Over the years, the world of banking has modified radically and has globally affected millions of individuals. During this age of development, instead of making payments by cash, checks, credit or debit card, the payment process has evolved into faster, safer and more efficient electronic methods of transferring money. Automated Clearing House (ACH) has made this possible.

ACH network transactions, also known as "direct payments", have become one of the most popular methods of transferring money electronically. Since the early 1970s, this U.S. financial network allows institutions to transfer money without using paper checks, credit card networks, wire transfers or cash - domestically and globally.

More than 25 billion ACH transactions are processed each year by the Automated Clearing House Network consisting of an electronic network of banks and financial institutions supporting both ACH credit and debit payments in the U.S.

Tens of millions of American individuals and businesses use the ACH network to send money, transfer money and receive money -and whether you know it as Direct Payments, Direct Deposit, or electronic payments, ACH handles everything from mortgages and recurring payments to credit card payments and more.

ACH Transfers explained

There are two main categories for which both consumers and businesses use an ACH transfer.

-

Direct payments (ACH debit transactions)

-

Direct deposits (ACH credit transactions)

Some financial institutions also offer bill payment, which allows users to schedule and pay all bills electronically using ACH transfers. Or you can use the network to initiate ACH transactions between individuals or merchants abroad. If you're a business owner, you can also use ACH transfers to send money to vendors or employees.

Often, ACH transfers clear the bank in just a few business days unless there are insufficient funds in the account. However, transactions can take longer under certain circumstances—such as if the system detects a potentially fraudulent transaction.

How do ACH payments work?

An ACH payment is made via the ACH network, rather than going through the major card networks like Visa or Mastercard. An ACH payment method is also referred to as ACH transfers or ACH transactions.

ACH is run by an organization called the National Automated Clearing House Association (NACHA), and may also be referred to as the ACH network or ACH scheme.

Definition and Examples of ACH Debit

All depository financial institutions, such as banks and credit unions in the U.S. are connected to NACHA. The network enables these institutions to set up electronic deposits and withdrawals to and from customer accounts.

When you make an ACH debit payment from your bank account, the payee will initiate an electronic withdrawal directly from your account. An ACH debit transaction does not involve physical paper checks or debit card. The only information the payee needs is a bank account and routing number.

How ACH Debit works

To initiate a transaction with ACH, you’ll need to authorize your biller, such as your electric company, to pull funds from your account. This typically happens after you provide your bank account and routing numbers for your bank account and give your authorization by either physically or electronically signing an agreement with your biller.

Automatic payments

If you choose automatic recurring payments, your biller will deduct those funds from your account each time your bill is due. For example, you may allow a utility company to automatically charge your account for monthly bills. The biller initiates the transaction, and you do not have to take any action.

On-Demand Payments

You can also set up a link between your biller and your bank account without authorizing automatic payments. This gives you greater control of your account, allowing you to transmit payment funds only when you specifically allow it.

What is an ACH deposit?

If an employer wants to pay a worker, an ACH deposit is their alternative to cash or a physical check. It moves money from the employer's bank account to an employee’s in an easy and relatively inexpensive way.

The employer simply asks their financial institution (or payroll company) to instruct the ACH network to pull money from their account and deposit it accordingly.

Likewise, ACH deposits allow individuals to initiate deposits elsewhere—be that a bill payment or a peer-to-peer transfer to a friend or landlord. Government agencies also rely on ACH deposits to send out pension and unemployment benefits.

An ACH direct payment delivers funds into a bank account as credit. A direct deposit covers all kinds of deposit payments from businesses or government to a consumer. This includes government benefits, tax and other refunds, and annuities and interest payments.

When you receive payments through direct deposit with ACH, the benefits include convenience, less fees, no paper checks, and faster tax refunds.

In the case of recurring purchases, payments via ACH can be automatic - meaning the customer doesn’t need to worry about receiving and paying a bill; it will be an automatic direct payment from their bank account.

