According to a new study from UK based firm, Juniper Research the global transaction value of the Business-to-Business (B2B) payments market will rise to in excess of $111 trillion in 2027. This represents a 26% growth from $88 trillion in 2022.

Escalating prices and inflation, as well as robust economic growth in developing markets is driving this predicted increase, along with rapidly developing technology that's increasing the efficiency of digital payments in the B2B sector. More choices, and the ability for businesses to choose their preferred payment method is creating a significant opportunity for B2B payment vendors.

What is a B2B payment?

Business-to-Business transactions are electronic payments, specifically occurring between businesses, for example a wholesaler and manufacturer, or a retailer and wholesaler, rather than between a business and individual consumer.

Today's business processes are changing the way B2B payments are made, with digital platforms and automation being the main drivers of continuously evolving B2B payment solutions.

Paper checks have been almost completely phased out, and replaced by electronic transfers in the consumer arena, but business-to-business payment options have been slower to evolve.

The difference between B2B & B2C payments

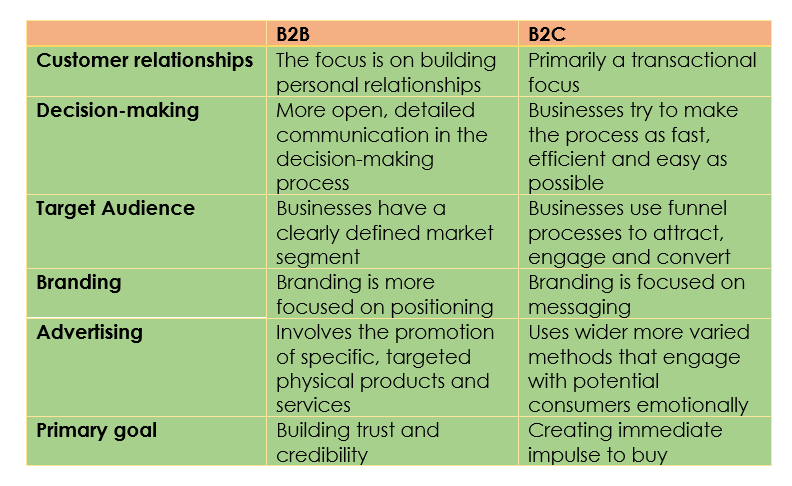

In digital marketing, the strategies associated with B2B and B2C businesses are different. B2B marketing is primarily judicious and process-driven, whereas B2C marketing relies on more emotion-driven purchasing decisions.

Image source: Wordstream

Image source: Wordstream

To maximize the effectiveness of B2B and B2C marketing tactics, it's useful to compare the differences.

The most common B2B payment processing methods

B2B transactions can be more complex, and take longer than B2C, although the B2B payment processing landscape is evolving rapidly, as the business world transitions to digital payment platforms.

To simplify and make B2B payment processes more streamlined, businesses are leveraging innovation and technology to replace outdated payment processes with efficient payment systems.

With the global e-commerce boom, businesses are being driven to set up payment gateways to process transactions through their payment cycle. A purchase between businesses can involve a wider variety of payment methods, payment schedules, and other factors, but the most common payment methods include:

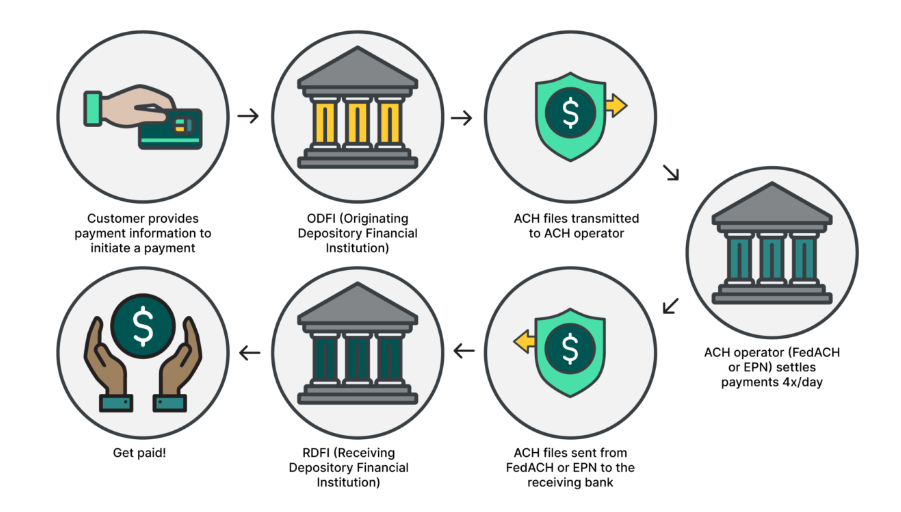

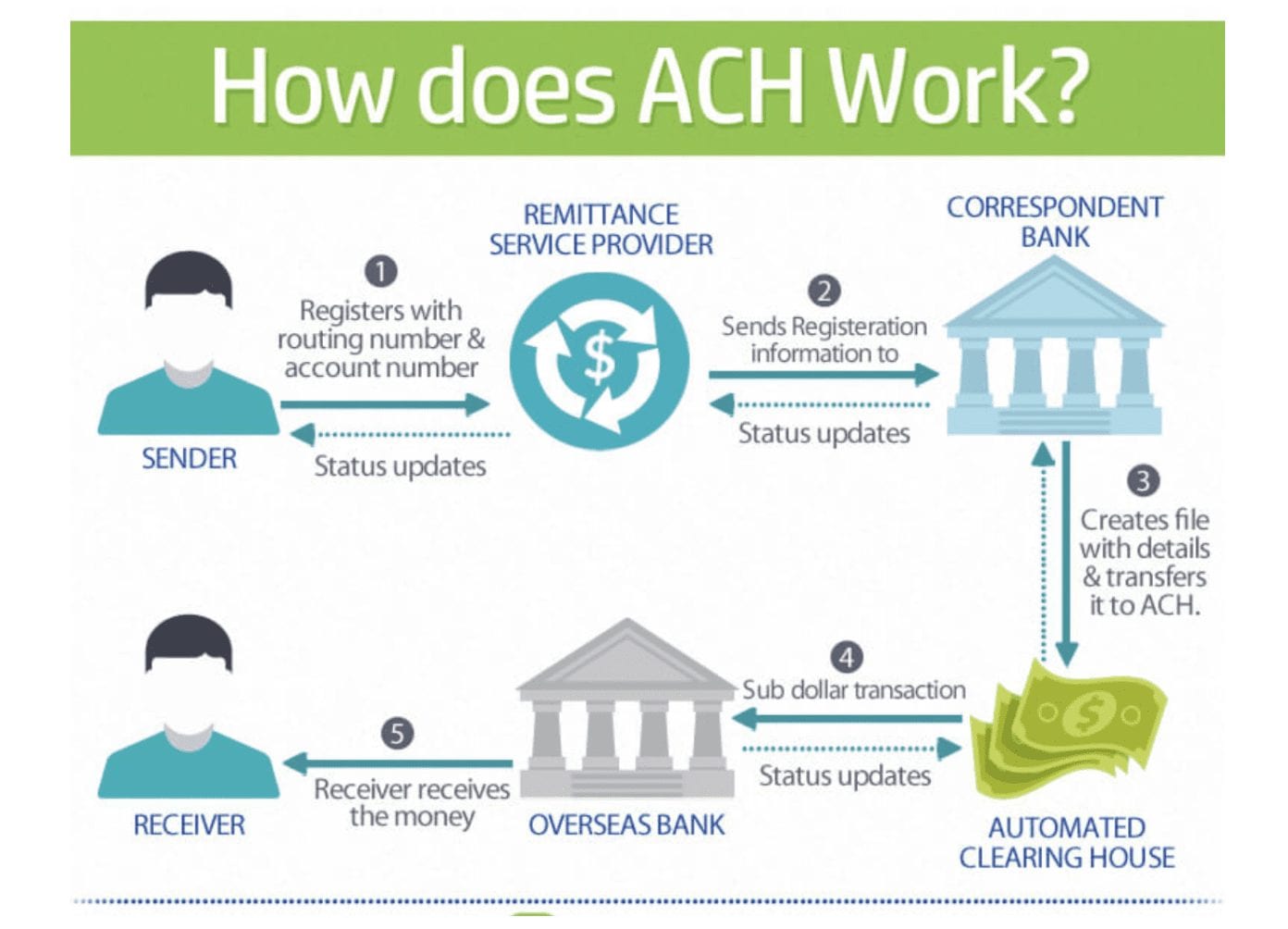

ACH payments

The Automated Clearing House payment gateway (ACH) was still a preferred payment solution in 2021. This payment method allows businesses to transfer funds electronically to other businesses using the Automated Clearing House Network, rather than going through the major credit card payments networks like Visa or Mastercard.

The ACH payment gateway is a long established technology, trusted by businesses for direct deposit and direct debits. ACH transactions traditionally require more time and administration than other real-time payment models recently introduced, however, ACH payments are poised to undergo a substantial shift as demand grows for faster digital payments.

Read our: A Complete Guide to Understanding ACH Payments

Image source: AppFrontier

Image source: AppFrontier

B2B payments processing using ACH payments is fast, reliable and cost effective. It can be used by businesses for recurring payments to ensure that expenses and employee wages are paid into their bank accounts on time.

ACH payments have lower transaction fees than wire transfers, and there is no need for a third party payment provider.

While ACH allows for speedy payment processing, there are some disadvantages to using this payment solution.

Limits

Some banks and financial institutions place limits on how much you can send from one bank account to another using an ACH transfer. They may also limit the frequency of daily, weekly, monthly or even per-transaction transfers

Banks may also limit where a business sends money, with some financial institutions prohibiting international transactions altogether.

Timing

Unlike wire transfers for B2B payments, which are done on an individual basis, ACH payments are processed in batches. So to send an ACH transfer the next business day, businesses need to be aware of the cutoff time. Making a transfer after the cutoff time could result in a delay in processing your business payments, which could incur late fees.

Rewards and payment discounts

Unlike credit card payments, the ACH payment gateway offers no cashback incentives, or rewards programs that businesses can use to trade for value-added marketing purposes.

