What is liquidity risk?

In financial terms, liquidity is the ease with which an organization can convert its assets into cash without the sale having a negative impact on its market price.

In simple terms, liquidity risk is the potential difficulty that financial institutions or corporations might face in meeting their short term financial obligations, whether this threat is real or perceived. A sound liquidity risk framework helps to ensure an institution's ability to fulfill its cash and collateral obligations, which are often affected by outside circumstances beyond their control.

An effective liquidity risk management system is crucial because a liquidity shortfall at a single institution can have disastrous repercussions.

Liquidity risk is managed through effective asset liability management (ALM).

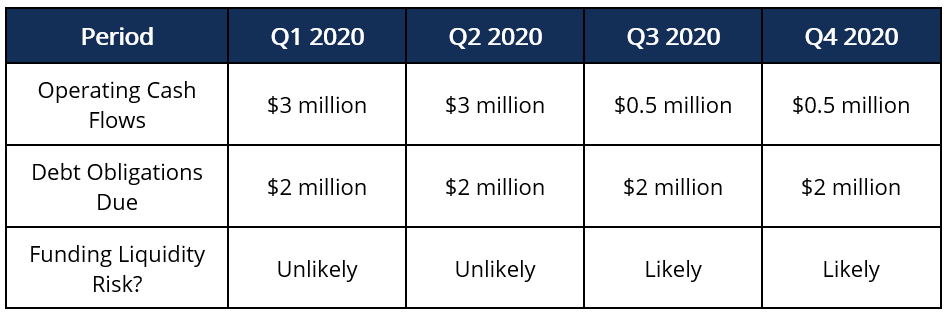

Funding liquidity risk

Funding liquidity can be a major concern for those organizations whose operating cash flows might not be in line with their debt obligation due dates. In other words, a strong performance quarter may be followed by a quarter of weak performance, leaving an organization exposed to funding liquidity risks if their due obligations exceed their operating cash flows.

Image source: CFI

Market liquidity risk

Market liquidity is the ability to access funds and conduct transactions fluently and efficiently. This is the most important prerequisite for financial stability, as it provides a safety-net capacity and limits the scope for major fallout. Market liquidity and funding liquidity are intrinsically linked. When market liquidity begins to falter, financial markets experience less reliable pricing, and can tend to overreact. This has a knock-on effect, leading to an increase in market volatility and higher funding costs.

Why does liquidity risk matter?

While liquidity refers to the quick conversion of assets into cash without significant loss of value, it's also about having sufficient cash on hand to meet financial obligations when needed. Contingent liquidity is an important metric that should be part of every organization's liquidity framework, and liquidity risk management strategy.

Contingent liquidity is the cost of maintaining a sufficient back-up of high quality liquid financial assets to withstand stress tests, meet unexpected funding obligations, and absorb potential losses.

Here are some of the reasons why liquidity is a fundamental part of an organization's success, and why a robust liquidity risk management system is so important:

Financial resilience

Having sufficient cash, or assets that can be easily traded provides financial flexibility, allowing organizations to respond fast to unexpected expenses, emergencies or business growth opportunities. It also enables them to manage their balance sheet without being forced to offload long-term assets for an unfavorable market price.

Reducing or avoiding unnecessary debt

Sufficient cash flow means that organizations and financial institutions can meet financial obligations, cope with unexpected expenses or a financial crisis without resorting to taking on additional debt and becoming a credit risk. Avoiding debt helps minimize liquidity risk, keep interest costs down and maintain financial health.

Payment of bills and obligations

Putting robust liquidity risk management measures in place ensures that there will be sufficient cash or liquid assets available to pay bills, meet obligations such as wages and salaries and make important payments in a timely manner, without defaulting. For organizations, a good reputation depends on meeting these obligations on time.

Capital for growth and investment

Liquidity is vital for organizations and financial institutions to drive growth and attract investment. Sufficient liquid cash allows the means to purchase new equipment or embark on marketing campaigns and increase new markets. A healthy balance sheet can attract investors that can potentially grow your business.

Find out more about effective liquidity management

What are liquidity ratios?

A liquidity ratio is a type of metric used to determine if an organization can use its liquid (or current) assets to cover its current liabilities. Liquidity ratios impact an organization's ability to secure a loan or other funding, as banks and investors look at liquidity ratios when determining a company’s ability to pay off debt.

There are three basic liquidity ratios:

1. Current ratio

Current Ratio = Current Assets / Current Liabilities

The current ratio is the simplest metric on a balance sheet, and is calculated by dividing current assets by current liabilities to arrive at the current ratio.

2. Quick Ratio

Quick Ratio = (Cash + Accounts Receivables + Marketable Securities) / Current Liabilities

The quick ratio metric is similar to the current ratio, however, it only takes into account particular current assets. It includes more liquid assets such as cash, accounts receivables and marketable securities, but omits current assets such as inventory and prepaid expenses.

