In today's rapidly evolving payments industry, businesses, Financial Institutions (FIs), merchant acquirers and Managed Service Providers (MSPs) are facing a challenging payments landscape.

To keep up with consumer demands for faster, more seamless transaction processing, the need for increased security and to stay ahead of changing Anti Money Laundering (AML) regulations, transaction monitoring has never been more important.

For all players in the payments industry, a robust transaction monitoring system is absolutely crucial to meet and improve AML compliance requirements and detect fraudulent activity as well as create a more streamlined transaction processing environment.

Simplify your payments by using one tool to monitor and manage transactions across multiple vendor solutions

What is transaction monitoring software?

Technologically advanced monitoring software like IR Transact collects transaction data that brings real-time visibility to your entire payments environment. Here's how:

-

A good transaction monitoring tool helps organizations to prevent fraudulent activity by monitoring in either real time or in specific time intervals, and blocking transactions deemed to be suspicious.

-

Additionally, monitoring software gives financial institutions a clear window through which they can see customer transactions and analyze historical data based on past and predicted future activity.

-

Transaction monitoring tools identify poorly performing payments systems, which can result in queues and bottlenecks, increasing the likelihood of abandoned purchases and dissatisfied customers.

All of these important insights can not only spot abnormal behavior and identify suspicious financial transactions and block high-risk activities, but help create a better user experience, and streamline the user payments experience from end-to-end.

How does transaction monitoring software work?

Transaction monitoring tools like IR Transact follow a common workflow, inspecting all transaction data, identifying suspicious activity and reporting anything abnormal to risk and compliance teams, who can then investigate further.

Transaction monitoring tools are an essential part of a payments system, and a mandatory requirement for a great variety of business sectors.

But the increasing volume and velocity of payment transactions in today’s financial ecosystems make manual transaction monitoring cost prohibitive and far too labor-intensive, hence the need for automated transaction monitoring software.

When a transaction monitoring solution flags a suspicious transaction, it's then investigated to determine whether the alert is showing genuinely suspect activity, or false positives.

What are false positives?

While a transaction monitoring tool tends to flag any unusual activity, not every alert is an indicator of a suspicious transaction, and false positives can generate alarms even in situations that pose no actual risk.

This can be a challenging issue, and can prove to be costly for organizations, as they need time and resources to investigate the transaction, which can cause delays in legitimate transactions.

Without the benefit of artificial intelligence and machine learning technologies to monitor transactions, the sheer volume of false positive rates can escalate. This makes focusing on real suspicious behavior more difficult.

Why is transaction monitoring important?

To recognize the indicators of fraud, money laundering, and other financial criminal activity, every financial institution, merchant, acquirer and payments processor needs deep, comprehensive insights into transactions within their payments system in real time.

IR Transact is a monitoring tool that can not only track suspicious transactions, but can also provide invaluable insights into transactions and trends to help organizations make better business decisions. Here's how:

-

By using customizable dashboards to see the information most relevant to your payments environment.

-

By translating complex data sets into simple, easy-to-understand information

-

By enabling you to add your own rules when setting alerts, to help reduce false positives

-

By giving you the analytics tools to better understand how your environment is performing

Transaction monitoring is a crucial aspect of financial risk management that enables you to identify suspicious patterns, mitigate potential risks, and comply with relevant regulatory requirements.

While transaction monitoring software is important for risk management and compliance, it can also improve operational efficiency by analyzing vast amounts of data quickly and accurately. This gives financial institutions more time and freedom to re-distribute resources more effectively.

Find out more about real-time monitoring

How does transaction monitoring help prevent money laundering?

Money laundering refers to the use of illegal money, or criminal proceeds which have been turned into legitimate cash or assets. AML transaction monitoring is designed to curtail these financial crimes, and anti-money laundering regulations are strictly policed.

Key features to look for in a transaction monitoring system

Monitoring software needs to be powerful enough to meet compliance regulations, yet with enough flexibility to be updated regularly. Here are 4 of the most important features to look for in transaction screening systems:

1. Risk scoring

While the best transaction monitoring tools are designed to identify suspicious transactions, rule management is an important feature at the core of every monitoring tool.

Rule management triggers suspicious activity alerts based on your specific risk management strategy. This allows you to set a risk score to automatically decide whether the transaction is to be accepted, declined, or manually reviewed.

2. Sandbox testing

Risk rules need to be tested using live data as well as historical data, so it's important to have the option to test monitoring software in sandbox mode, to make certain that you can minimize false positives and negatives.

3. Real-time alerts

Monitoring tools must detect suspicious activity and deliver results almost instantaneously. This not only helps with compliance, but alleviates any friction and frustration for legitimate customers.

4. Custom rule management

Compliance regulations and requirements are always changing, so it's vital to have the ability to update your rules as often as you need to without having to rely on developers. Make sure your monitoring software allows you to easily create, edit, and update rules.