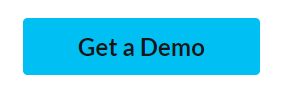

Image source: The Balance

How much money goes through ACH payment processing?

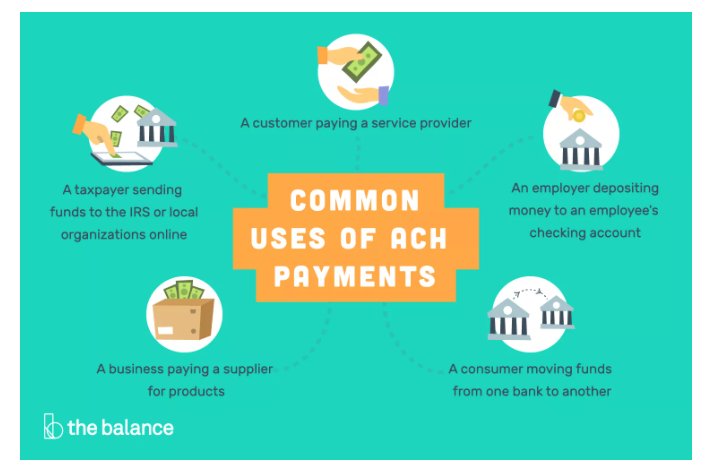

The number of debit or ACH credits processed each year is steadily increasing. In 2020, the ACH network processed financial transactions worth more than $61.9 trillion, an increase of almost 11 percent from the previous year. These included government, consumer, and business-to-business transactions, as well as international payments.

Among the sectors experiencing tremendous growth in 2021 was business-to-business (B2B). The 5.3 billion B2B payments—valued at $50 trillion—reflect a 20.4% increase from 2020, as the pandemic fast-tracked businesses’ switch to ACH payments. Over just the past two years, ACH B2B payments are up 33.2%.

A summary of types of ACH transfers

ACH credit transfers (push payments)

An ACH credit involves ACH transfers where funds are pushed into a bank account. That is, the payer, like a customer, triggers the funds to be sent to the payee, like a merchant.

For example, when someone sets up a payments through their bank or credit union to pay bills from their nominated bank account, these payments would be processed as ACH credits.

ACH debit transfers (pull payments)

ACH debit transactions involve ACH transfers where funds are pulled from a bank account. That is, the payer, or customer gives the payee permission to complete payments from their nominated bank account whenever it becomes due.

For example, when someone sets up a recurring monthly payment for a mortgage or utility bill, an ACH debit would be used and their checking account would be debited automatically.

ACH payment vs Credit card payment

ACH and credit card payments both allow you to take recurring payments simply and easily. However, there are three main differences that it may be beneficial to highlight: the guarantee of payment, automated clearing house processing times, and fees.

When it comes to ACH vs. credit cards, the most critical difference is the guarantee of payment. Credit card payments are “guaranteed funds” transactions. The credit card network will verify whether the payer is within their credit limit and then approve the trade, meaning that the funds are guaranteed. ACH doesn’t guarantee the funds and transactions can be rejected for a broad range of reasons, including Non-Sufficient Funds (NSF) or closed accounts.

Who uses the ACH network?

All sorts of organizations accept ACH payments, and the ACH network is widely used for all kinds of recurring payments, electronic transfers and bill payments, including:

-

Direct deposits of paychecks into a checking or savings account

-

Business payments to other businesses

-

Consumer online payments to credit-card companies and utilities

-

Consumer and business transfers between their bank accounts

-

Individual payments to other individuals using platforms such as PayPal and Zelle

-

Electronic tax refunds paid directly into a checking or savings account

How long does it take to process ACH payments?

Considering these are electronic payments, making ACH transfers seems like a long-winded process. Traditionally, a standard transfer would take three to four business days. Here are the factors as to why:

-

The amount of time it takes for a bank to send each ACH request, verify that there’s enough money in the account, and wait for the receiving bank accepting ACH payments. Typically this process would take 48 hours, at minimum.