Wire transfers

A wire transfer is one of the fastest ways to make a B2B payment, with funds generally received within 24 hours. Wire transfers can incur higher transaction fees, but unlike the ACH payment gateway, they are ideal for cross border payments and international payments.

Image source: MerchantCostConsulting

Image source: MerchantCostConsulting

Credit cards

As with B2C payments, businesses do sometimes use credit card payments. It's convenient and frictionless, but can be cost prohibitive. Fees to process payments by credit card can seem small, but B2B transactions tend to be much larger than B2C, so it can rapidly add up when payments themselves could total several thousands of dollars. Also, If you're making a payment with a B2B provider, you will need to check if they accept credit card payments.

Checks

As with most paper-based payment methods, the use of a business checking account for processing payments is declining. According to a survey by NACHA, 73% of businesses are transitioning their payment transactions processes from checks to electronic or online payments due to expense and inconvenience, as well as being prone to fraud and human error. With an estimate of costing $1 to $2 for businesses to receive and process a check, it may no longer suit the future needs of most enterprise organizations.

E-checks

Similar to paper checks, but processed electronically, E-checks are sometimes called direct debits. E-checks are simpler and cheaper than paper checks and use the ACH payments system to execute payments, but differ from actual ACH payments. They are overall a much faster option than regular checks, but still require quite a few steps for processing.

Image source: PaySimple

Image source: PaySimple

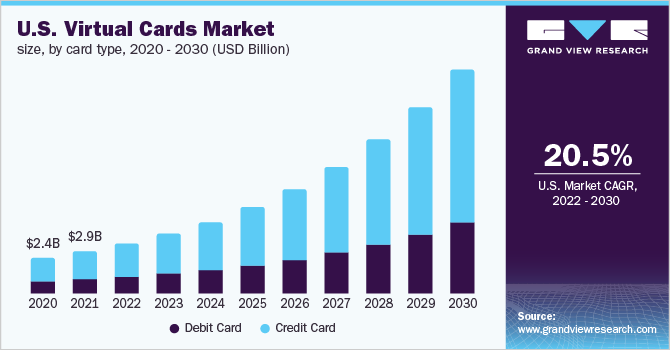

Virtual Cards

Another payment method that is gaining popularity in B2B payment processing is the use of virtual cards. In fact, a 2022 report by PYMNTS revealed that the “global value of virtual card transactions is expected to jump to $6.8 trillion over the next four years — compared to $1.9 trillion last year — and a large portion of that growth will come from business-to-business (B2B) transactions.”

