The state of the world economy remains tenuous, and rife with uncertainties brought about by a number of factors. A sharp rise in inflation, supply chain problems, Russia's invasion of Ukraine and changes in monetary policies worldwide have greatly increased the potential for a recession.

Amidst all of this, commercial banking and indeed the financial services industry is undergoing a massive shift, driven by industry consolidation and the growing consumer demand for embedded payment experiences.

Image source: Wealth MD

This shift is underpinned by a congruence of themes:

-

Digital transformation and the focus on digital capabilities throughout the commercial banking industry globally

-

The ongoing rise of Fintech companies

-

A greater focus on customer experience

-

Increased regulatory developments in commercial banking

-

More focus on social and environmental responsibility to build inclusive, sustainable financial practices

In this blog, we'll highlight the top commercial banking trends to watch out for in 2023, and the critical role of the commercial bank in renewal, and as a growth facilitator of the economy.

Take a look back at our comprehensive guide Payments Trends Transforming the Industry in 2022 and beyond

10 Commercial banking top trends

Image: IR

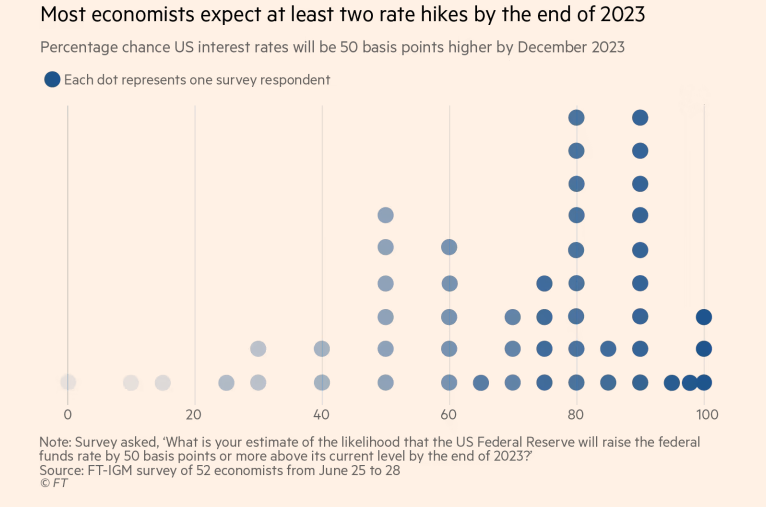

1. Rising interest rates

Low, stagnant interest rates over the last 15 years or so means businesses and homeowners have reaped the benefits. But as deposits have gained little profit for banking services, and the banking industry as a whole, they've have had to focus on new products to generate revenue.

Higher rates are expected to bring deposits back to commercial banks, providing more funds for commercial lending, as well as radically changing competitive strategies.

"Most of the trends shaping banking in 2023 are affected, if not actually caused, by the return of positive interest rates - the gravity that keeps the industry in a predictable orbit", Michael Abbott, Senior Managing Director, Global Banking Lead

Image source: Financial Times

Read our blog Omnichannel Banking: Benefits, Challenges and More

2. The return of bank branches

The commercial banking industry has benefited from reduced costs associated with lessening their geographic footprint over the last few years. But by encouraging customers and corporate clients to use only digital channels, the commercial banker has risked eroding personal relationships and placed client needs and intents in jeopardy by driving them to comparison sites.

The evolution of customer portals

Even though customers today carry out most of their banking transactions on mobile devices, achieving the right balance between in-branch interaction and digital banking services will mean re-training and re-orienting their workforce.

3. The metaverse will continue to evolve

Online is the default choice for Gen Z, fully-digital natives. The metaverse provides a continuous immersive digital environment to get the products and services they need. Just as digital transformation propelled financial services firms and the commercial banking industry to adopt mobile banking and embrace automation, the metaverse will enable the commercial banking industry to connect with customers in a far richer environment digitally, and all under one roof.

