Technological advancement is driving change in the payments landscape. One of the most significant shifts in the North American payments landscape is from Automated Clearing House (ACH) systems to Real-Time Payments (RTP).

Want to know more? Watch the full webinar.

ACH vs RTP

ACH transfers are aggregated transactional payment instructions issued between banks. Due to the sheer volume of ACH transactions, the settlement – the movement of funds between banks - takes place daily or within batch windows. These windows and end-of-day timeframes are defined by national clearing houses, which each country’s central bank regulates. ACH is, by definition, a batch process. Numerous small-value transactions are bundled up to comprise a singular large-value transaction that includes instruction details of all transactions within the batch. For several reasons, ACH is the most cost-effective means to transfer funds, but lacks immediacy. If you miss a cut-off window, your transaction will be rolled into the window, which could delay processing until the next business day.

By contrast, RTP is precisely that – authorized, settled, and cleared payments into the receiver’s bank account within seconds or minutes. And unlike ACH, RTP networks run 24 hours a day. ACH will remain the most cost-effective means of transferring funds. But for an additional fee, consumers, merchants, and businesses can have funds deposited into their accounts within minutes rather than days. The value of RTP is substantial, and market interest is increasing.

RTP growth

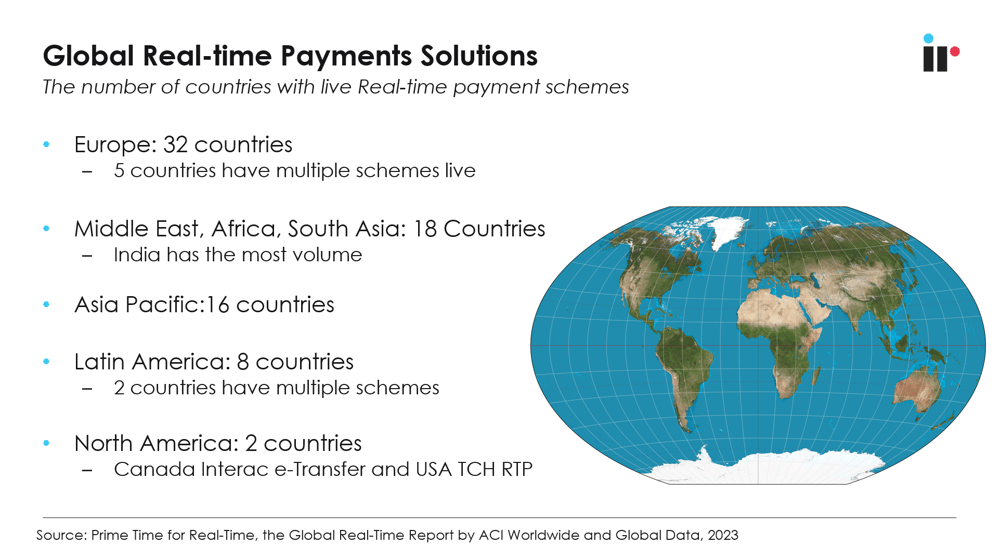

RPT schemes are present in countries around the globe – several countries already have multiple schemes running alongside one another.

While RTP schemes are accelerating in growth, adoption rates vary from country to country, and generally, the world’s largest economies have been slower to adopt RTP schemes.

But that is starting to change.

Success of RTP schemes

Certain factors have been shown to impact the successful implementation and adoption of RTP schemes around the world.

- Strong branding and packaging – strong, consistent, clear branding has proven to be a big factor in RTP scheme adoption. Knowledge, familiarity, and trust must be established with consumers, merchants, and businesses. They need to understand the benefits of RTP so they can make informed decisions on how they’ll conduct commerce.

- Government implementation – Governments are large buyers and spenders. Their participation in receiving and initiating RTP payments plays a considerable role in the success of the RTP programs. It’s not just mandating and regulating the service but also being a vital participant in using the service.

- Merchant acceptance – Improved liquidity and reduced risk are solid incentives for merchants and businesses to adopt RTP. The adoption rate of merchant and businesses is directly related to the ability of their IT and payment processing organizations to support RTP. RTP rails need to be as accessible to merchants as other forms of payment (cash, checks, credit/debit cards).