-

Many banks process ACH transfers in batches only a few times per day. Some even only process them once per day, so if you miss the cutoff for the batch that day, you’ll have to wait another day for processing to take place.

More recently however, banks have come to allow same day ACH payments or next-day ACH transfers that take only one to two business days. So as long as the electronic payments request is submitted before the cutoff for the day, it's possible for the money to be received within 24 hours.

Same Day ACH payment volume grew nearly 74%, new figures from Nacha show.

The 7-step process of making ACH payments

No matter what type of ACH payments are involved, a transfer is a process of 7 steps, which begins with the money in one account and ends with the money arriving in another account.

1. The ACH transaction is initiated

ACH payments begin when the originator (payer)starts the process by requesting the transaction. The originator can be a consumer, business, or a government agency. The transaction can be a deposit or a credit or debit payment.

2. The originating financial institution submits entry

Once a transaction is initiated, an entry is submitted by the bank or payment processor handling the first phase of the ACH payments process. The bank or payment processor is known as the Originating Depository Financial Institution (ODFI).

3. ODFI sends ACH entry batch

Financial institutions often send ACH entries in batches, typically 3 times a day during regular business hours. Batches are sent on a predetermined schedule to an ACH operator, an institution within the ACH network authorized to handle switching funds between the originating and receiving bank account. Federal Reserve banks and the EPN are national ACH operators.

4. ACH operator sorts entries

Once received, an ACH operator sorts the batch of entries into deposits and payments, and payments are then sorted into ACH credit and debit payments. This ensures that money is transferred in the right direction.

5. ACH operator sends entries

After sorting entries, the ACH operator sends them to their destined bank or financial institution, known as a Receiving Depository Financial Institution (RDFI).

6. RDFI verifies there are sufficient funds

If the ACH transaction involves moving funds out of an ODFI’s account, the RDFI must first check to verify that sufficient funds are in the ODFI account to cover the transaction.

7. RFDI debits or credits originating institution

Finally, when receiving ACH payments, the receiving financial institution either credits or debits the receiving bank account, depending on the nature of the transaction.

