It's no secret that the global financial crisis sent shock waves throughout national financial systems.

It had a pandemic effect on the banking sector, causing banks to lose money on mortgage defaults. It also caused lending between banks to stop, and consumer and business credit to cease. To keep the economy afloat, central banks had to inject liquidity into financial systems.

As a result of banks and financial institutions being unable to maintain adequate market liquidity, it highlighted a critical focus on liquidity risk and balance sheet management - and prompted the introduction of new standards for the global banking sector.

Understanding Liquidity Risk

Liquidity risk refers to the potential difficulties faced by banks, financial institutions or corporations to meet their short term financial obligations. This situation is due to an inability to convert financial assets into cash without facing substantial losses, and/or not being able to borrow funds to cover debts.

Liquidity risk can have a disastrous impact on operational and financial stability for banks and FIs, enterprise organizations and the financial sector as a whole - as became evident during the GFC.

Until the GFC, liquidity risk was not an important consideration for many financial entities, as its effects are not usually evident until reaching a crisis point. This crisis prompted the International Basel Committee to introduce a set of proposals for new global capital and liquidity standards.

The core component of liquidity risk is the discrepancy between liquid assets and liabilities, when assets can't be easily liquidated at market value to meet short-term obligations.

image source: eFinance Management

Defining funding liquidity risk vs market liquidity risk

Funding liquidity risk refers to the inability of a financial institution or corporation to borrow sufficient funding to meet debt obligations.

Market liquidity risk is associated with an organization's inability to sell financial assets at prevailing market price due to disruptions or insufficient market depth.

Measuring and managing funding liquidity risk

Without well constructed management plans for cash flows, and sound liquidity risk management strategies, organizations will almost certainly face a liquidity crisis. Not being able to meet short term financial obligations could ultimately lead to insolvency.

Measuring and managing liquidity risk requires a sound understanding of the common sources of risk, including:

-

Insufficient cash flow management practices

Without proper cash flow management practices, an organization can become exposed to unnecessary funding liquidity risks. Without well-managed cash flow management in place, businesses will face an uphill battle to remain profitable, secure favorable financing terms, attract potential inventors and be viable in the long run.

-

Difficulty obtaining financing

Not being able to obtain funding at competitive rates and acceptable terms, or being denied it at all increases liquidity risk. Late debt repayment history or defaulting on loan terms and conditions can cause challenges when attempting to secure financing. It's vital that organizations have good capital structure management processes in place that match debt maturity profiles to assets.

-

Unexpected disruptions in the economy

Before the pandemic struck, the stock market was at its all-time high. Then the adverse economic impact of the pandemic created unexpected economic disruptions that became catastrophic for many organizations and saw liquidity risk drastically increase.

-

Unplanned capital expenditures

For any business, but particularly those that operate in a capital-intensive industry such as energy, telecommunications or transportation, efficient fixed asset management is crucial. Even one or two unplanned expenses such as a new purchase or major repairs can strain budgets, and increase liquidity risk.

-

Profit crisis

To combat negative profitability margins and remain in operation during a profit crisis, businesses often start dipping into cash reserves, which can eventually deplete those reserves and cause a liquidity crisis.

For more in-depth information on best practices for Liquidity Management and Mitigating Risk

What is Net Stable Funding Ratio (NSFR)?

In 2010, the Basel Committee on Banking Supervision revealed their third reform as a response to the GFC. This third accord focuses on funding liquidity risk management rules in order to meet debt obligations and current liabilities.

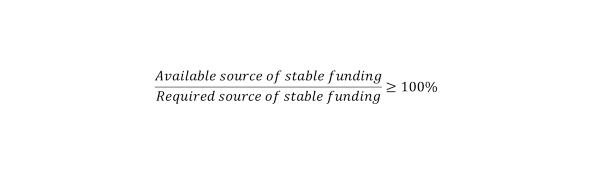

The NSFR is calculated as the amount of Available Stable Funding (ASF) divided by the amount of Required Stable Funding (RSF) over a one-year horizon. This ratio must equal or exceed 100% as shown below:

Measuring funding liquidity risk

Funding liquidity risk can be measured by looking at what an organization owns in current liquid assets versus what it owes - and what cash and assets can be turned into liquid funds within one year.

Funding liquidity risk can be calculated using three general ratios. Each ratio as a measure of liquidity versus financial obligations. These include:

-

Current ratio or working capital. This compares current assets, including inventory, and liabilities.

-

Quick ratio. This measures only current assets, such as cash equivalents, against liabilities.

-

Cash ratio or net working capital. This excludes inventory and accounts receivable.

:max_bytes(150000):strip_icc():format(webp)/terms_l_liquidityratios_FINAL-d2c8aea76ba845b4a050eacd22566cae.jpg)

How banks manage funding liquidity risk

The NSFR has changed the way banks manage liquidity risk with the liquidity coverage ratio.

As an example, as banks inherently fund long-term loans such as mortgages with short-term liabilities (including deposits), it creates a discord in maturity and creates funding liquidity risk if depositors suddenly rush to make withdrawals in a bank run. As a result, banks are required to hold enough high-quality liquid assets to fund cash outflows for 30 days, and this reduces liquidity risk.

How to mitigate funding liquidity risk

Depending on the organization, and individual circumstances, there are a large number of reasons why liquidity risk occurs. One of the factors constituting a classic mitigant for example, would be volatility of cash flows due to seasonal fluctuations in revenue generation. Others include:

-

Unforeseeable business disruptions

-

Unplanned capital expenditures

-

Increased operational costs

-

Inefficient working capital management

Every organization needs strategies in place to mitigate funding liquidity risk.

Here are 7 steps that organizations can take to ensure better control over funding liquidity.

How real-time payment processing benefits funding liquidity management

Effectively managing liquidity for banks, financial institutions and enterprise organizations is dependent on being able to see the full financial picture.

For any organization, making the right decision at the right time, and maintaining a healthy balance sheet depends on having visibility into every transaction as it happens in real time. This means the collection and analysis of huge amounts of data.

Managing data collection and deep, dynamic insights and analysis of that data has never been more critical to ensure that an organization avoids funding liquidity risks and remains financially viable.

Data associated with loan disbursement and other investment activities can help banks predict liabilities and balance them against revenue generated across interest-based assets. This enables financial institutions and enterprises to forecast their Net Interest Income (NII) and predict interest rate risks.

For more in-depth information on data observability, read our guide

How Data Observability Empowers Informed Decisions

How IR Transact can help

IR Transact simplifies the complexity of managing modern payments ecosystems, bringing real-time visibility and access to your payments systems so that you can manage your liquidity and market risk.

Transact can help give organizations unparalleled insights into transactions and trends to help turn data into intelligence, offering hundreds of points of reference, from a single point of view.

Find out how IR Transacts High Value Payments can simplify the complexity of managing your entire payments environment