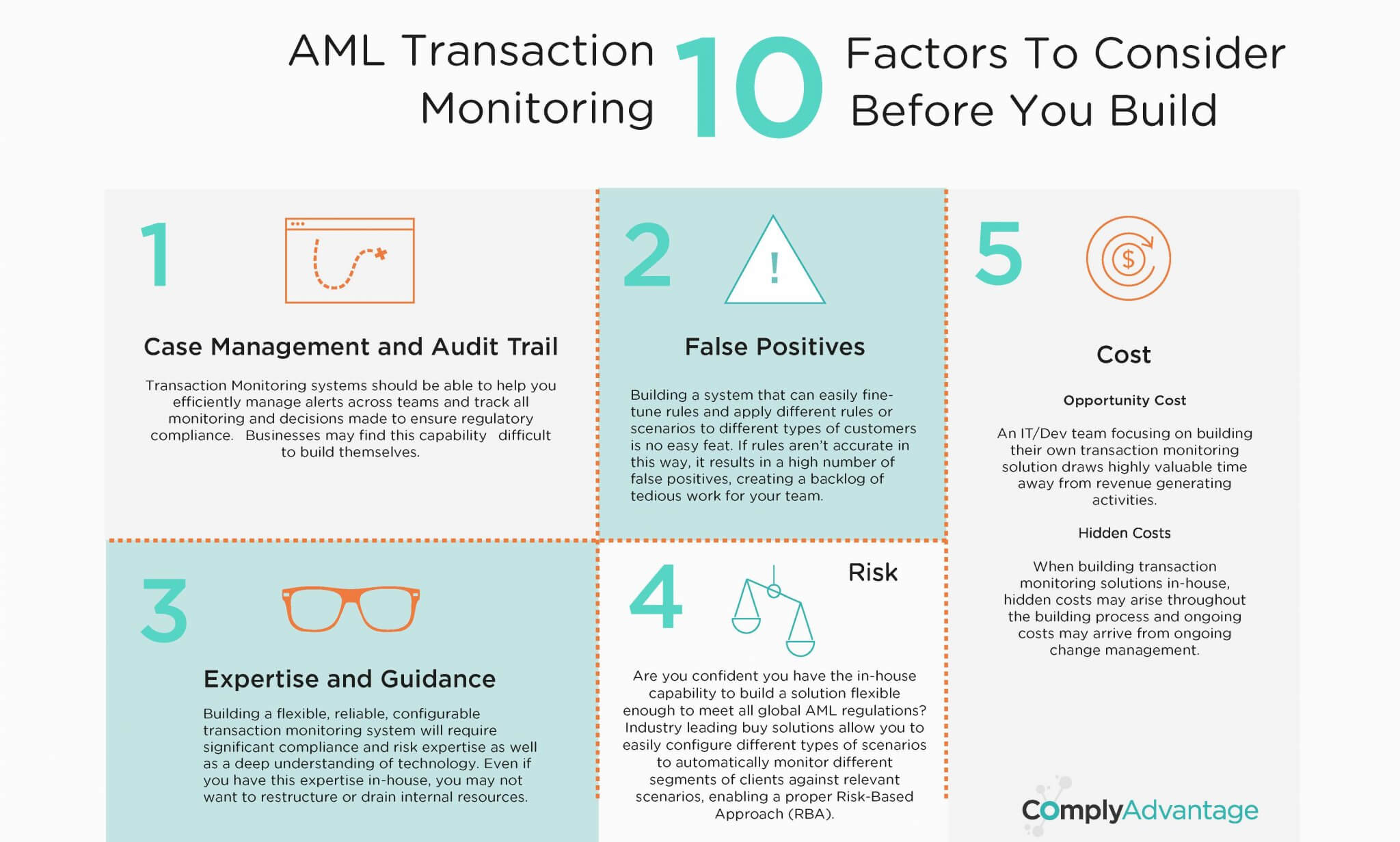

Image source: Comply Advantage

Monitor and analyze payments with IR Transact

Navigating the growing complexity and demands of the payments world means that organizations must shift their focus from a reactive problem-solving approach, to proactive resilience-building. Mitigating the threat of financial crime, keeping customers happy, ensuring security and keeping up with compliance requirements is simply not possible without the help of powerful monitoring software like IR Transact.

Creating a resilient payment infrastructure with the ability for unlimited flexibility is a proactive approach to ensuring seamless operations and sustaining continued growth.

to find out how you can detect and troubleshoot problems in your payment processing environment

Keeping you in business

In a world where downtime costs serious money, it's imperative to have a resilient payment system to meet compliance regulations, safeguard against financial crime, and place seamless customer transactions at the forefront of your business priorities.

Turn data into actionable insights

IR offers end-to-end observability throughout your entire payments environments. This capability provides organizations with real-time, actionable insights, allowing them to identify and address issues before they escalate. Contact our team to find out how IR Transact can help you:

- Deploy new technology with confidence

- Deliver the best customer experience

- Find and fix performance issues fast, and;

- See your data your way to uncover the insights you need to succeed.