terminal Address – which is typically your BIC 8 (YOURCODE) + Logical Terminal Code (Z) + Branch Code

-

1234 – Session Number

-

567890 – Sequence Number

-

} – Indicates the end of the Basic Header Block

SWIFT Message Structure: Application Header Block

The Application Header Block will always starts {2:

And will look something like: {2:I101YOURBANKXJKLU3003} where:

-

{2: – Indicates the start of the Application Header block

-

I – Informs you that you’re in Input mode (i.e. the Sender), O would indicate Output mode – so you would be the recipient of the message

-

101 – Message type – in this case, an MT101

-

YOURBANKXJKL – The recipients BIC, consisting of their BIC (YOURBANK) + Recipients Logical Terminal Code (X) + Recipients Branch Code (JKL)

-

U – Message Priority:

-

U – Urgent

-

N – Normal

-

S – System

-

3 – Delivery Monitoring – Ask your SWIFT contacts or Service Bureau how you should populate this, if at all – Optional

-

003 – Non-delivery notification period – again, ask your SWIFT contacts how to populate this, if at all – Optional

-

} – Indicates the end of the Application Header Block

SWIFT Message Structure: User Header Block

The User Header Block will always starts {3:

And will look something like: {3:{113:SEPA}{108:ILOVESEPA}} where:

-

{3: – Indicates the start of the User Header Block

-

{113:SEPA} This is an optional 4 alphanumeric bank priority code

-

{108:ILOVESEPA} – Indicates the Message User Reference (MUR) value, which can be up to 16 characters, and will be returned in the ACK

-

} – Indicates the end of the User Header Block

What is a Single Customer Credit Transfer?

This message type is sent by or on behalf of the financial institution of the ordering customer, directly or through a correspondent to the financial institution of the beneficiary customer.

A Singe Customer credit transfer is used to convey a funds transfer instruction in which the ordering customer or the beneficiary customer, or both, are non-financial institutions from the perspective of the Sender.

The single customer credit transfer message type may only be used for clean payment instructions.

What is a Multiple Customer credit transfer?

The Multiple Customer Credit transfer deals with payments, or information about payments, in which the ordering party or the beneficiary, or both, are not financial institutions.

This message type is sent by or on behalf of the financial institution of the ordering customer(s) to another financial institution for payment to the beneficiary customer.

It requests the Receiver to credit the beneficiary customer(s) directly or indirectly through a clearing mechanism or another financial institution, or to issue a cheque to the beneficiary.

This message is used to convey multiple payment instructions between financial institutions for clean payments. Its use is subject to bilateral/multilateral agreements between Sender and Receiver.

Amongst other things, these bilateral agreements cover the transaction amount limits, the currencies accepted and their settlement.

What is direct debit transfer message?

Direct debit is a payment method, by which a pre-authorised agreement enables one organization to debit money automatically from the bank account of another individual or organization. Direct debits are made automatically, and on a regular basis.

SWIFT operates a system of payment by direct debit transfer message and this method is favoured by 70% of SWIFT customers. party foreign exchange deal

What is (was) bilateral key exchange?

A bilateral key allowed secure communication across the SWIFT network. The text of a SWIFT message and the authentication key were used to generate a message authentication code or MAC. The MAC ensured the origin of a message and the authenticity of the message contents.

The scheme was retired on January 1, 2009 and has now been replaced by the Relationship Management Application (RMA). All key management is now based on the SWIFT PKI that was implemented in SWIFT phase two.

The migration from SWIFT to ISO 20022

The payments ecosystem continues to rapidly change and evolve. This is being driven by increasing pressure from regulators, intense competition from new entrants and by customers who now expect payments to be instant, transparent and seamless.

New channels and platforms for business are evolving at unprecedented speed, and the harmonization of risk-bearing data exchange across all these channels is critical to the security of the world’s financial system, and to high value and cross border payments.

To address these new challenges, a more modern, structured, open and pervasive standard language is now required. That standard language is ISO 20022.

Banks and financial institutions globally are entering a new era, as they prepare to transition their payment systems from using the SWIFT message system to the newer, highly structured and data-rich ISO 20022 financial messaging standard.

The new approach impacts SWIFT cross-border payments and cash management messages (CBPR+) only. However, SWIFT will continue to support domestic payment market infrastructures (PMIs) adopting ISO 20022, including:

-

Major reserve currencies

-

TARGET2 and Eurosystem Market Infrastructure Gateway (ESMIG) for EUR

-

Bank of England (new RTGS) for GBP, MEPS for SGD, and 30 additional PMIs going live by the end of 2023.

The migration from MT to ISO 20022 payment messages comes with many benefits for banks, financial institutions, corporations, businesses and individuals.

ISO 20022 provides rich data with each transaction, enabling everything from enhanced analytics to status tracking, sanction checking and automated invoice reconciliation – all whilst delivering an enhanced experience for end customers.

The global ISO 20022 standard for financial messaging also reduces fragmentation and improves interoperability on key services such as instant payments - domestic and cross-border, Open Banking, API platforms and other overlay services.

Read our comprehensive guide to ISO 20022 here

The high value market infrastructures in Europe, TARGET2 and EBA E1/S1, intend to migrate to fully fledged ISO 20022 in November 2022. Although their plans have been deferred by twelve months due to the delay by SWIFT, the two infrastructures are committed to the migration.

The importance of third-party monitoring solutions

ISO messages can be hundreds of times longer than standard payments messages. This dramatic expansion of data means that infrastructures will need to be redefined to manage the additional ISO 20022 information.

Each and every character within a message has to be 100% aligned with the specifications. The format is validated at several steps along the communication channel chain on the sending and receiving sides.

Even a single missing colon could result in a multi-million transfer being rejected or delayed for days.

Real-time payments analytics are vital to measure, view growth and make decisions all the way through the payments chain, and across each different platform. This is even more important now with the impending global ISO 20022 migration.

Monitoring with an outboard, or third-party solution like IR Transact is non-intrusive, and integrates seamlessly into the existing enterprise environment, bringing real-time visibility to the entire payments ecosystem. It collects data from all silos across the payments system, filters, correlates and analyzes this information and brings it into a single application.

Keeping on top of emerging technologies, regulatory changes and the introduction of new international payments standards is challenging. With ISO 20022 migration imminent, turning information into intelligence will assure the safe, efficient operation of payments systems worldwide.

Through valuable data insights, led by information and payments data, a business can improve profitability, optimize revenue and cut costs.

Without transaction data and analytics to get clear visibility into the payments environment, it's impossible to identify transaction performance issues, or detect fraud and other anomalies.

Payment analytics tools allow banks and financial institutions, payment providers, acquirers and merchants to take historical data and apply it to things that are happening to a business right now. This applies to sales and payment processing or any online services in the payment space.

Download the IR guide to managing your changing payments environment