With worldwide international money transfers amounting to trillions each day, SWIFT codes exist to ensure the safety and security of all those transactions.

What exactly is SWIFT ?

The Society for Worldwide Interbank Financial Telecommunications (SWIFT) is a bank code essential for sending international or cross-border payments, so they're a vital part of the financial side of businesses with a global presence. The SWIFT network is a messaging infrastructure, not a payments system. In addition to customer and bank funds transfers, SWIFT is used to transmit foreign exchange confirmations, debit and credit entry confirmations, statements, collections, and documentary credits.

SWIFT is a member-owned cooperative, established in 1973. It began operating in 15 countries in 1973 and now has members in more than 200 countries, linking more than 11,000 financial institutions. In 1979, SWIFT delivered 10 million financial messages for the year. In May 2021, SWIFT recorded an average of 42.3 million financial messages per day, a traffic growth of +11.7% versus same period of previous year.

SWIFT is headquartered in Belgium and has offices in Australia, Austria, Brazil, China, France, Germany, Ghana, Hong Kong, India, Indonesia, Italy, Japan, Kenya, South Korea, Malaysia, Mexico, Russia, Singapore, South Africa, Spain, Sweden, Switzerland, UAE, and the United Kingdom.

Before SWIFT, the only reliable means of message confirmation for global funds transfer was Telex. But Telex has mostly been superseded by SWIFT after facing an ongoing slew of issues, including low speed, security concerns, and a free message format.

How does the SWIFT message system work?

SWIFT's unified system of codes to name banks and describe transactions is an important element in the international payments world. Using SWIFT codes helps financial institutions to combat financial crime like money laundering, increase security and make the straight through processing of international funds more seamless.

The SWIFT network is a messaging infrastructure, not a payment transaction system. As well as customer and bank funds transfers, a SWIFT message is used to transmit foreign exchange confirmations, debit and credit entry confirmations, statements, collections, and documentary credits.

The platform uses a standardized proprietary communications platform to carry out the transfer of secure financial transactions. While the SWIFT message service handles the transmission of information about financial transactions, it doesn't hold funds on its own, and doesn't manage external client accounts.

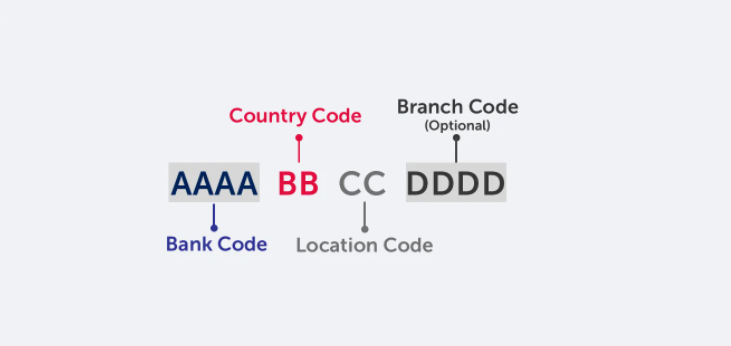

SWIFT codes are a combination of various letters used to identify the branch codes of banks. These codes are known as Bank Identifier Codes (BIC), and the terms BIC and SWIFT are often used interchangeably, even though they mean the same thing.

For money transfers, SWIFT assigns each participating financial organization a unique code with either eight or eleven characters. The code has three interchangeable names: the bank identifier code (BIC), SWIFT code, SWIFT ID, or ISO 9362 code.

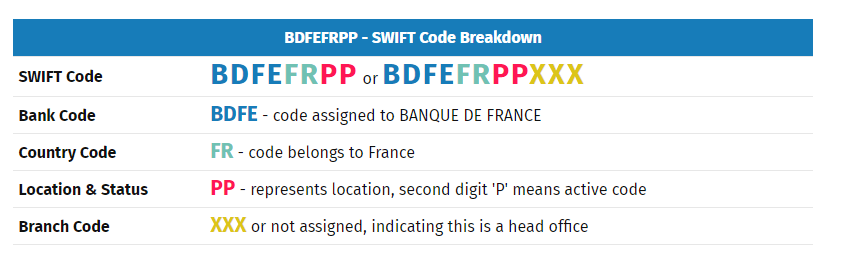

For example, the SWIFT code for Paris, France would look like this:

When banks send international payments, they rely on correspondent banking. That is, the involvement of a network of correspondent banks. These correspondent banking systems work together to move your money from one place to another, before it finally reaches the recipient.