3. Cash Ratio

Cash Ratio = (Cash + Marketable Securities) / Current Liabilities

This ratio metric goes even further by considering only a company’s most liquid assets – cash and securities, which are the most readily accessible to pay short-term obligations.

When calculating liquidity ratios, in each case the amount of current liabilities is the denominator in the equation, and the liquid assets amount is placed in the numerator, where ratios above 1.0 are the best scenario.

For example, a ratio of 1 means that a company can exactly pay off all its current liabilities with its current assets. A ratio of less than 1 (e.g., 0.75) would imply that a company is not able to satisfy its current liabilities.

A ratio greater than 1, for example 2 or 3 means that an organization could cover their current liabilities 2 or three times over.

Sources and causes of liquidity risk

When an organization has insufficient liquidity risk management systems in place, they can face a liquidity crisis, and possibly even become insolvent. Some of the most common sources/causes of liquidity risk include:

1. Inefficient cash flow management

Cash flow remains the life blood of all businesses, and proper cash flow management provides good visibility into whether an organization has adequate liquidity, as well as potential liquidity challenges and opportunities. Without it, a business can become unnecessarily vulnerable to liquidity risks, and even struggle to remain profitable, secure favorable financing terms, attract potential inventors and be viable in the long run.

2. Lack of funding

An organization's inability to obtain finance or fail to obtain it at competitive rates and acceptable terms increases their liquidity risk. Additionally, a track record of late debt repayment or defaulting on loan contractual obligations could result in additional challenges when attempting to secure financing. Liquidity management is therefore dependent on capital structure management, matching debt maturity profiles to assets, and a good liquidity coverage ratio

3. Unplanned capital expenditures

Liquidity risk can increase without proper fixed asset management systems in place, particularly when an organization is heavily capital-intensive, such as transport, telecommunications or energy. Capital intensive businesses often have a high fixed to variable costs ratio, increasing operational risk and heightening liquidity risk.

4. Economic disruptions

Risk management became a global priority, and liquidity risk soared with the onset of the pandemic. Before it struck in 2020, the stock market was at an all time high, and few people expected its adverse impact and the ensuing financial crisis. Liquidity risk increases when such economic disruptions render businesses unable to meet cash flow and collateral needs under normal and stressed conditions.

5. Profit crisis

When a business is going through a profit crisis, it often needs to start drawing from its cash reserves. If this continues for a prolonged period, cash reserves become depleted and businesses will inevitably face a liquidity crisis.

Measures of Market Liquidity Risk

Market liquidity is measured in various different ways - the most common being the bid-ask spread. A bid-ask spread in simple terms is the difference between the highest price a buyer is willing to pay for an asset and the lowest price that a seller is prepared to accept. This is also referred to as width. A low or narrow bid-ask spread tends to imply a more liquid market. Financial models incorporating the bid-ask spread adjust for exogenous liquidity risk, and are referred to as exogenous liquidity models.

Another measure is depth, which refers to the propensity of the market to absorb a sale or exit. For example an individual investor selling Amazon shares will more than likely not impact the share price, however an institutional investor selling a large amount of shares in a smaller company will probably cause the price to fall. Finally, resiliency refers to the market's ability to bounce back from temporarily incorrect prices.

Position size in relation to the market, is a feature of the seller. Models that use this measure liquidity in the quantity dimension and are generally known as endogenous liquidity models.

Resiliency is a measure of liquidity in the time dimensions and such models are currently rare.

Sound liquidity risk management

Each aspect of liquidity risk management is important in its own way, but one aspect stands out as a fundamental cornerstone, and that is having in the first place.

Every financial institution or organization has a liquidity management strategy, but the key elements of effective liquidity risk management are:

-

Being able to to collect the right data at the right time

-

The ability to carry out data analysis

-

Risk measurement

-

Stress testing

-

Monitoring and reporting

Find out how IR Transact’s High Value Payment solution can simplify the complexity of managing your entire payments environment, providing the best possible solution for monitoring payments in real time.

How real-time payment processing benefits liquidity management

Being able to see the full financial picture is at the core of effective liquidity management. Making the right decision at the right time, and having a healthy balance sheet is dependent on having visibility into every transaction as it happens in real time.

Managing data collection and deep, dynamic insights and analysis of that data has never been more crucial to ensure that an organization remains financially viable.

IR Transact: Helping with liquidity risk management

IR Transact simplifies the complexity of managing modern payments ecosystems, bringing real-time visibility and access to your payments systems so that you can manage your liquidity and market risk.

Transact can help give organizations unparalleled insights into transactions and trends to help turn data into intelligence, offering a thousand points of reference, from a single point of view.