2020 changed the way we do business, and how we pay for goods and services, and this has dramatically affected the revenues of financial institutions. There has been an accelerated shift towards digital payments – and real-time payments in particular.

Real-time is big time

The payments industry is various stages of real-time payments adoption and value realization, depending on where you are in the world. But regardless of what stage of the journey you are at, there are challenges aplenty for banks, processors, acquirers and FinTech’s.

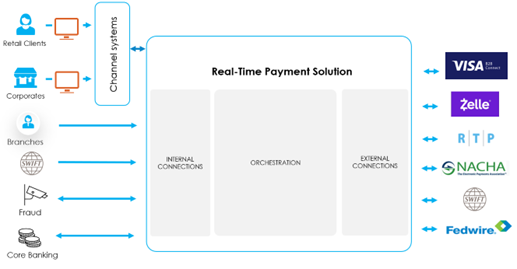

As Payments Market Infrastructures (PMIs) create the platforms to make instant payment possible, banks are being forced to reassess, and in many cases, restructure their business models.

Additionally, they’re facing the threat of an increased risk of fraud as well as the task of developing new services for customers to realize value for their shareholders.

The success of instant payments globally demands interoperability.

In this blog, we’ll look at real challenges facing real-time payments, and how to combat them. We’ll highlight use-cases, and how our monitoring and tracking solutions can simplify the complexity of managing your entire real-time payments ecosystem, delivering results you can depend on.

Read our blog “How Real-Time Payments are changing the world”

Why tracking your real-time payments is crucial

Without effective management of your real-time payments, there are some serious issues that could affect businesses by attracting penalties, losing revenue and damaging reputation.

Customer impacting issues

It only takes one thing to go wrong within the payment chain, to impact customer satisfaction. This has been proven to lead to a decrease in revenue and even a damaged reputation.

Not settling within agreed timeframes

Not delivering on an SLA, or the ineffective management of processing issues can result in a breach of trust between customer and provider.

Sub-optimal payment flows

If this is a recurring issue, it could result in lost productivity and higher liquidity issues.

Missed revenue opportunities

Without monitoring and tracking, you could be missing out on valuable insights and opportunities to monetize data and capitalize on fees.

Missed reporting obligations

Without the right tools to create accurate, real-time reports, you could be wasting valuable time dealing with compliance issues, and lost productivity.

Real-time payments use cases

IR’s real-time payments solution can give you detailed, actionable insights into every facet of your payments stack, giving you the intelligence and contextual data to truly capitalize on the opportunities of real-time payments.

Detailed tracking of payment flows

SLAs are built around the time-to-settlement, using configurable payment flows across separate systems and processes, often called orchestration.

It could be a fraud check followed by a sanctions check, followed by an AML (Anti-Money Laundering) check etc. These are often separate systems, so any slowdown in any step of the flow can impact your SLAs.

Native search capabilities, or even a detailed payment flow for each transaction typically won’t roll up a real-time view into the whole process.

What IR’s solutions can do

- IR’s real-time solutions show a dashboard focusing on the SLA performance of each step of your payment engine.

- The payment flow can either be summarized based on inbound flows or outbound flows.

- You can view this information based on different matrices such as response time for each instruction, aggregate response time over the period of time, and even number of transactions passing through each channel.

- You can get insight into application and service up-time, and how these components are performing.

- Users get the flexibility to plot this data either in the form of charts or trends or a simple tabular view to provide more detailed and meaningful information.

- Users can immediately track the entire payment flows and can identify any delay or issues in any channel, improving SLA management.

Instant monitoring and management

Many vendors will bundle a monitoring solution which offer deep, but narrow, platform specific insights.

Alternatively, a bank may try to adapt their enterprise monitoring tools to the task, but will have to build out the data model (including the flows), the dashboards, the alerts, the reports and typically settle for basic monitoring as they realize the ongoing cost of this path.

In complex, high-volume environments, like those that cater to real-time payments, you need a more comprehensive tool that can provide an end-to-end view of your ecosystem.

What IR’s solutions can do

- Our Out-of-Box dashboards can provide both a summarized and high level view of your entire payment processing system as well as more details transaction dashboards showing the individual transactions and its payment flows.

- Some of our dashboards include:

- The overall summary of your Payment engine and their transactions

- Your current in-flight processing transaction dashboard

- The completed transaction dashboards

- Bank account dashboards

- SLA performance dashboard

- Users also have the flexibility to create their own DIY dashboards using various options and can filter the information specific to their requirements.

- Complimenting these dashboards are alerting capabilities which can detect the high failures, delay from any channels, SLA, settlement and liquidity accounts monitoring.

- Dynamic thresholding can analyze the patterns from historical data and compare it with current data to provide more accurate alerting on the issues and minimizing any false alarms.

Delivering results

Identifying and responding to issues quickly is one aspect, but you need to ensure that recurring issues are addressed. This can be done through post-incident analysis.

From a business point of view, you need access to the current data to track the adoption of new services, understand what is holding back adoption in some demographics, while it’s growing in others.

What IR’s solutions can do

- Using our Business Insight solution, we can collect all relevant information for long term storage.

- Once the data is collected, user can either use our Out of Box reports or they can even create their own set of reports.

- As part of the package, this comes with various reports for different users like operations team and business team.

Now is the time for real-time

The real-time payment industry booming, with growth and maturation accelerating in many markets. As real-time payment traffic increases and customer demand grows, it is critical that payment providers can monitor, troubleshoot and, optimize their environments to ensure they are delivering a seamless payments experience.

Everyone in the payments space has more complexity, and competition, to deal with than ever before – you can’t afford to leave the performance of your environment to chance. Now is the time to assure the transactions that keep you in business, with complete visibility of your entire payments infrastructure and the insights you need to help navigate the rapidly evolving payments world.

Want to know more about the challenges and opportunities in the real-time payments market? Check out our free guide.