The virtual card is an electronic-only payment card with a randomly generated 16-digit number, received via email and used to pay a specific invoice. One reason for the increasing popularity of virtual cards is that they are among one of the safest payment methods.

Image source: Grandview Research

Image source: Grandview Research

There is no need for the storage of any banking data and are one-time use in nature, so they make a secure payments option. Their expiry date is short, often only 60 or 90 days, and once the payment has been processed by the supplier, the numbers card numbers become invalid.

Cash Payments

Quickly on the decline, with the exception of businesses in a few select emerging markets, cash is rarely used as a B2B payment processing method today. With the risk of theft, little or no flexibility in record keeping, and the limitations of location, cash is no longer a truly viable payment method in the B2B space.

What is a payment gateway?

Some payment service providers act as a go-between facilitating B2B payments between senders and recipients, in effect creating a payment gateway.

Payment gateway vendors

The payment gateway vendor is responsible for collecting payments and depositing them securely at their destination. Stripe is an example of a payment gateway provider. PayPal is a well known payment gateway and a payment processor all in one.

How a payment gateway facilitates B2B payments

Payment gateways can be used for either one-time B2B payments, or recurring transactions.

Payment gateways and payment processors are designed to optimize the B2B payments process for both vendors and their clients. A payment processor is also helpful to a business as they work in tandem with accounting software, facilitating the accounts payable, and accounts receivable process and helping businesses manage cash flow.

Payment gateways provide digital payment solutions that are well suited for SaaS companies that are required to handle a high volume of B2B transactions and many different contracts.

Upcoming trends for B2B payment processing

B2B eCommerce is undergoing a major transformation. The payments landscape is changing, and businesses need to stay on top of current trends, and what's coming in payment automation, choosing the right payment processors and reviewing how they accept payments.

Real Time payments

Real time payments technology is finding its way into the B2B sector, and according to a recent report by FIS, 'by 2025, 30% to 50% of B2B payments will not only be done digitally, but they will also be done in real time.'

Read our comprehensive blog on How Real Time Payments are Changing the World

Collaborative commerce

Mobile payments, and digital payment solutions are improving internal accounts receivable and cash flow processes for B2B, but they’re also increasing data and efficiency between buyers and suppliers.

Enhancing the B2B payments process

Many banks, card providers, payment processors, fintech companies and other players in the payments industry are working together to solve common challenges, such as how best to harvest, process and store data. As businesses look for the best payment platform for their specific needs, the ongoing digitization of the payment industry is helping to simplify and enhance the B2B payment process. payment gateway payment gateway concept of businesses working together through connected systems to create more frictionless automation in the B2B payment process.

The success of your B2B payments systems with IR Transact

The importance of complete visibility throughout the B2B payment processing system can’t be over-stressed, and having access to the individual payment details of a particular B2B transaction is crucial.

Every business needs a solution that enables complete real-time visibility into their payments ecosystem. Without visibility, businesses are faced with poorly performing systems and increased frustration throughout the entire payments chain, resulting in loss of business, and ultimately, revenue.

IR Transact payment monitoring and performance management solutions bring that real time visibility to your entire payments ecosystem so that businesses can streamline their B2B payment processing systems, and reduce operating costs.

Simplifying complexity with IR Transact

B2B transactions can be more complex than B2C, so it's even more important that transaction monitoring solutions are in place to curtail any service disruptions and pinpoint anomalies in the payment chain.

With IR Transact you get data analytics that provide flexibility to add new payment types as well as elevating customer experience with real-time insights. Deep visibility and insight into all your inter-connected technologies from a single point of view ensures that you stay in control of your B2B payments environment.