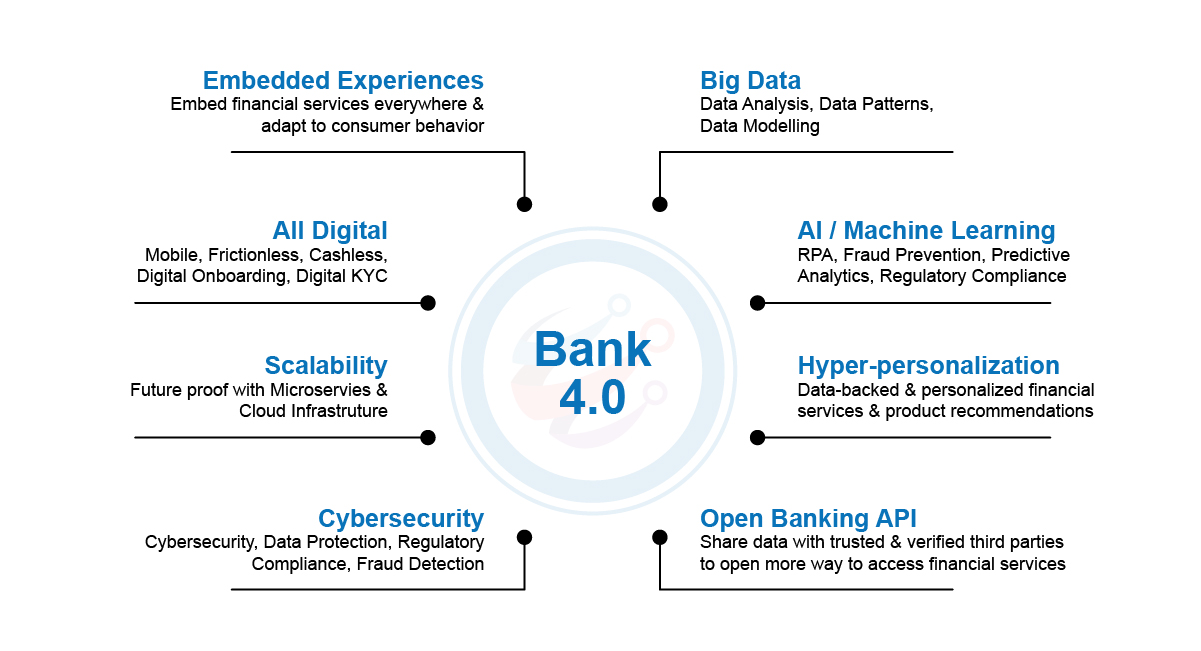

Image source: Profinch

4. Risk management in the financial services industry

Commercial bankers will be looking at more innovative ways to deal with risk, based on the truism that a rise in unemployment drives delinquencies, and ultimately losses. For example, as inflation continues to strangle household budgets, shadow lending markets like BNPL are increasing in popularity, and so too is the risk of default. Commercial banks will focus on developing their risk function in the early stages of a process review, rather than at the end.

5. The right talent breeds the right culture

Hybrid working has caused a seismic shift in the rigidly siloed work culture within the commercial banking industry. The new environment is seeing an increase in employee demands to work within a more flexible, transposable work arena that allows fluidity and opportunities to acquire new skills. In the near future, we expect to see banks changing their talent strategy, and taking a more deliberate approach to aligning talent with the demands of the business strategy.