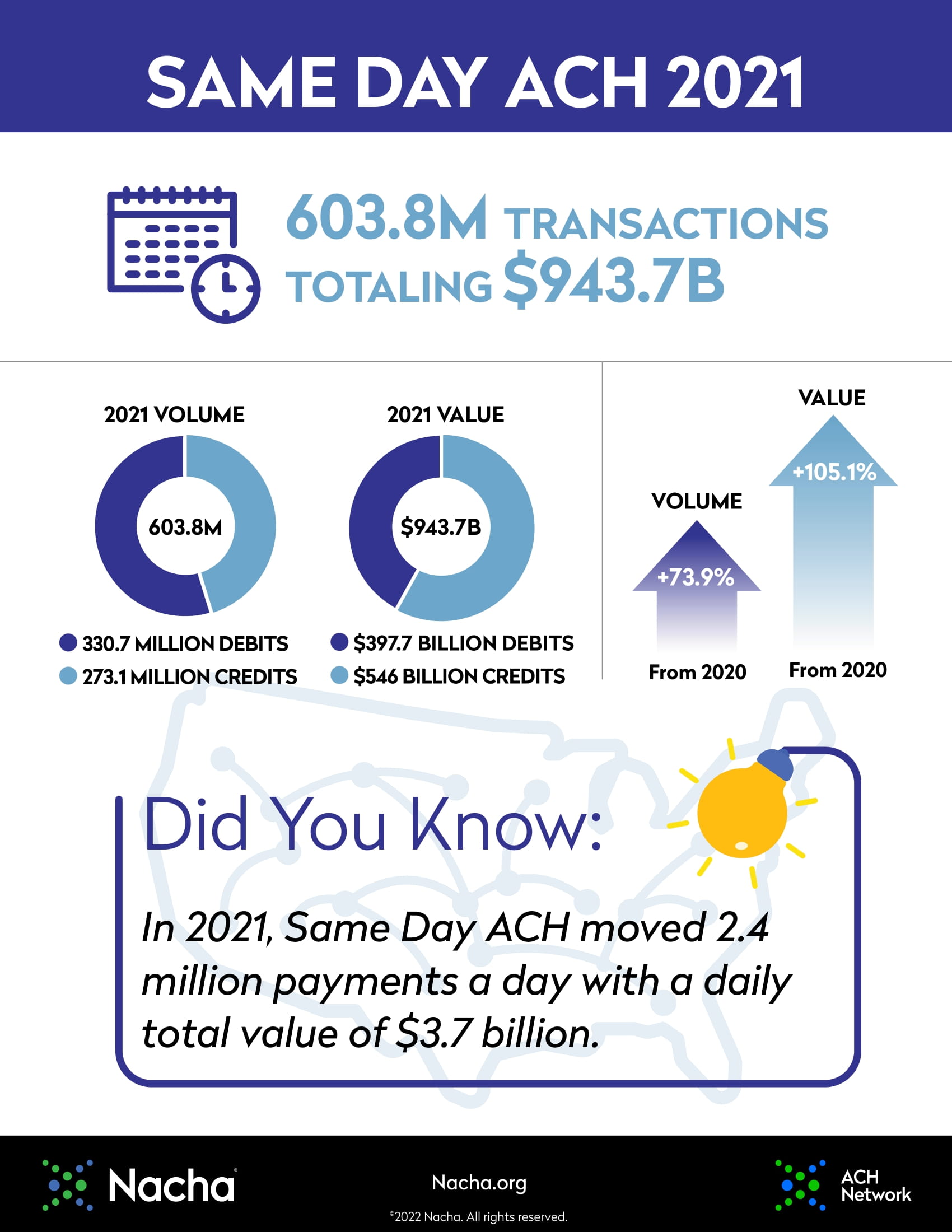

How much do ACH payments cost?

While the total cost associated with accepting ACH payments varies, ACH fees are often much cheaper than the fees associated with accepting card payments.

One of the biggest cost-influencers of accepting ACH payments is the volume of transactions your business intends to process. Businesses with larger transaction volumes tend to pay less per transaction.

When accessing ACH indirectly through a Third Party Payment Processor (TPPP), a number of types of fees may be involved:

The difference between wire transfers and ACH payments

While both wire transfers (like SWIFT) and ACH payments allow for electronic payment of funds to bank accounts, the main difference is that wire transfers are used to facilitate international payments, whereas electronic ACH payment is only available domestically. An ACH transfer takes typically 2-3 business days, while wire transfer is instant or next day delivery.

To find out more about wire transfer, read our in-depth guide to SWIFT transaction monitoring

Managing your payments environment with IR Transact

Whether you’re an acquirer, payments processor or merchant, it’s crucial to be able to gain complete real-time visibility into your payments ecosystem. Poorly performing systems increase frustration throughout the entire payments chain. It can lead to long queues, the likelihood of customers abandoning purchases, and dissatisfaction from customers – severely impacting revenue. Transaction monitoring is vital to combat any service disruptions and potential lost revenue.

IR Transact simplifies the complexity of managing modern payments ecosystems, including ACH payments. Bringing real-time visibility and payment monitoring to your entire environment, Transact uncovers unparalleled insights into ACH transactions and payments trends to help you streamline the payments experience, turn data into intelligence, and assure the payments that keep you in business.

Transaction monitoring refers to the monitoring in real time of customer transactions, including historical as well as current information and interactions. This provides a complete picture of the activities from all your customers, including transfers, deposits, and withdrawals to automatically analyze this data.

/ach-vs-wire-transfer-3886077-v3-5bc4cc6d4cedfd0051485d64.png)