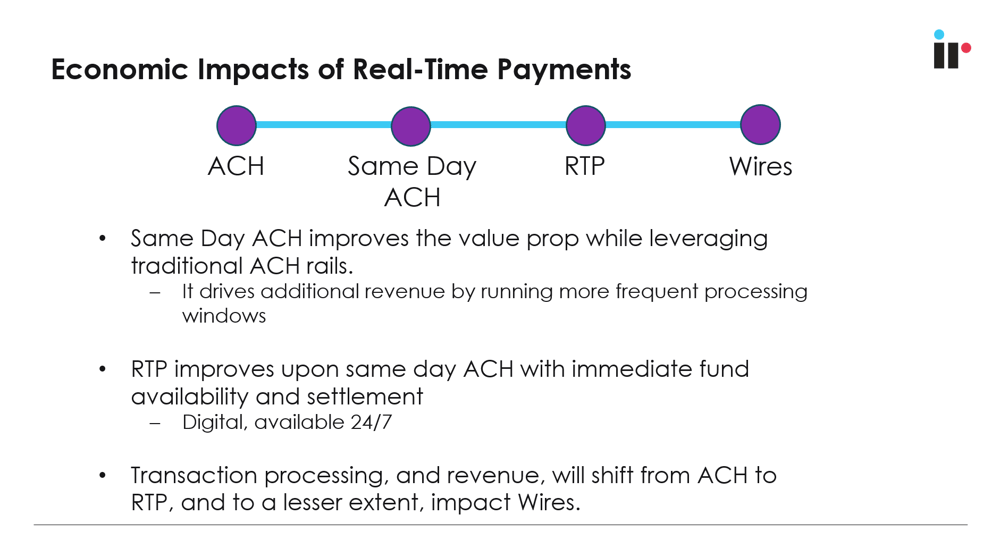

Economic Impacts of RTP

So, what does this shift mean for customers, merchants, banks, and the broader payments landscape?

Value to merchants

RTP offers merchants instant access to funds, helping businesses strengthen cash flows and improve operational efficiencies, budgeting, and overall cash management. Cash is risky. ACH is inexpensive but slow. Credit and debit cards have costs that eat into a merchant’s margins. RTP will have a fee but reduces risk and provides immediate fund liquidity. Merchants around the globe are welcoming the RTP option.

Revenue models will change

Banks must restructure their business models with funds moving faster into and out of accounts. The value of legacy payment methods such as cashier checks and money orders must be questioned. A portion of debit card usage, and perhaps credit card usage, may shift to RTP. Businesses will opt for RTP to address higher transaction amounts than card networks while benefiting from instant funds transfer. Large value payments involving currency conversion will not be impacted, but a segmentation analysis of wire transactions is warranted to ensure delineation between RTP and wire services.

Competition and incentives

Consumers can be influenced to change or maintain behaviors. The benefits to merchants and businesses will continue incentivizing them to prefer one payment method over another. As RTP gains momentum with consumers, banks may realign their reward programs to influence consumer behavior at merchants.

In short, RTP schemes are a further diversification of the payment ecosystem. And choice is generally a good thing! One simply needs to manage the complexity of offering a more comprehensive array of payment options.

Simplifying complexity

Everyone in the payments space has more complexity and competition than ever before. Your customers and their customers demand immediate visibility and resolution to any actions involving their bank accounts.

That’s where IR Transact comes in. We can:

- Provide instant visibility of your payment networks to improve customer satisfaction and trust. Provide business analytics of payment types and how revenue is shifting, enabling you to stay on top of trends and tendencies.

- Help ensure availability, keeping all your systems up and running efficiently and predictively alerting to situations before quality of service is impacted. Provide business reports on SLAs and technical analysis of how to reduce bottlenecks.

Now is the time to ensure the transactions that keep you in business, with complete visibility of your entire payments infrastructure and the insights you need to help navigate the rapidly evolving payments world.

Want to know more about how IR Transact can help you manage your payments ecosystem? Get in touch with our team today.