BIC codes are used to ensure that your payment goes to the correct bank. From a customer's point of view, the process is simple. Once the recipient’s SWIFT number is confirmed and correct, customers can either make an international payment from a bank branch, or use online banking to make the payment.

Why is a SWIFT code important?

Cross-border payments that involve sending large amounts of money can be complex, so the process needs to be secure and foolproof, and the same applies when receiving international payments.

A bank needs to be a SWIFT member to receive the SWIFT code and be part of the network. Then, for any transaction a bank makes on an international level, they will use their unique SWIFT code, which acts as an international digital language. The concept makes for a faster, more hassle-free process. The SWIFT system is electronic and uses a cloud platform to quickly transmit codes to and from banks.

As well as a BIC code, global financial transactions need an IBAN or International Bank Account Number when making an international currency transfer. An IBAN number is essentially a unique identification code for your bank account, detailing country location, the account number and sort code.

Does every bank need a SWIFT code?

While every bank has the option to join, SWIFT messages are used for secure cross-border money transfers, but not all financial institutions have a banking system that uses that facility, or may see the need to opt into the SWIFT messages network. SWIFT is an international organization created for convenience, but there is no requirement for banks to be affiliated with it, even though many are. For banks who do engage in cross-border transactions, the benefit of affiliating with SWIFT is having access to a secure and streamlined method of transferring money internationally.

Detecting and disrupting financial crime with transaction monitoring

Recent research commissioned by the SWIFT Institute has made an analysis of the current financial transaction monitoring model, and suggests opportunities for the future.

Transaction monitoring , or the surveillance of client money transactions by a bank or financial institution has become a key Financial Crime Compliance (FCC) function. Market research suggests that transaction monitoring is one of the major growth areas in the global Regulatory Technology (RegTech) market, worth USD 2.2 billion in 2020.

The Financial Action Task Force (FATF), is the international standard-setter for Anti-Money Laundering and Countering the Financing of Terrorism (AML/CFT). The FATF has created regulations and laws pertaining to obligations to monitor client transactions for inconsistent activity and reporting suspicious activity. These laws and regulations have created a transaction monitoring model in the private sector, particularly amongst banks and financial institutions.

This model includes automated platforms that apply supposed patterns of illicit behavior, often referred to ‘typologies’ or ‘red flags’. When this monitoring model is applied to transactions, it can generate financial crime alerts.

SWIFT Correspondent Monitoring

As part of the Compliance Analytics portfolio, SWIFT has developed Correspondent Monitoring, designed to deliver global, top-down reports needed for in-depth reviews of correspondents’ activities, with patterns flagged for investigation as they occur.

International regulatory bodies, including the FATF and the Basel Committee on Banking Supervision, have encouraged stronger due diligence and anti money laundering monitoring between correspondent banks. Many AML tools, however, are designed for retail rather than correspondent banks.

SWIFT has developed Correspondent Monitoring in close collaboration with the industry to address the specific requirements of correspondent banks for a group-level, top-down view of payment chains and relationships.

As it is SWIFT-hosted utility service, there is no hardware or software to install or maintain, making it fast, efficient and easy to embed into every day operations.

Transaction Monitoring Challenges

Transaction monitoring and reporting frameworks have been experiencing serious difficulties over the last 30 years, with high volumes of wasted alerts, wasted investigative effort, and little evidence of value added to the broader fight against financial crime.