Image source: Fintalent

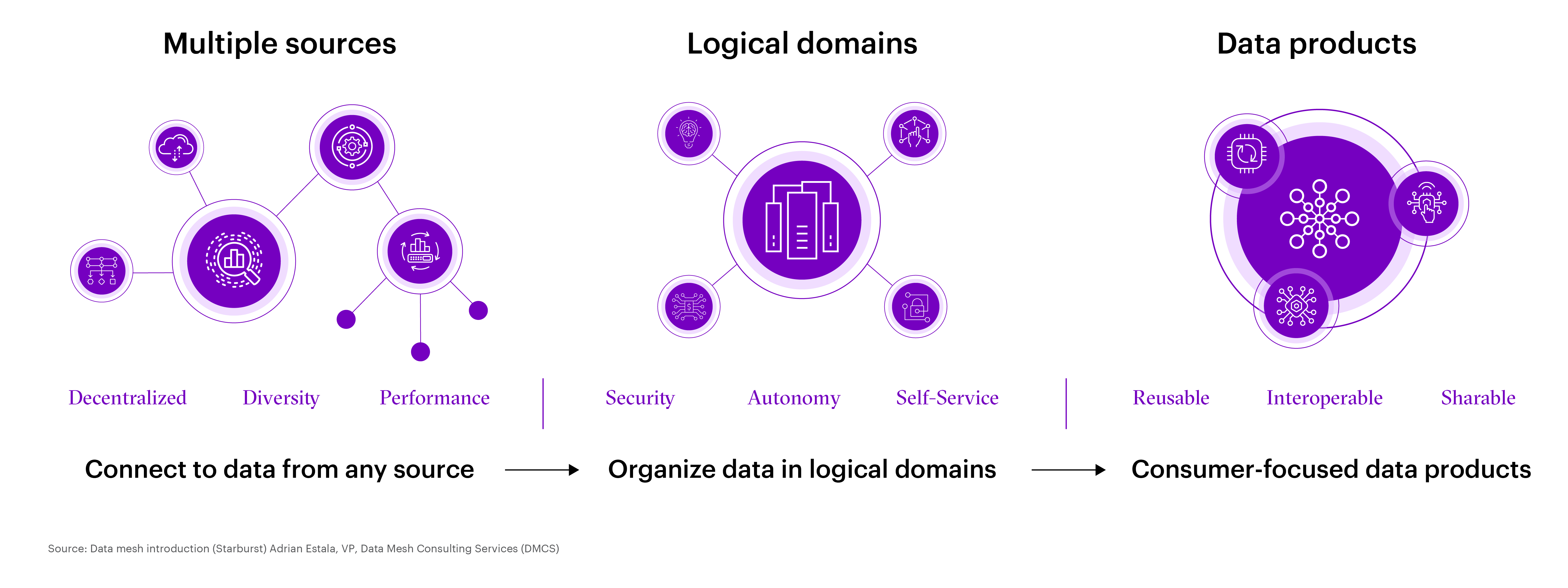

6. The increasing importance of democratizing data

The value of data to the commercial banking industry and its customers is well recognized, but the demands of maintaining data, analyzing it and turning it into a product is becoming more complex and costly in commercial banking.

Image source: Accenture

Consumers expect their financial institution to know and understand them. Typically, data siloes mean that customer information is stored in various places across the organization, and not easily accessed by relationship managers from a central point. Commercial banks who organize their data as a product can collect more detail once and then use it repeatedly.

