In the payments world, there's nothing more frustrating and potentially damaging to a business than a payment failure. In addition to customer irritation created from disrupted transactions, business owners and payments providers risk losing customers for good due to failed payments.

Research shows that 62% of customers who experience payment failures during the course of a transaction will not return to the same website to try again.

This startling statistic highlights the importance of having a high quality payment processing solution for eCommerce sites.

Online stores and businesses who work proactively to reduce the number of failed payments will consequently increase their sales, as well as enhance customer experience.

Download our payments guide.

What causes payment failure?

Failed payments can occur from both the merchant’s end and the customer’s end. A customer will often experience payment failure due to a faulty internet connection, entering incorrect payment details, or because there is not enough money in their account to cover the payment..

A rejected payment from a customer's end is not generally something a merchant can fix. Here are some common customer payment failure alerts.

However, there are proactive solutions for payment failure on the merchant’s side. More about that later.

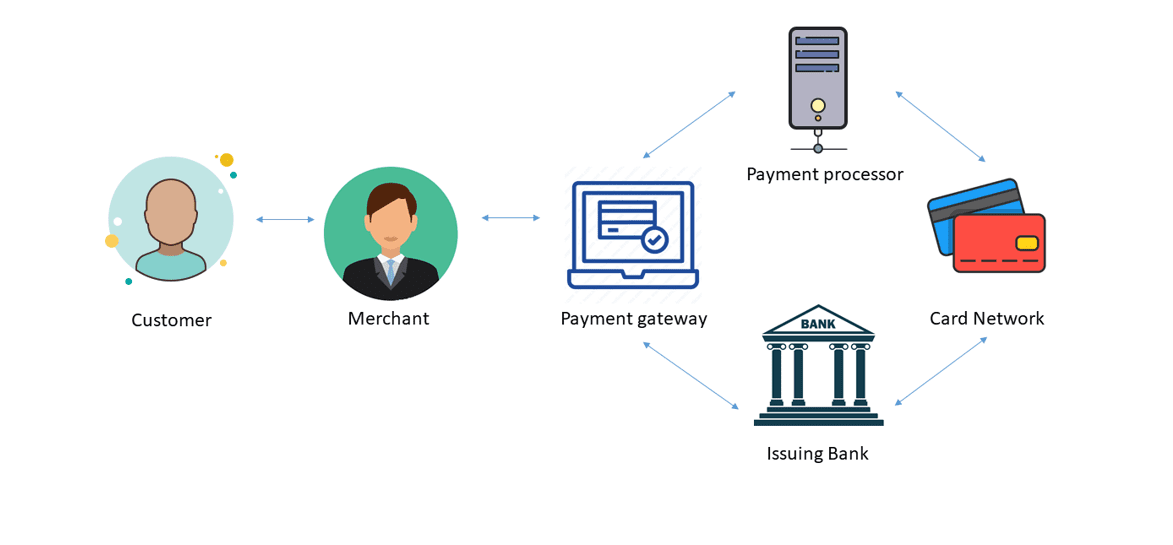

Usually, a customer has no idea what actually goes on 'behind the scenes' when using their preferred payment method. Whether it's card payments, or online payments, to the average consumer, completing an online transaction is as simple as the click of a mouse or the tap of a screen, and takes place in mere seconds. In reality, there are quite a few steps to go through, and consumers only realize that things aren’t so simple when they experience a failed transaction.

From the customer to the merchant, the payment process goes through several more steps after it enters the payment gateway.

Image source: Lyra

Here are some of the most common reasons why a payment fails, from a merchant or payment processor point of view:

Downtime and/or maintenance

Online payment processing should technically be operational 24/7 with no exceptions because customers expect it. However, this is not always the case, as many payment processors experience involuntary downtime or need to temporarily close down their systems for maintenance.

In July 2019, for example, Stripe experienced nearly 2 cumulative hours of downtime in one day, which meant that companies that used Stripe could not accept payments during that time. While this incident is quite rare, unless companies take precautions to prevent outages and unnecessary downtime, it can disrupt the payment process more frequently.

Security

Most consumers tend to have online spending patterns, with recurring payments to merchants, or the regular use of a certain debit card at a certain location. Through the collection of customer data and payment details, banks and financial institutions use these patterns to detect security threats and fraudulent activity. For example, if a customer spends a lot more than usual or tries to complete a transaction when they’re in another country or unfamiliar location, the bank may not authorize it. This can be a source of frustration when customer are making legitimate payments, yet transactions are being declined by their bank or financial institution.

Failed Payment Process

As mentioned, payment processing consists of multiple steps that include the money leaving the customers' account and getting deposited into the merchant’s account. Customers then choose their method of payment and the data is sent to the payment gateway and then the card network. All the information needs to be authorized and verified by the customer’s bank. The amount is transferred to the acquiring (merchant’s) bank, and only then to the merchant’s account. If there is an issue with any one of these steps, including insufficient funds, the payment fails.