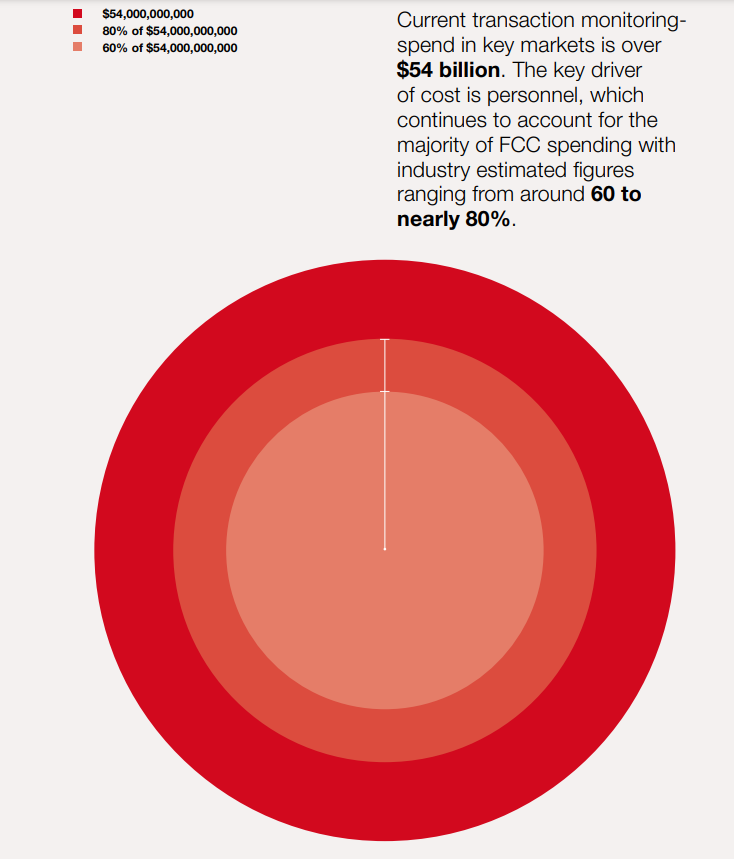

Added to this, due to the significant costs associated with transaction monitoring, FCC teams face internal pressures to keep those costs down, while following regulators’ requirements that financial institutions cover all relevant risks.

Anti money laundering initiatives

According to the SWIFT institute's research, global money laundering is estimated at around USD 800 billion - 2 trillion annually. It's estimated that less than 1% of the proceeds of financial crime are actually retrieved by authorities.

Combined with escalating costs, regulatory censure and uncertain intelligence outcomes, the issue of transaction monitoring reform is a key issue for financial institutions and the wider AML ecosystem.

SWIFT studies found that in the first ten years of the monitoring requirement, it was common for an automated platform to be built in-house, often using pre-existing models based on credit risk and fraud. More recently, financial institutions are deploying models from external, leading technology vendors.

This growth in the deployment of automated platforms has affected the scale of technical support necessary to undertake monitoring. This has led to the development of dedicated transaction monitoring teams with FCC technology functions, sometimes supported by vendors or management consultancies.

Transaction monitoring implementations also tend to face a consistent set of practical problems, especially during planning and execution related to:

• Poor data access and quality

• Archaic IT architectures

• Lack of technically skilled staff

Assessing transaction monitoring metrics

Financial institutions mostly depend on self-created metrics to assess their intelligence production performance. The two most commonly cited metrics across industry are:

- The False Positive Rate: The proportion of alerts determined to be neither unusual nor suspicious by AML investigators. This is treated as a crude measure of platform accuracy.

- The Suspicious Transaction Report (STR) Conversion Rate: The proportion of alerts that lead to an STR. The figure is used to estimate ‘True Positives’ produced by the platform.

False positive rates vary somewhat between business lines, financial institutions and geographies. However, industry data from a range of sources suggest that the typical proportion of false positives is high, possibly up to two thirds of alerts. In a 2017 survey for example, Europol, found that only 10% of STRs received by Financial Intelligence Units in the European Union were likely to spur an immediate investigation, with the vast majority of reports filed for later usage.

The technologies behind new transaction monitoring initiatives

Another common initiative in the combating of global financial crime is the deployment of new technologies, either to enhance or replace existing platforms. This is a growing trend around the world, especially amongst top and mid-tier financial institutions.

Two of these technologies are now in regular use with transaction monitoring platforms:.

Robotic Process Automation (RPA)

This is a rapidly developing technology uses software robots, or 'bots' to undertake simple but repetitive tasks and behaviors at high speed.

Machine Learning (ML)

Machine Learning is a field of Artificial Intelligence (AI) which uses learning algorithms to categorize and subcategorize data into two main areas:

- Supervised Machine Learning (SML), which is trained on data pre-determined by humans, where an algorithm learns to sort material into known ‘types’.

- Unsupervised Machine Learning, which identifies patterns across unlabeled data, with the algorithm creating its own categories based on apparently common clusters.

How new technologies are influencing the world of payments

New and emerging technologies are influencing the payments world, both domestically and internationally. With rapidly changing market circumstances there is an increasing need for flexibility within business operating models, and businesses now more than ever need monitoring and performance management solutions to help them leverage emerging technology effectively.

Find out more about some of the main challenges in managing the evolving complexities of a changing payments environment. Download our essential guide