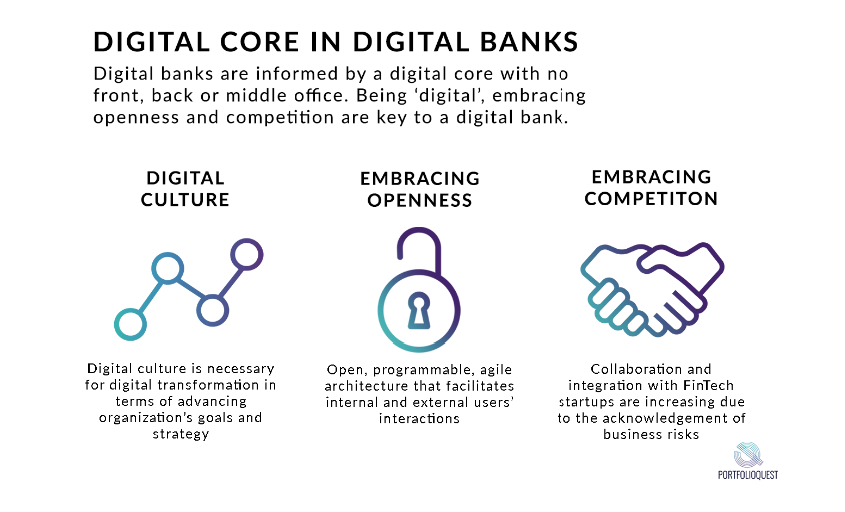

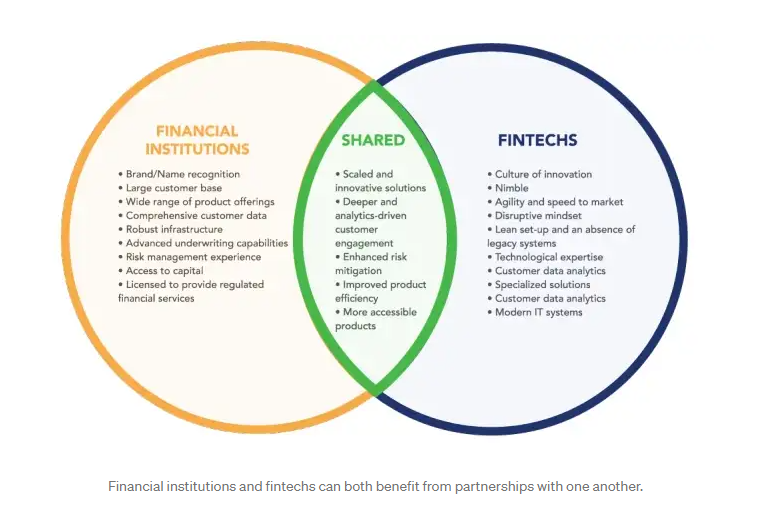

7. Commercial banks and their relationships with Fintechs

The number and value of Fintech deals and the companies who offer them is in decline for several reasons, including the rise in the cost of money. As a result, banks are becoming better at matching Fintechs in the delivery of customer service, and visiting new markets to develop a more competitive edge. Instead of competing with the commercial banking sector, many Fintechs will work closely with commercial banks and large financial institutions or risk being swallowed.

Image source: Medium

8. The increase in customer focus through personalization

The combination of technology, and nurturing a holistic relationship with their clients will allow commercial banks to optimize their customers' experience. Banks will begin the move from customer journey to customer intent, by developing the most relevant solutions within individual contexts.