Payment method not supported

Not all online merchants accept all types of credit card payments. When this type of payment failure happens, a consumer may try to re-enter their information, but ultimately the transaction will be rejected. One of the most common reasons for an invalid payment method message is because of outdated payment information. It’s possible a consumer's current method has expired and needs to be updated, or in the case of a new credit card, the card’s expiration date and CVV number may need updating.

Payment authentication friction

3DS2, a multifactor authentication protocol, is designed to reduce friction in the online checkout process. Merchants and banks can share card payments information quickly and determine if for example, a credit card payment is risky. If it’s risky, the customer is required to provide additional authenticating information, like a fingerprint, face scan, or one-time password. If a customer isn’t able to provide this information or doesn’t want to, the payment can fail.

What is voluntary vs involuntary churn?

When it comes to payment failures, there's nothing more damaging to a business (particularly a subscription business who deals with recurring payments) than losing customers or having a high churn rate.

There are two different types of churn – voluntary and involuntary.

Image source: 2checkout

Voluntary churn

Voluntary churn is when a customer leaves you of their own accord. The most common reasons a customer will cancel a subscription and thus 'voluntarily' churn include:

- Unexpected charges on a subscription bill (72%)

- Not using the service enough (63%)

- Too expensive (60%)

- Inadequate customer service (56%)

- No option to pause subscription (45%)

- No special deals/discounts available (36%)

Ways to reduce voluntary churn

- Offer value and flexibility, which can be individually tailored for different regions or countries depending on what a particular customer is looking for. Optimizing for geographic locations and local payment methods is a must.

- Offer different billing lengths, including monthly or yearly offerings, with incentives to subscribe for the longer term but a fit for every customer depending on their needs.

- Bill based on customer usage rather than a set subscription amount, which gives customers an alternative to churning if they feel they aren’t using it enough.

- Sign your customer up for auto-renewal. Once you have acquired the customer, (for example if you are a membership based business), auto-renewal will contribute positively to their long-term experience and will ultimately help prevent churn. For those who have opted for manual renewal, make sure you have efficient renewal notifications, and perhaps even offer discounts for earlier or timely renewal.

Involuntary churn

Unlike one-time eCommerce payments which are captured and authorized before every purchase, subscription businesses capture payment information during the initial sign-up, and keep it stored securely for recurring payments.

After that, the same payment and credit card details are used for every renewal process. But the chances of the payment being declined grow more and more as time goes on. This is because the payment information, which is usually related to a credit card, can become outdated, causing a failed payment.

Every time this happens and a customer fails to update their payment information with new and correct data, the business will lose revenue and their customer churn rate will increase. All future revenue from that subscriber is also lost if the customer doesn't update their payment information.

Since this type of churn is passive and doesn’t happen because the subscriber voluntarily stopped paying for his subscription, it’s called involuntary churn. If the customer's subscription fails because they didn’t take any action to update their payment information and provide new credit card information, the business has suffered due to involuntary churn.

Why involuntary churn can destroy a business

Involuntary churn can ruin a subscription businesses, resulting in loss of revenue and the inability to grow. The growth of any company relies on the stability of its unit economics and how good its ratio is.

This is the ratio between the Lifetime Value (LTV) of each customer and their Customer Acquisition Cost (CAC), which needs to be 3:1. Even if a business has a great unit economics ratio and satisfied customers, involuntary churn can still happen as soon as a customer credit card expires.

Some companies try to resolve the impact of involuntary churn by increasing prices or decreasing CAC, both of which can be bad for business.

Maintaining a good relationship with customers is imperative for success. Customer relationships can be destroyed by involuntary churn

For example, if a customer that didn’t know their card expired and is locked out of their account, it can cause a lot of frustration, so it pays to be diligent about all methods of payments on your system, and inform your subscribers if their credit card expires.

The events that cause involuntary churn mostly related to payment processing issues, are addressed by standard tactics:

Soft declines

Soft declines are temporary authorization failures which may be successful upon re-trial of payment. The card number could be valid but was denied by the issuing bank. If a soft decline occurs on a renewal, retrying the card at a later date may work.

Reasons for soft declines include:

- Insufficient funds

- Card activity limit exceeded

- Payment processing failures, or timeouts

- Expired cards

- Incorrect or outdated billing address

Hard declines

Hard declines are permanent authorization failures that cannot be recovered and should not be retried. It's estimated that 10 to 20% of declines are hard declines.

Reasons for hard declines include:

- Stolen or lost card

- Invalid credit card data

- Account closed

Tactics for addressing involuntary churn

Most businesses who accept recurring payments will undoubtedly go through payment failure at some point. The challenge can arise with payments gateways, payment processors, card networks, direct debit networks or virtual wallets.

When recurring payments are unsuccessful, because of failed credit cards, it can cause customers to churn out. To collect recurring payments successfully, there are some effective preventative measures that businesses can use.

Tactic 1. Pre-Dunning Emails

This is an email that goes out to the customer when a payment method is about to expire asking them to update soon to avoid payment failure. The advantage with the dunning process, or putting in place a dunning cycle, is that by getting in early, you can pre-empt a customer's payment method expiry and process payments without failure.

In general, pre-dunning emails should only be used if there are no other systems in place to catch credit card updates or ask customers to update their information. They also make sense if you want to specifically talk to certain customers when their payment method is about to expire.

Your pre-dunning emails should (ideally) contain a link to a card update page where your customers can update card information.

Tactic 2. In-app/website notifications

This method is a non-intrusive notification bubble inside your app or website that informs customers that their payment information is about to expire and that they should make an update as soon as possible. It's a relatively easy and non-intrusive tactic to implement, and it means you can notify customers before their preferred payment or credit card details are about to expire.

Tactic 3. Card/Account updater

Payment gateways like Stripe and Braintree have partnered with card networks like Visa and MasterCard to automatically update the cards in your system without customer intervention. As long as you're using Stripe or Braintree, it's easy to implement, automatic, and creates a frictionless renewal experience, avoiding failed payments.

However, a few cards can slip through the cracks - international cards, prepaid cards, and cards belonging to unsupported card networks are not updated.

Tactic 4. Request that a customer shift to ACH/SEPA

With an impressive failure rate of only 0.5%, Direct Debit payments are by far the most efficient way to collect recurring payments and eliminate payment failures. Shifting to ACH/SEPA eliminates the incidence of credit card failures and streamlines a billing system, requiring only a bank identification number and a customer account number. But it can be difficult to implement due to back-end processes, and at the same time, you need to convince your customer to make the shift.

The advantage is that the direct line of communication between the issuing banks and the receiving banks that handles the direct debit transfers eliminates a host of problems that might cause failed payments to occur. For example, bank accounts can’t be lost or stolen, and the payment process is solid. Direct debit also reduces admin time, because collecting payments is done automatically, and tracked each month.

The downside is that while card payments land in your merchant account almost immediately, direct debit payments can take between 3 and 10 days, depending on the network.

Tactic 5. Backup payment methods

Another way to combat failed payments is to set up backup payment methods for each customer to use as an auxiliary method on when the first method fails. It could be difficult to implement, as it means either collecting two payment methods from each customer on sign up, or giving a customer the means to add new payment information later. The advantage is that if the first payment failed, you can avoid the time-consuming dunning process. It's an almost foolproof way to curtail a failed payment issue, as it's rare tor two different methods to come up with a 'payment failed' error message at the same time.

Retry technology

One company that specializes in backup payment technology is BridgerPay, who have focused on the challenge of failed payments and designed a payment solution to address it using 'retry technology'. This solution automatically retries a transaction through various payment providers to recover payments.

Equiti Group, an authorized global trading broker, recently reported a 30% increase in global deposit approvals by using BridgerPay’s Retry feature. Its approval rate is now between 10% to 20% above the industry norm. Additionally, BridgerPay partners with a huge number of payment methods and card issuers and supports 39 currencies, including cryptocurrencies.

Image source: Bridger Pay

The importance of real time transaction monitoring

There's probably no other industry as complex as the payments industry. Without stringent monitoring, payment processors, merchants, card issuers and banks are open to frequent payment failure.

The world of real-time payments offer a faster, more consistent means of payment and it's rapidly becoming a global standard, expected to grow by more than 30% over the next few years. But payment providers need to ensure that their real-time payments systems are optimized for peak performance.

With IR Transact, you can track every detail of your payment system workflows, and monitor and manage real-time payments to ensure overall payment health, and deliver results that drive optimal business outcomes.

Download our payments guide.

Using data insights to improve profitability

Through valuable data insights, led by information and payments data, a business can improve profitability, optimize revenue and cut costs. Without transaction data and analytics to get clear visibility into the payments environment, a business wouldn't be able to identify transaction performance issues, or detect fraud, failed payments and other anomalies.

Services would be disrupted, repair times and troubleshooting processes would also be derailed, and the risk of bottlenecks for services like online banking, POS or mobile payment networks would increase.

Payment analytics tools allow a business to take historical data and apply it to things that are happening to a business right now. This applies to sales and payment processing or any online services in the payment space. Analytics are as important to the payment industry as any business, if not more so. In order to improve your payment services and performance, it's necessary to understand customer profiles and behaviors - as well as having insights to providers' risk profiles.

Find out how using payments data can give you unparalleled insights and simplify complexity in your payments systems