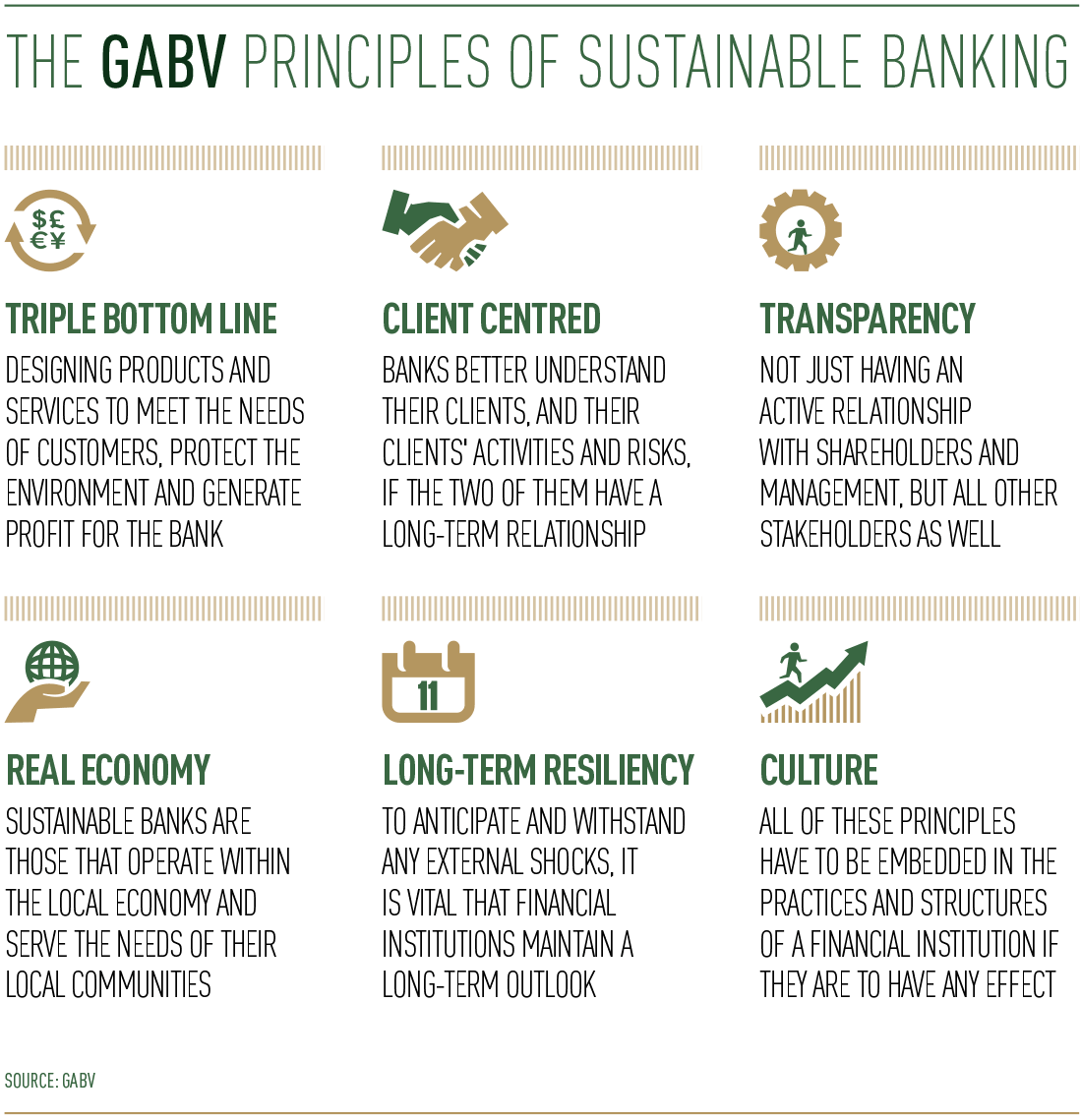

9. Sustainability

In keeping with industry trends, sustainability is high priority on the agenda of most commercial banks. Aside from the pressure by regulators and stakeholders, many commercial banks still grant loans to heavy carbon emitters. As global awareness of climate change intensifies, banks are under growing pressure to shrink their carbon footprint, or be directed to impose a risk premium or higher cost of lending

Image source: World Finance

10. Modernization

Rising interest rates is putting the commercial banking industry in a position to address the challenge of their legacy environments and create more modern banking operating systems for the future. Those who move towards technology investments will be far better positioned to improve, consolidate and, importantly, deliver exceptional, innovative products more efficiently than competitors.

Key takeaways on trends in commercial banking in the year ahead

- Increasing interest rates as a catalyst for growth: Increased profitability for banks, and the potential for economic growth

- Sustainability as a competitive advantage: Banks adopting sustainability principles that will change the financial sector and its future long-term strategy.

- Data democratization and personalization for increased customer focus: Better organization and management of data leading to improved customer service.

- Modernization of business operating systems: Machine learning, and other technology investments will help deliver more innovative products.

- Digital fluency: The ability to use digital tools and technologies to create something new and innovative is a business imperative for banks.

Third-party monitoring solutions

IR Transact is a third-party monitoring and performance management solution that optimizes the commerce that connects our global economies. It's non-intrusive, and integrates seamlessly into the existing enterprise payments environment. It collects data from all silos across the payments system, filters, correlates and analyzes this information and brings it into a single application.

Find out how IR Transact can transform your payments environment: Download our IR Transact Solution overview